Moats are ditches of water that surround castles. They’re the first-line of defense against intruders.

Legendary investor Warren Buffett suggests you look at your business in a similar way. Your business is the castle, and the moat is what protects your business from competitors. Some refer to this moat as a competitive advantage.

Successful companies have moats that protect them from competitors. Their moat can be a technological advantage, a real estate advantage, pricing advantage, and intellectual property.

Here’s why moats matter, and why every successful company needs one.

Background on Moats

“The most important thing to me is figuring out how big a moat there is around the business. What I love, of course, is a big castle and a big moat with piranhas and crocodiles.” ― Warren Buffett

Warren Buffett was the first to refer to a competitive advantage as a moat. Here’s a video of him explaining moats back in 1998 at a speech at the University of Florida:

Now that we understand moats, let’s look at the common types of moats. We’ll then get into examples of companies with wide moats, and how entrepreneurs can ensure they’re building a moat for their business.

Types of Moats

Moats can vary in every industry, but let’s look at some common ones that cross industries:

Price

Offering discounts isn’t a moat. Being able to offer a lower price over a long period of time while at the same time offering similar service to competitors is a moat.

A prime example of this would be Geico insurance company. Everyone needs insurance, and Geico is able to offer lower price than competitors. And customers don’t have to sacrifice service in order to save, either.

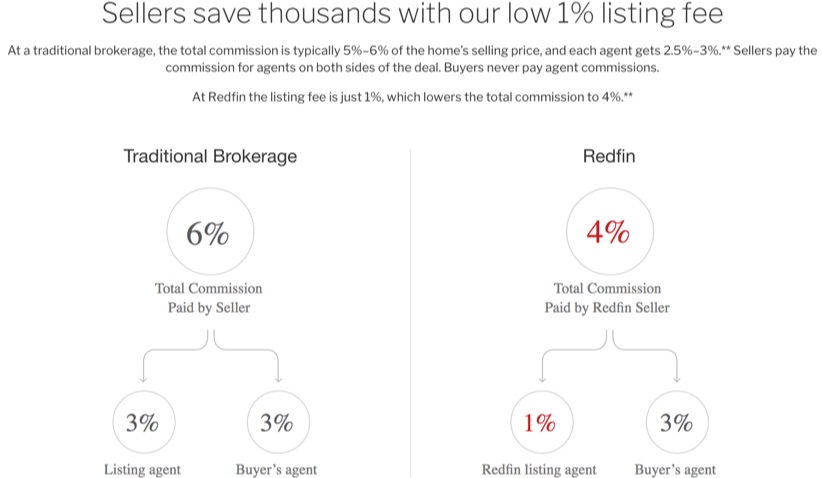

Most realtors charge a 6% commission fee for selling your house. So what does Redfin do? They cut those fees down to 4%, which means that the seller makes thousands more when they sell with Redfin.

The only way another realtor can compete is by significantly cutting their fees and accepting less money. And are they really going to do that after keeping their fees at 6% for years? Probably not, unless they’re forced to.

Another company with pricing advantage is Walmart. Amazon and E-Commerce may be growing, but Walmart is still the king of retail (which is not dead).

One of the biggest criticisms of Walmart (which is ironically also its strength) is that they put their big-box stores in small towns, and undercut local stores using predatory pricing, and drive those established, local stores out of business.

It’s that strategy of being able to consistently undercut competitor prices (even in suburban communities) that drive Walmart’s success and is their deepest moat. If Walmart raised prices on all the products they’d sell, their revenue would plummet and they would lose market share to their competitors.

Technology

Exclusive technology can encourage customers to use your product over any other. And it doesn’t have to be anything groundbreaking. It can be the sum of many features all rolled into one.

Salesforce CRM has a lot of features. You can do a lot with the product – both sales and marketing teams can get a lot of use out of it. The development cost of this is steep for other competitors looking to disrupt the commanding market share that Salesforce owns. This technology, combined with high switching costs makes for high retention rates and strong recurring revenue growth.

