Brands want to know where, how, and why consumers make final purchase on products, so that they can make smart decisions about retailer partnerships, product selection and development, and marketing and promotions. Retailers, meanwhile, need to understand how they are performing in different channels (in-store and digital), as well as which brands and models sell best and why. Manufacturers and retailers alike also want insights into competitor performance and partnerships.

A case study of the TV market in India

Having looked at how our Consumer Journey solution helps brands understand how consumers research a purchase in my previous post, let’s dive into the insights it offers into the moment of their final purchase.

Truly understand all the factors that influence consumers’ final decision at the moment of purchase

Powered by the GfK Consumer Insights Engine, our Consumer Journey offers technology and consumer durables manufacturers a full view of the online and offline consumer purchase journey. This enables them to answer key business questions, including:

Lost shoppers

- How many shoppers did we lose during the purchase journey and what is the size of this lost opportunity?

- Who are these shoppers?

- Which competitive brands or retailers did we lose out to and why?

Partnership opportunities:

- Which retail or manufacturer brands should we partner with?

- Which retailers or brands could offer access to unique customers?

- Which competitive brands or retailers attract the same consumer profile as we do?

Channel conversion:

- What are my channel conversion rates?

- How can I improve them?

- What role does each channel play in the consumer journey?

As a subscriber to the Consumer Journey module, you can use the Consumer Insights Engine to get instant access to insights that will allow you to answer your key business questions. To provide you the data that leads to trusted and actionable consumer insights, we seamlessly integrate multiple data sources into this advanced analytics platform: global sales data*, consumer research, behavioural data, and AI-enabled review data.

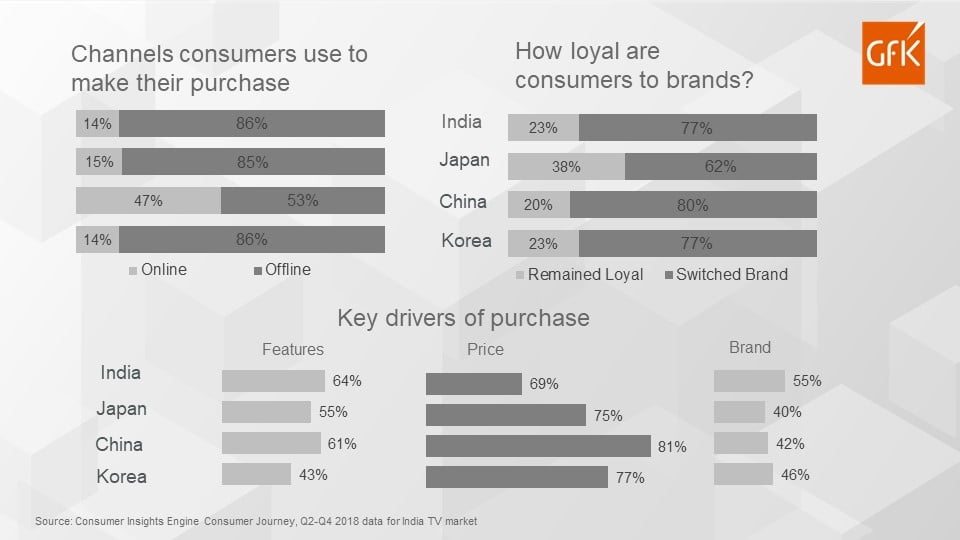

The data visualized below is pulled from a cross-market analysis of the TV category using the Consumer Insights Engine and is used to answer many important questions our clients are asking about the moment of purchase.

Source: Consumer Insights Engine Consumer Journey, Q2-Q4 2018 data for the TV category in multiple markets

Percentage of respondents in the four key Asian markets who are influenced by Price is the lowest in India, at 69%. On the other hand, Indian consumers holds the highest regard for the product’s Features, as compared to consumers from the other markets. In addition, the product’s Brand is also a significantly more important factor for Indian consumers with 55% mentioning this as a key driver during the final purchase stage– the highest across all markets we track. Manufacturers therefore need to recognize the importance of product’s Brand and Features, and not consider Price as the only factor.

As the data above illustrates, our solution provides a coherent view of – and granular detail about – the consumer’s purchase journey and the factors that influence his or her final purchase decision to equal granularity across participating markets, in this case, India. This data informs the marketing team that messaging around this feature should resonate in this market. When this data is coupled with data identifying that 9,304,460 TVs were sold in Q4 2018 alone in India, it can begin to inform other business units within our clients’ organisations, such as supply chain and logistics. This total market view of units sold is achieved through our calibration with actual point of sales data*.

Fig2. Source: Consumer Insights Engine Consumer Journey, Q4 2018 data for the TV category in multiple markets

Fig2. Source: Consumer Insights Engine Consumer Journey, Q4 2018 data for the TV category in multiple markets

Importance of Brand during the final purchase cycle

Taking a look at the importance of Brand as a driver during the final purchase cycle in India is another practical example that highlights the value of the insights derived from the data in the Consumer Insights Engine

Our solution covers 13 major markets – France, Germany, Italy, Netherlands, Spain, UK, US, Brazil, Russia, China, India, Japan and South Korea. Thus, multinational brands can not only get insights into national markets, but also compare brand performance and consumer behaviour across multiple territories.

Note: *In the US, GfK does not have access to Point of Sales (POS) data. US data is calibrated using information gathered from a telephone survey based on probability-based sample representative of both mobile phones and landlines. No retailer data is used in the development of the US offering.

Get an online demo of our Consumer Insights Engine to find out how to get actionable business insights at speed that go beyond point of sale data and help you get inside the mind of your consumers.

![]()