Media companies could soon become collateral damage in Google’s escalating shopping war with Amazon.

A recent report from the Information (paywalled) writes about Google’s ambitious shopping efforts. In its attempt to compete with Amazon–whose digital ad program is showing real signs of encroaching on the Google-Facebook ad duopoly–Google has been adding retailers to its Express shopping (which will reportedly rebrand to Google Shopping). This program will be how the search giant attempts to beat Amazon: People will search for items on Google.com and then be able to buy them through smaller merchants while still using the platform.

But one thing the Information report doesn’t mention is how Google’s shopping ambitions will negatively affect how media companies monetize their own content. The change will likely have a significant impact on affiliate marketing link revenue, which is one of the ways that publishers have been trying to make up for advertising headwinds over the last few years.

Back in the good old days, digital advertising was more diversified and websites were able to bring in relatively stable revenue. Now the ad market share has concentrated toward the two biggest platforms–Google and Facebook–and media companies have seen revenues plummet. As a result, organizations have sought out other means of making money; affiliate linking is one such model.

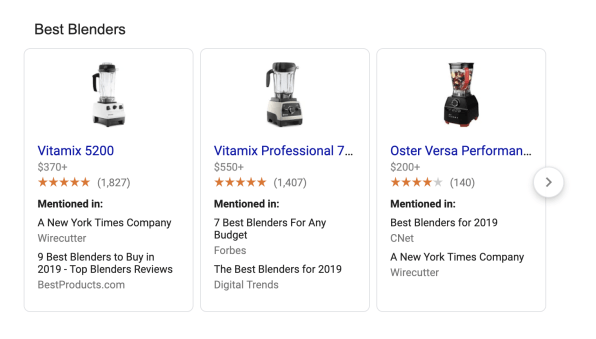

Affiliate linking works thus: Publishers feature certain products on their websites and include a link to make a purchase. If readers choose to buy said items, the sellers–usually Amazon–offer them a (tiny) cut for helping to facilitate the sale. For websites like the Wirecutter and CNET–which have become go-to sources for product recommendations–affiliate linking and search engine optimization have become a solid way to bring in meaningful revenue.

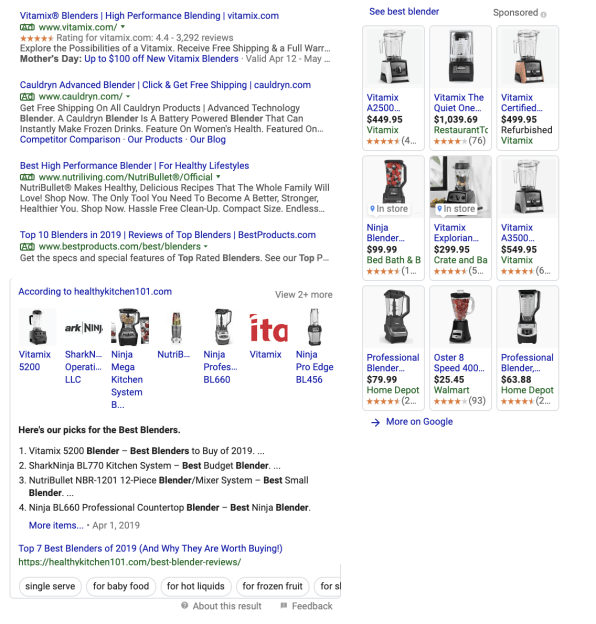

But things may be changing soon, as Google continues to advance its e-commerce efforts; Google appears to be building a shopper recommendation algorithm. For example, when I search “best blender,” I am given sponsored blender choices at the righthand side of the search results. A little ways down is another Google-made list of the best blenders, feeding recommendation content from the website healthykitchen101.com.

Then, if I scroll down even further, there’s another box that gives even more recommendations–and it mentions the myriad sites on which they’ve been rated.

This section, if it were to become featured more prominently, could significantly eat into affiliate revenue that would otherwise go to media companies. Even though Google is linking to these recommendation lists, it is using that content to feed its own recommendation engine. Not only that, but the top link provides a way for users to bypass the articles themselves and find a seller via Google. In essence, it’s taking these sites’ content, while handicapping their ability to monetize on it.

This new widget doesn’t show up in all of my searches, so it’s likely an experiment for the time being. For other product searches, Google highlights one individual review article at the top, teases its content, but doesn’t link to external sellers. This is slightly less disruptive than the first example, but it still relies on these websites’ content for an automated search recommendation.

I reached out to Google multiple times for comment and will update this post if I ever hear back.

For websites like the Wirecutter, this could be a significant blow. The New York Times-owned website uses this revenue model to help the overall company rely less on the volatile advertising industry. So far, it’s been a good bet. In its most recent earnings report, the New York Times Company reported $49.4 million in “digital other revenue” for all of 2018. This metric is likely slightly north of what the Wirecutter brought in for the newspaper that year.

Media companies, however, likely aren’t part of Google’s shopping equation. For the digital juggernaut, it’s all about competing with Amazon–especially in light of the fact that its core advertising business is beginning to see slower-than-expected growth. At its last earnings report, Alphabet missed revenue expectations by nearly a billion dollars–which gave investors the impression that its biggest money engine was beginning to slow down. As Amazon continues to invest in its growing advertising business, Google now seems to be trying to find other ways to beat the competition.

For now, this seems like just an experiment. We’ll see if Google decides to roll out the new shopping feature further. If it does, expect to see some publishers suffer.