Apple has created a moat with their products. A feature like Messages automatically syncs with your iPhone and you can send and receive text messages through your computer. I’ve personally become so used to it that it makes it cumbersome to go back to texting on my iPhone. This feature, combined with dozens of others, is why someone may choose an iPhone over Android. Apple has done a tremendous job of creating this ecosystem and bridging iOS with macOS.

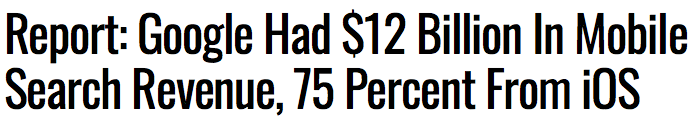

Google’s algorithm is probably the most high-profile technology advantage that we all know. Their search algorithm, along with their infrastructure, has been built up and refined over the years and competitors simply cannot match it. Creating a new search engine with the goal of more accurate search results would result in failure. So smaller companies that are looking to disrupt Google, such as DuckDuckGo, take advantage over some user concerns with using Google. DuckDuckGo is a privacy-based search engine that capitalizes on the ascension of privacy-related concerns more and more of the public is having.

Socially-driven companies like Ecosia plant trees when users search. They’ve found some niche of the market and used it to their advantage, but ultimately they won’t be able to surpass Google.

Google throws some piranhas in their moat with Android, which has Google search built into every phone. And Google pays Apple a hefy charge to have their search as the default on iOS devices, but it nets them billions more to ensure it’s a profitable deal for Google.

Think about what matters in your industry. Are you in information security? Then a unique technology that no other company has would be the start of a moat – you’ve got the ditches built and a little water, now you need more to add to your moat.

People

The employees can be the sharks that swim around in the moat. Good people make good products. If your company is able to attract and retain the best people, you’ll be adding more to the moat that you already have.

Think of the companies that consistently attract the best people – Google, Apple, Goldman Sachs, etc. These companies are great because of the products and services their employees create, which in turn attracts more great people to work for them. (Because who wouldn’t want to work for a great company that’s surrounded with talented employees?)

Apple has a moat, particularly because of its design, which Marissa Mayer has called the “gold standard”. The design can be credited to the creativity and innovation from Apple’s design team, most notably Jony Ive.

Ive is the design leader at Apple, and has more than 1400 patents in his name. Would it be possible to put a dollar value to the growth that Ive has contributed to Apple? Some may argue that with Jobs’ passing, Ive is Apple’s most valuable asset.

Patents

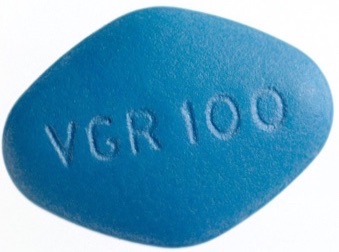

There’s a reason why we have patents. They encourage innovation and protect intellectual property. A pharmaceutical company that discovers an effective new drug has a moat protecting that discovery for years.

The new profits from that drug continue for as long as the patent is held, and the company grows its business because of that moat. The only thing that could disrupt the moat is a competitor creating a similar drug, or undercutting prices.

For instance, take a look at the Viagra business for pharmaceutical giant Pfizer. Developing that drug cost a lot of money on Research and Development, and once they discovered it and how effective it was (and the market opportunity), they secured the patent. It’s estimated that Viagra drug has earned Pfizer nearly $1.5 billion in annual sales.

That moat – being able to spend millions on R&D and discover a new drug with a great market opportunity (and patent the drug) has made Pfizer a leader in the pharma market.

Locations

This is obviously more important if you’re in retail or real estate, but a great location can help your company a lot. Good locations are expensive but very valuable. And once you have a good location, it’s locked in. A competitor can’t literally build on top of you (although some may try to get right next to you).

Apartment company Aimco acquires properties and buildings in key locations that serve their business well. They pick cities and neighborhoods that are growing, have an educated population, and high-incomes. Then they charge a premium for their apartments. And they can do it because they have the locations that people want to live at.

