Google Pay doesn’t begin or end with a mobile app, but the next stage of its universal rollout does.

Today (Feb. 20), the tech giant announced the launch of its new mobile app for viewing and managing payments across platforms, cards and other payment methods, in addition to plans for making the Google Pay capability accessible to all — no matter what device they’re using, no matter where they’re shopping and no matter whether they’ve established an account on a Google property before.

The goal? To enable easy, secure payments for anyone, anywhere in the digital or physical world, all using a single account — the holy grail of modern payments.

It’s a tall order, but it’s one Google’s VP of Project Management for Payments, Pali Bhat, believes is necessary to move commerce to the next level.

In a recent interview with Karen Webster, Bhat explained why Google’s latest payments development marks the beginning of the rest of Google’s payments life, and what it’s going to mean for consumers and merchants online, in apps and in physical stores.

Automatic Onboarding

Google Pay isn’t Google’s first digital payments rodeo — or even its third or fourth.

With roots that date all the way back to Google Checkout’s debut in 2006, Google’s quest to conquer payments online, and then in-store, has remained elusive. Android Pay, its in-store contactless mobile wallet that launched in 2015, suffers from the same malady with which most other contactless, in-store payment methods are plagued — without functionality beyond just payments, most people aren’t all that interested.

Google Pay, Bhat said, is different. It’s a digital payments experience that has embraced the valuable lessons the company has learned over the last 12 years — a new commerce experience that makes commerce possible in a digital world by making payments seamless.

That starts, Bhat said, with making it utterly simple for a consumer to get a working Google Pay account. The secret sauce of Google Pay, the CEO said, is the ability to convert the hundreds of millions of consumer accounts with registered card credentials on any one of Google’s touchpoints into Google Pay accounts. That means consumers with accounts and credentials on file with Google Play, Assistant, YouTube and — the potential motherlode of payments credentials — Chrome are all essentially teed up to become Google Pay accounts.

There’s no navigating to Google platforms, no need to even download the Google Pay app to become a Google Pay user.

All users must do, said Bhat, is say “yes.”

“We have a billion users on Chrome,” Bhat said. “We want every one of those users to be able to pay. Users are already checking out [with merchants] on Chrome, so it will be easy to save their credentials there.”

Entering payment credentials on Chrome the first time, Bhat said, will generate a prompt to save those credentials, he explained. Once the user agrees, he or she is automatically onboarded and can now use those credentials across all Google platforms and partner platforms, such as InstaCart, Airbnb and DoorDash.

In other words, a Google Pay account is established for a user at any one of Google Pay’s touchpoints and can then be used across every Google touchpoint; it becomes the default credential for consumers to use at any merchant that accepts it.

Invisible Payments

Bhat said Google Pay will work wherever customers want or need to use it, as long as the user is signed into his or her Google account — with or without having ever downloaded the Google Pay app.

“What’s different [about Google Pay] is the number of ways a consumer can onboard and the seamless way that they can use it, including at any store that accepts contactless payments,” Bhat said.

Google’s payments philosophy, he explained, is that customers should not have to download an app to pay, because many users want a mobile payments app experience in addition to just having a mobile payments experience.

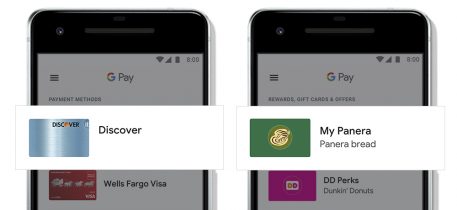

The Google Pay app, he said, does have a few bells and whistles that improve ease of use and, hopefully, create an incentive for people to use it.

The Google Pay app is organized around a live feed of transaction data, regardless of the method of payment used to make the purchase. The app also provides a place for loyalty cards and other membership information to be organized, as well as an easy way to access merchant partners, including those that may be nearby.

Google Pay: What’s Next

Bhat said that soon, all Android Pay users will be upgraded to Google Pay. Then, over the coming months and throughout 2018, Bhat said Google will partner with more merchants to bring them onboard, as well as the platforms that can enable the easy integration of Google Pay for their merchants. Additional functionality for Chrome in support of Google Pay is also on the short-term roadmap.

Bhat said the Google Pay app released Tuesday is the beginning of making payments really “pay” for consumers and the many merchants who want a more efficient way to do business with them.

Turning existing account credentials already on file into a Google Pay account removes one big barrier to getting consumers onboard – in a sense, they already are – with no behavior change required. A consumer who “says yes” is what turns those credentials into a Google Pay account – and Google, it hopes, into something more than that: the Amazon challenger that uses Google Pay to turn its ecosystem into a powerful commerce engine.

Turning existing account credentials already on file into a Google Pay account removes one big barrier to getting consumers onboard – in a sense, they already are – with no behavior change required. A consumer who “says yes” is what turns those credentials into a Google Pay account – and Google, it hopes, into something more than that: the Amazon challenger that uses Google Pay to turn its ecosystem into a powerful commerce engine.

We’ve often said that, in payments, time is a currency. Wait too long, and there’s the risk of getting one-upped by something better. Enter too soon, and it’s too much of a slog to make and shape the market.

Google Pay enters the market at a time in which merchants big and small seem eager for an Amazon alternative, and when consumers want a single way to pay everywhere they shop – on and offline.

And that’s at a point in time when Google needs a plausible way to defend its core business: search-based advertising.

Another power player makes its power play in payments today.

And just think, we have 10 more months in the year.