It’s that time of the year again.

High street chains and online retailers alike are preparing to take part in what might be the biggest shopping event of the year – Black Friday.

Despite the uncertain economic environment around trade and interest rates, this year’s Black Friday sales in the U.S. are actually projected to exceed those of 2018 by about 4%, to $731 billion.

In fact, rumors about customers growing more skeptical over Black Friday discounts aren’t quite justified, given that holiday sales continue to rise steadily year-on-year, growing almost threefold between 2002 and 2018.

So where do brands need to reach and engage with discount-hungry consumers this season, and how much are shoppers willing to spend?

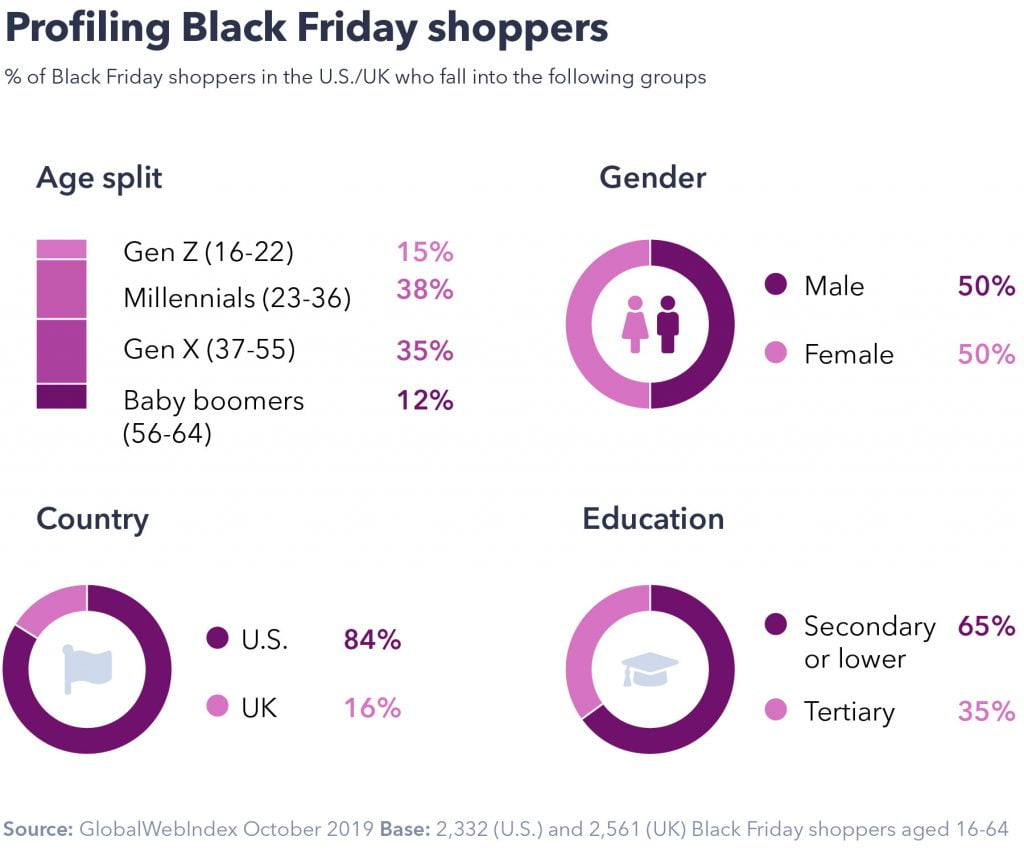

Using a bespoke survey from October 2019 among 2,332 (U.S.) and 2,561 (UK) internet users, we’re going to answer some of the pressing questions marketers may have about Black Friday.

1. Who is the Black Friday shopper?

Over 7 in every 10 online consumers will take part in a Black Friday shopping spree this year.

Although this figure is largely driven by those in the U.S., where Black Friday originates from, its popularity has spread all around the world, with 16% in the UK anticipating the event.

The typical Black Friday shopper is in their late thirties, with a particularly high representation among millennials aged 23-36 (38%).

Millennials are closely followed by Gen X, 35% of whom will shop this Black Friday, while Gen Zs aged 16-22 (15%) and baby boomers aged 56-64 (12%) are less enthusiastic.

Despite being the smallest group in numbers (25% of the U.S. population), Gen X have the biggest disposable income, which accounts for 31% of total U.S. earnings.

Men and women equally will be taking advantage of retailers’ discounts, but the destinations they intend to shop at differ.

First and foremost, shoppers will head to online retailers (73%), big-box retailers (44%) and shopping centers (33%).

However, men are more likely to look for offers in department stores before brand websites, while the latter applies to women.

Online retailers like Amazon will also undoubtedly be the top choice for both UK and U.S. shoppers looking to avoid the frenzy of Black Friday crowds.

This year, Amazon’s sale will last 8 days and it won’t be limited to the online marketplace. The company is bringing back its “Home of Black Friday” experience store to London in efforts to provide shoppers with the opportunity to test all the latest innovations.

In the U.S. more so than in the UK, online retailers will face much stronger competition from offline brands this season.

