As coronavirus continues to dominate daily lives and newsfeeds, consumers are understandably anxious – not just about the disruption to their day-to-day, but about the longer-term consequences.

Rarely does an event have such a profound impact on all countries across the world and, at GWI, our role is to keep you informed about how consumers are feeling and reacting at this time.

That’s why we’re releasing the results of a multi-national study that we fielded in 13 markets.

The research was conducted in Australia, Brazil, China, France, Germany, Italy, Japan, the Philippines, Singapore, South Africa, Spain, UK and the U.S. We chose these places to give a geographical spread, as well to represent countries which are at different stages in their journeys:

- Those seeing the possibility of emerging from the crisis (China, Singapore)

- Those experiencing country-wide lockdowns (Italy, Spain, France)

- Those seeing partial lockdowns (Germany, Philippines)

- Those which appear to be heading towards partial or national lockdowns (Australia, UK, U.S.), or where further actions could be needed (Brazil, Japan, South Africa)

Here are some of the most important insights gathered from our international study. You also can also find full reports and updates on the consumer response to COVID-19 in our hub.

Big increase in in-home media consumption.

95% of consumers say they’re now spending more time on in-home media consumption activities.

Unsurprisingly, the biggest spike is for watching more news coverage; 2 in 3 are spending more time doing this (half of whom say they are spending significantly more time on it).

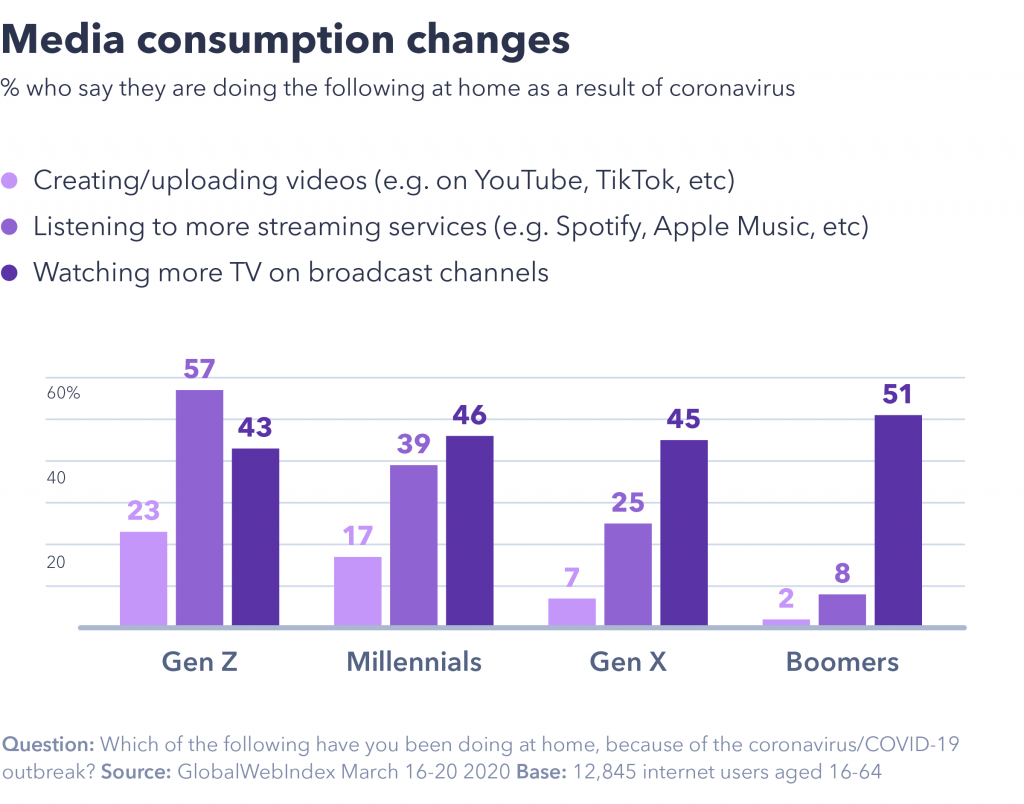

Age can be a huge influencer over behaviors here; Gen Z are seven times as likely as boomers to report increased usage of music-streaming services, and over ten times as likely to be creating and uploading videos.

Conversely, boomers are the most likely to be watching more TV on broadcast channels.

Income has an impact too:

Higher wage-earners are more likely to report increased media consumption.

This especially the case for watching news coverage and using streaming services.

But there is a general uptick across the 13 markets surveyed:

- Over 50% are watching more streaming services.

- 45% are spending more time on messaging services.

- Almost 45% are devoting more time to social media.

- Almost 15% say they are creating and uploading videos.

Spain, Brazil and Italy are ahead for increased gaming (40%+).

Smartphone usage is up significantly.

70% globally say they are spending more time on their smartphone, climbing above 80% for Gen Z.

Increased usage of PCs and desktops is led by boomers. For many other devices, increased usage is highest among Gen Z and then falls in line with age; this pattern is particularly pronounced for laptops, smartphones and smartwatches.

Millennials show the highest increased usage of games consoles, smart speakers and tablets.

Location can make a big difference here. Over three-quarters of urban respondents are spending more time on their smartphones, compared to just under half of rural consumers.

Country-by-country behaviors can also be very different; around three quarters or more in the Philippines, China, Brazil and South Africa report increased usage of their smartphone, compared to around a third in the UK, Australia and Germany.

iPhone owners (71%) have a 10-point lead over Samsung owners (61%) for increased smartphone usage.

Widespread belief that the Olympics should be cancelled.

Only 5% now think they should go ahead regardless, peaking at 7% in Japan and the U.S. This remains consistent by age, although Gen Z (6%) and millennials (6%) are ahead of boomers (3%).