A competitor may be able to offer a cheaper apartment, but it won’t be next to the lake or have the great views. Those are the things that the higher-income people care about, and they’ll pay a premium for it.

Companies with Successful Moats

Companies with sustainable competitive advantages have moats. Here’s three examples of companies we all know with deep moats.

1. Netflix

Do you have a Netflix subscription? I’ll bet you do. And if you don’t yet, you’ll eventually give in and pay Netflix that $10/month for access to their library of high-quality content.

Netflix is taking over the entertainment world. They have 118 million worldwide subscribers and it’s only growing more by the day. They’re able to keep attracting new subscribers and retaining their current subscribers for a few reasons:

- Most people in Netflix’s market have broadband internet.

- They’re adding new shows and movies every month to keep people watching. This means you can’t simply subscribe when the new season of House of Cards goes live, then cancel after you’ve watched that season.

- The cost for Netflix is relatively low when you consider that the library is commercial-free content.

- Cord-cutting is a real thing and Netflix is profiting from it.

So how did Netflix create their moat that has led to this phenomenal success? Let’s look at their keys – a data-driven formula to content.

Content and Data Model

You may not know it, but Netflix is one of the most data-driven companies there is. Believe it or not, they didn’t greenlight American Vandal because the executives laughed at the pitch. They greenlighted it because their data said it was worth the investment.

You may be thinking: so what? A lot of companies use data, why does that mean Netflix has a moat?

The key lesson here is that Netflix doesn’t just rely on savvy network executives. They have an edge on these companies because they rely on data. The success rate for network executives is pretty low. Most shows don’t last more than a few seasons before they’re cancelled. Netflix, on the hand, has quickly risen to the success of HBO, which has long been considered the gold standard of cable television. The list of successes with HBO is long, but Netflix has become quite a competitor to HBO, with most recently getting 2nd place in Golden Globe nominations.

It’s the data system that they have that can continually produce high-quality content. That technology, and that team, provide a moat for Netflix.

2. SiriusXM

In the era of Spotify (free), podcasts (free), and terrestrial radio (free), SiriusXM (paid) thrives. And not just thrives, their business is the best it’s ever been. They recently recorded a milestone – 32.7 million subscribers, most in the company’s history. How does a company that charges roughly $200/year for radio do so well?

They succeed because of their infrastructure, exclusive content, and deals with automakers. Let’s break all three down.

Infrastructure

SiriusXM uses satellites to transmit their programming to subscriber’s cars. This essentially means that anyone in the world can receive their signal, and thus, their programming. If anyone wanted to compete with them, they’d have to have massive upfront costs. This makes it a high barrier to entry.

The only other competition is terrestrial radio, which has limited range, and internet radio like Pandora, Spotify, and Slacker. These are good options, albeit their data usage, but here’s where SiriusXM throws some sharks in their moat with their exclusive content.

Exclusive Content

SiriusXM has exclusive contracts with the NBA, NFL, and NHL. This means that if you’re in Phoenix and can’t get the Chicago Cubs game, you can tune in and listen to it through SiriusXM. No one else offers that. You cannot get it with terrestrial radio or streaming services.

They also have an exclusive contract to broadcast Howard Stern, a massively popular talk show host. You can’t podcast him. If you want to listen to Stern, you’ll have to sign up for SiriusXM.

This content, combined with hundreds of talk and music stations give SiriusXM a deep moat over their competitors. And they add some phirnahas to their moat by having deals with automakers.