Shoppers in the U.S. are more than twice as likely as those in the UK to head to big-box retailers like Walmart and Target (48% vs. 22%), which are starting their deals earlier than ever this year.

2. Where do shoppers discover Black Friday deals?

Perhaps one of the few days of the year when consumer demand dramatically exceeds brand supply, the purchase journey on Black Friday is profoundly different than usual.

Normally, brands are discovered and researched via search engines, with 37% and 53% of internet users globally saying this, respectively.

Offers on Black Friday in the UK and U.S., on the other hand, are first and foremost discovered via TV ads (39% of shoppers say this), followed by word-of-mouth (35%).

This route applies mostly to the U.S., however.

In the UK, emails or letters from companies are on a par with TV ads (35%) as the most popular source, while word-of-mouth remains behind search engines (32%), social media ads (30%) and brand websites (30%).

Brands need to also keep in mind their target demographic when releasing promotions ahead of Black Friday.

The youngest and most digitally-savvy shoppers – Gen Z and millennials – are most likely to find out about offers via social media (35% and 36%, respectively).

This is hardly surprising, given that in the UK and U.S., Gen Z spend over 3 hours on social media each day, compared to an hour less watching linear TV.

That doesn’t mean TV is dead; but it needs to be thought of as the leader in a crowded field.

Not only do older audiences watch more TV in absolute terms, their media consumption habits are also more focused around TV – even at the expense of other habits.

That’s why we see Gen X and baby boomers as the ones most likely to discover offers via TV this season.

Younger audiences, on the other hand, split their time among a wider range of media channels that they access primarily through their mobiles.

Despite this, however, TV ads complemented with social media ads will be the most effective strategy to target Gen Z and millennials.

3. What role will social media play this season?

Last year, we found that when it comes to Black Friday and Cyber Monday campaigns, social shopping rises by as much as 66% in the UK.

In fact, only a quarter of respondents said they wouldn’t make a purchase through social media after seeing a sales offer during the discounted weekend.

But a lot has changed since then, making social networks an even more appealing channel to drive sales on Black Friday. Slowly but surely, social commerce is becoming more of a prominent feature on social network platforms.

Providing a more user-friendly and seamless shopping experience is at the core of these platforms now.

In its quest to build an effective shopping platform and create a “personalized mall” for users, Instagram is now covering all aspects of the purchase journey.

Recently, Instagram released a new feature that allows brands to set up reminder notifications about their latest product launches. These alerts will mean that brand followers can purchase products on the platform as soon as they become available.

Meanwhile, WhatsApp Business is facing some hurdles with pushing its payments solution to India, but it’s currently testing a “Catalogs” feature in Brazil, Germany, India, Mexico, the UK, and the U.S..

Catalogs will allow brands to create a list of the products on sale with prices and information about the items.

We found that social media ads are the third-most popular source of offer discovery ahead of Black Friday (33%) and Facebook tops the charts here.

8 in 10 shoppers in the UK and U.S. who discover offers on social media say it’s most likely on Facebook.

Importantly, this goes beyond the discovery stage and different social networks are more effective depending on the products sold.

While Facebook is ahead of the game when it comes to overall discovery, it somewhat loses its effectiveness when it comes to consumers actually completing a purchase.

With its visual content, Instagram leads the charge in the beauty sector; 56% of those who discovered offers on the platform were motivated to purchase a beauty product afterwards.

However, with Instagram about to hide the “likes” on the platform, this could be short-lived. A number of influencers have already expressed their concerns over uncertainty around brand partnerships and have threatened to stop posting content.

Twitter, on the other hand, is most effective for promoting tech deals.

In fact, Twitter visitors in the UK and U.S. are 31% more likely than the global average to say having the latest technological products is very important to them (42% say this).

So, targeting these early adopters on the platform should prove beneficial for tech brands, especially during Cyber Monday.

Meanwhile, restaurants and grocers will reap the most rewards by promoting food content on YouTube.

Undoubtedly, social media is a key touchpoint this Black Friday, with retailers having to prepare for a 40% increase in social messages per day during the holiday season compared to the rest of 2019.

4. How much are consumers going to spend?

Shopping on Black Friday is strategic; people are aware in advance what deals they are going to look for, with only 11% saying they haven’t decided what products they’re going to purchase.

Electronics top the charts (55%), followed by clothes (53%) and gifts (47%).

The budget shoppers have dedicated varies depending on the product.

In the UK the highest budget (£250+) is dedicated to automotive purchases (57%) and charity donations (51%), while people plan to spend anything below that sum for personal care items (60%) and groceries (58%).

Charity donations above $250 will be even more popular in the U.S. (68%), but a considerable amount will go to luxury items too (64%).

Compared to last year, we expect the overall spending to increase.

In 2018 we found 25% of UK shoppers expected to spend over £250, and this figure has risen to 27% today.

It’s clear that the anticipation and demand are there, with consumers’ budgets already sorted. Brands looking to empty their shelves this holiday season need to ensure they’re covering all touchpoints on social media and meeting the expectations of their target demographic.