Some 46% think they should go ahead only if the outbreak is completely or mostly over, 36% think they should be postponed, and 12% think they should be cancelled. By generation, boomers are the most likely to want cancellation (20%).

Even in host country Japan, just over 50% believe they should be postponed or cancelled.

Strikingly, among sports fans (those who list watching sport as an interest) and sports participators (those who take part in sport), the figures remain very low: just 5% of fans and 7% of participators think they should go ahead regardless.

Large purchases could be delayed for a long time.

Almost 40% say they will buy major purchases they have delayed only when the outbreak begins to decrease or is over in their country. But close to 20% say they will wait until the outbreak decreases or is over globally.

The top income groups are most open to making their purchases once the national situation begins to improve.

Flights (26%) and vacations (41%) are the most likely to have been delayed, but around 15% report delaying purchases of luxury items, technology devices and home appliances and devices.

The delay for luxury items climbs to one of its highest figures in China (20%), underlining the challenges for brands in this sector who rely on Chinese customers.

Age is a strong influencer here; Gen Z are most likely to be delaying purchases in several categories, no doubt in part to their lower average income levels. Over 20% in this generation say they are delaying buying technology devices.

Concern about the local vs global situation varies.

In China, around 1 in 4 are very or extremely concerned about the situation in their own country, but this rises dramatically when Chinese consumers are asked about the global situation.

In countries like France, Spain, UK, and the U.S., the figures are much more equal – in each case, between 50 to 60% are very or extremely concerned about the situations both globally and in their own country.

Business travelers and travel enthusiasts (those who express an interest in travel) are some of the most likely to have strong concerns about the global situation – almost two-thirds in each audience are very or extremely concerned.

Interest in live streams of postponed events.

The prospect of live-streamed sports events and music concerts are equally popular – over 4 in 10 are interested in watching them. By country, figures for both peak at over 50% in China.

Around 20% are interested in live-streamed theater shows, with millennials and the higher income group reporting the highest figures.

Age is a strong influencer here across the board; almost 50% of boomers aren’t interested in any live streaming, compared to around 20% of Gen Zs and millennials.

Interest in live-streamed music concerts drops in line with age, whereas millennials lead the charge for sports live-streams at almost 50%.

Unsurprisingly, fans of each entertainment type report the highest interest levels: 50% of music lovers are keen to see live-streams of concerts, while almost two thirds of sports fans are interested in watching live-streamed sport.

Perceived impact on personal finances vs national or global economy.

Across the 13 markets, 30% think it will have a big or dramatic impact on their personal finances. But 75% think the same about their country’s economy, and 85% think it will have a big or dramatic impact on the global economy.

The biggest discrepancies are found in France, Germany, Italy, Japan, the UK and the U.S.

Here there’s at least a 50-point difference between the smaller numbers expecting it to have a big or dramatic impact on their personal finances vs the higher numbers expecting it to hit their country’s economy.

By generation, boomers see a 56-point gap here: 30% expect it to have a big or dramatic impact on their personal finances, whereas 86% think it will have a big or dramatic impact on their country’s economy.

The higher income group (43-point gap) are ahead of the lower income group (35-point gap).

Chinese respondents expect the shortest length of outbreak.

Perhaps spurred by the absence of locally transmitted cases in recent days, Chinese respondents are the most optimistic about how long the outbreak will last nationally.

Over 85% expect it to be over in China within 3 months, compared to just 33% in Australia, 20% in Singapore, 35% in the UK and around 50% in the US who think the same about their own respective countries.

National attitudes are complex here, and can be influenced by multiple factors.

That’s why we find countries at similar points expressing very different perceived lengths of outbreak: in France, over three quarters expect it to be resolved in their country within three months, but only 40% in Germany think the same.

Chinese optimism decreases notably when we ask people how long they expect the outbreak to last globally; only a quarter in China expect it to be resolved within 3 months.

Fact-checked news is expected from social media.

Globally, around two thirds expect social media companies to be providing fact-checked content and to be filtering “fake news”. Almost 3 in 10 would like them to provide live-streams of events – something which peaks among Gen Zs and millennials.

Users of different services hold broadly similar views about what social media should be doing. But, if we look at Facebook, Twitter, Instagram, WeChat, YouTube and Snapchat, then it’s Snapchatters who are most likely to want live streams and to have connections with neighbors and local communities.

On the other hand, WeChatters are most vocal about wanting fact-checked content and the filtering of fake news.

Views on advertising are polarized.

When asked if brands should carry on advertising as normal, just over a third agree, just over a quarter disagree and just over a third aren’t sure.

This polarization remains present by age, gender and income.

There’s much greater divergence at a national level.

Approval is led by Australia, Brazil, Italy and the Philippines at over 50%. Disapproval peaks in Germany at 60%, followed by France at 40%.

Globally, people are most in favour of brands responding to the outbreak by providing flexible payment terms (83%), offering free services (81%), closing non-essential stores (79%) and helping to produce essential supplies (67%). All of these score significantly more than the 37% who think they should carry on advertising as normal.

Notes and Methodology

All stats in this report are from a GlobalWebIndex custom recontact survey fielded March 16-20 among 1,004 (Australia), 1,001 (Brazil), 1,003 (China), 1,016 (France), 1,010 (Germany), 1,010 (Italy), 1,079 (Japan), 1,008 (Philippines), 1,008 (Singapore), 573 (South Africa), 1,005 (Spain), 1,040 (UK) and 1,088 (U.S.A.) internet users aged 16-64.

We have made our report available to everyone, but clients will be able to cross-analyze the results of this coronavirus research with the digital lifestyle data we track on a regular basis.