COVID-19 brings a wave of public health, economic, and cultural crises that trigger yet unforeseen repercussions. While three-quarters of US online adults say they’re familiar with details of the illness, talk to myriad consumers and observe a range of reactions.

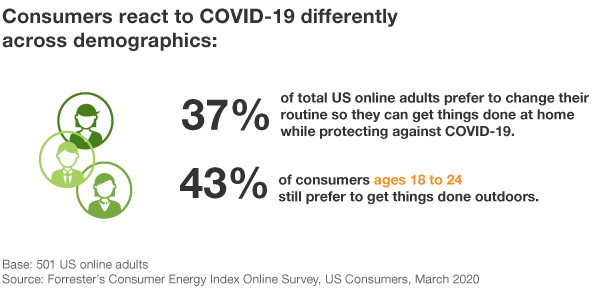

Our latest data reveals that looking at US consumers through the lens of age, income, and location explains the stark attitudinal and behavioral differences. Here are the five most important insights to consider when messaging to consumers across demographics:

- Younger consumers skew least afraid of COVID-19 and are eager to spend time outdoors. About half of consumers ages 18–24 say that current fears surrounding the pandemic are unrealistic, compared to 38% of consumers overall. And younger consumers are less inclined to stay home to get things done: 43% would rather go out than stay in during this time.

- Middle-aged consumers underestimate the virus’ impact in the long term but prefer to take precautions. Six in 10 consumers between ages 45–54 believe that COVID-19 will not have a significant impact on their life — this cohort is more likely than any other age group to undermine long-term repercussions. Nonetheless, half of consumers ages 45–54 still prefer to go about their daily lives from the safety of their home.

- Older consumers are the most fearful of its spread and change behavior accordingly. Forty-three percent of consumers ages 65 and up are afraid of COVID-19, and for them, the fear is compounding: As one ConsumerVoices member (female, 65-plus years old) says, “I am very stressed because I am elderly and have underlying health issues. I’m sure this stress isn’t helping my blood pressure.” These consumers are least likely to believe that media stories sensationalize news about the virus and are most likely to get things done from indoors only.

- Lower-income consumers rely on companies for guidance and protection. Even though consumers with a household income (HHI) below $25K skew more afraid of the virus, over a third of these individuals trust that companies will prioritize their customers’ health when making business decisions during the pandemic. In contrast, wealthier consumers strive to dispel their fear by seeking information: A third of consumers with an HHI of $150K-plus spend over an hour learning about COVID-19 each day; they are least willing to believe that businesses will look out for consumer well-being today and in the future.

- Consumers living in COVID-19 hotbeds like WA, CA, and NY are most cynical about the long-term dire impact. Half of consumers living in these states are afraid of the virus and believe that the virus will change their lives for the worse, compared to fewer than four in 10 in other states.

As the situation surrounding COVID-19 rapidly changes, so do consumer attitudes and behaviors. Forrester is continuously measuring consumer response — stay tuned into my blog as I share the most up-to-date insights. Forrester clients, please join us in discussion about what the latest consumer data means next Thursday, April 2. Non-Forrester clients, please share your questions, comments, or ideas via inquiry.