Deals with Automakers

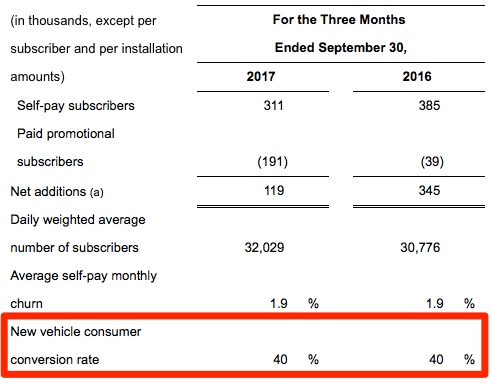

Most people sign up for SiriusXM when they buy a new car (or sometimes a used car). Their conversion rate from trying SiriusXM to subscribing is 40%:

Four out of ten people who try SiriusXM end up subscribing, and those that subscribe tend to stick around given their low churn rate. With strong auto sales, SiriusXM will continue to acquire new customers. Is there any competitor that has as good of a distribution as SiriusXM? It would be like if Spotify came pre-installed on every new iPhone and Android sold.

3. Airbnb

For decades, hotels competed with each other without any disruptive competitor. Some competed on price, others competed on location, some competed on service (at a high price), while others competed on all three. They all got market share and at the end of the day were very successful.

Then came Airbnb.

Airbnb was able to compete with hotels on all three fronts, and grew quickly. Unlike hotels, they don’t own real estate. Instead, they’re a service that facilitates travel between hosts and guests. They offered something hotels never could – a wide range of location options and pricing flexibility. And they’ve perfectly maintained the balance between supply and demand in nearly all markets.

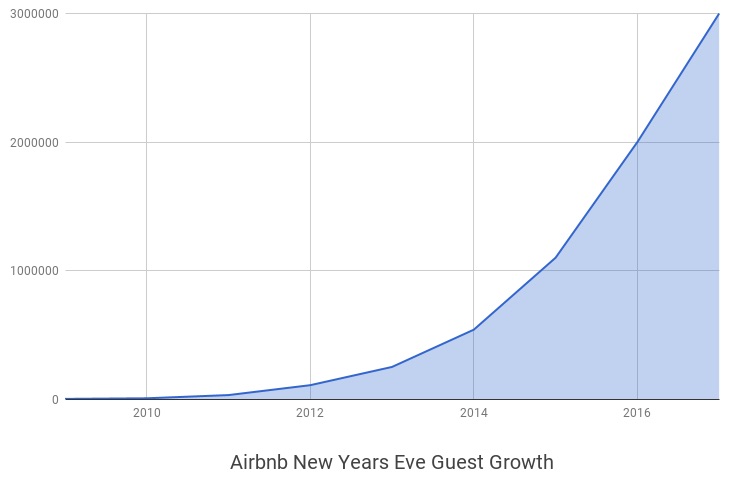

Just take a look at their growth, according to CEO Brian Chesky:

Guests on @airbnb over New Year’s

’17: 3 million+

’16: 2 million

’15: 1.1 million

’14: 540,000

’13: 250,000

’12: 108,000

’11: 31,000

’10: 6,000

’09: 1,400— Brian Chesky (@bchesky) December 31, 2017

Here’s a chart of that growth:

That growth is pretty remarkable, right? Pretty much hockey stick growth. That’s what a moat gives you – sustainable growth.

So that was their moat. Now they’ve threw sharks in their moat by improving their service and processes and building their user base. Let’s take a further look.

The Service Protects Against Entrants

Let’s imagine we want to create an Airbnb competitor. How would we get hosts and guests to use our service?

- We could undercut their prices, which would basically ensure that we are forever unprofitable. Airbnb already operates with low margins – taking a 3% cut of the guest charge.

- We could undercut that by charging hosts 0%, but how would we make money? Airbnb’s low fees means they get a strong supply of hosts.

- We could offer additional services to make revenue, but Airbnb already has a head start on that.

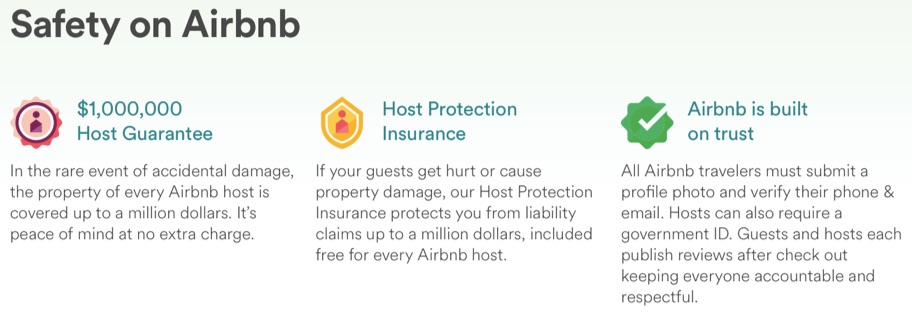

- How would we ensure safety? Airbnb has years of brand equity built up with hosts and guests, and throws in the $1 million warranty to cover any damages.

Going through this exercise shows us that creating a service that is superior to Airbnb is difficult. They have the brand equity built up, the business model works for them and their customers, their supply cannot be matched, and demand is equally as strong as we can see from the graph above. Can you think of any ways you could compete with Airbnb and threaten their moat?

Building Your Moat

While there is no formulaic method for building your moat, I’ll lay out a few steps to help get you thinking in the right direction.

1. Understand the Market

The first step in building your moat is to deeply understand the industry you’re about to enter. Understanding the market, pain points, and incumbents already in the marketplace is key to building your moat.

The last thing most industries need is another “me too”. If you build a hotel in a crowded urban area, will anyone notice? Probably not, unless you force them to notice you through beautiful architecture, historic landmarks, or exceptional service.

This sounds like an obvious first step, but many people start companies in already crowded markets, and don’t offer anything unique, and end up failing.

2. Understand Market Needs

Once you understand the market, it’s time to know if you can offer something unique. What does the market need that isn’t currently offered?

Netflix saw a market need. People didn’t like paying late fees for movies, and the selection offered at movie rental stores wasn’t vast. Netflix disrupted this by having a vast selection with no late fees. Tie that in with a recurring revenue model and they’ve put their competitors out of business. The only downside was the wait to receive the movie, but consumers decided the tradeoff was worth it.

3. Create Your Competitive Advantage

Now that you understand the market and the market needs, you can start creating your competitive advantage.

When Hiten and I created KISSmetrics, we created an analytics product no one else had. We created a better, more streamlined funnel report. And we didn’t track pageviews, we tracked each visitor as a person. We did this only after doing market research, building a Minimum Viable Product, and gaining market traction.

I can’t tell you what your specific moat should be. It will vary with each industry and market. The examples I have been giving should help you understand moats and get you started.

4. Create and Add to Your Moat

Now that you have a moat and it’s proven to get market traction, it’s time to build upon that moat. You have to do this because moats don’t last forever. If other businesses see you’re doing well with your competitive advantage, they’ll copy you. That’s why Warren Buffett says it’s important for business owners to throw some sharks and piranhas in their moat to further protect the business from competitors.

The early KISSmetrics team had a competitive advantage with our product, but no marketing advantage.

Then we started our blog and began building traffic.

After routinely publishing blog posts and promoting our posts, we started getting hundreds of thousands of people to our blog every month. That took a lot of time, but it added to our moat.

Most competitors would have loved to get our traffic and the amount of eyeballs we got on our site every month. And as we added to our traffic with each successive months, we throw more sharks into our moat. We had our product moat and marketing moat and that became very successful for us.

To help you further understand moats and get you in the frame of thinking, let’s look at some companies that have deep moats.

Conclusion

There are many reasons why companies go out of business, but a common one is that they didn’t have a moat. Their offering just wasn’t different or unique enough from the incumbents in the market.

Large corporations wind up with reduced margins and increased competition because they didn’t protect and add to their moat. Remember the market share Microsoft had with their Windows operating system? That dwindled because they didn’t innovate and Apple capitalized on their shortcomings.

As an entrepreneur, you have to build your moat and then add to it with some sharks and piranhas. And always being aware of competitors and disruptive companies that will try to take market share from you.

What moat does your business have and how have you added to it?

About the Author: Neil Patel is the cofounder of Neil Patel Digital.