Pressure to innovate has never been higher in the financial sector.

The advent of the digital era and the influx of innovative and appealing digitally-native challenger brands that came with it means traditional financial institutions – including high street banks, institutional investment and hedge fund companies – are being forced to innovate, and fast.

As a response, they’re in search of ‘alternative data’ to combine with their own, revealing the true state of the consumer landscape, supporting their own innovation plans, and making better decisions.

Here, we outline the problems facing traditional finance brands and how enriching their data with third party sets like GlobalWebIndex gives them the insights needed to identify their ideal audiences, increase the relevancy of their messages, and transform in the market.

Two challenges facing established financial institutions

Banking and investment as we know it has shifted. Quickly.

Traditional financial institutions are built on a high street model, a place which certainly still plays a big part in the lives of many consumers.

But high street institutions are closing their branches at an alarming rate, and the digital finance space is competitive.

A positive reputation built on the high street is not enough to guarantee the longevity of your brand as we move towards fully digitized finance. Young consumers are looking for more.

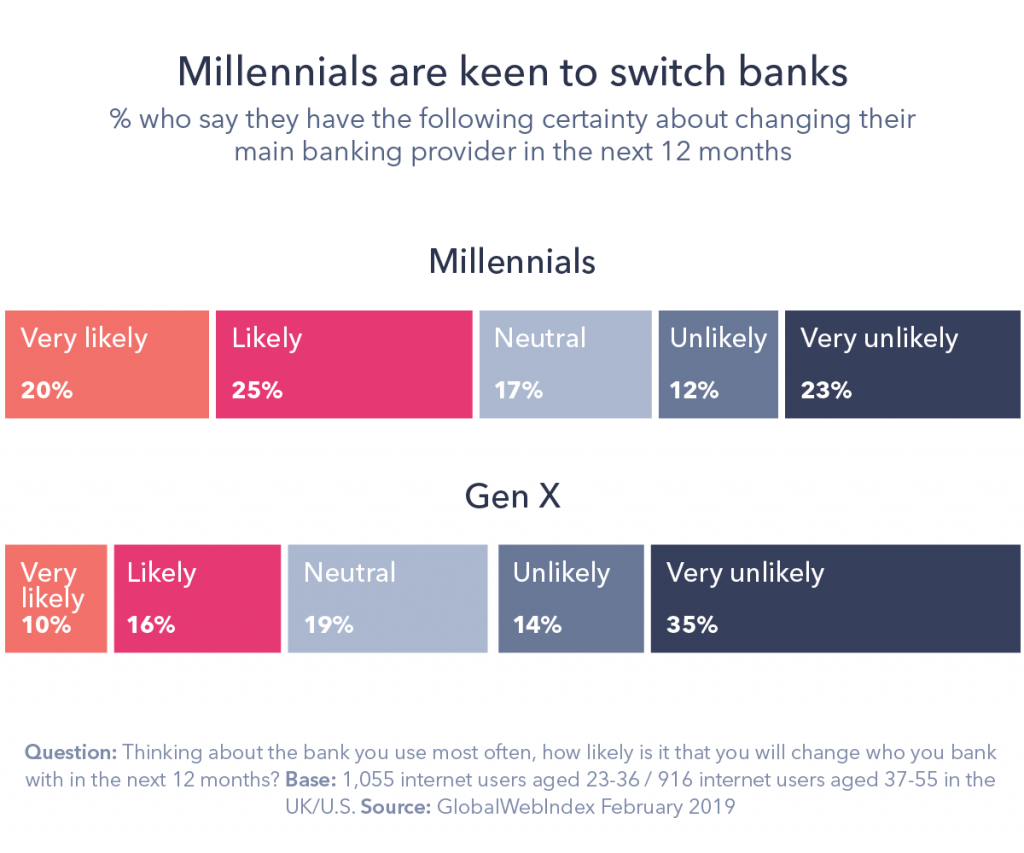

Nearly half of UK and U.S. millennials want to change banks in the next 12 months.

This statistic alone doesn’t suggest this change will be from a high street bank to a challenger, but regardless of the nature of the switch, it’s a turbulent time for an industry that is so rooted in and dependent on customer loyalty.

Industry spotlight: Banking

An area of finance that has seen the biggest shift in consumer expectations is banking. Let’s focus on younger consumers to see what they look for in banks today.

Digitally-native challenger banks like Monzo, Revolute and Starling offer consumer-first features and experiences as an exciting, convenient, even entertaining alternative to traditional banking – especially appealing to younger generations.

This chart shows how younger generations possess more of a ‘switching’ mentality when it comes to banking.

Losing younger customers creates a perpetuating problem for traditional banks, giving them a smaller pool of customers to retrieve data from, detaching them from the core markets of tomorrow.

Failure to stay relevant could mean established banking and finance brands will age with their core market.

Staying relevant means beating the challengers at their own game; offering digitally-pleasing, consumer-first experiences without ostracizing their existing customers.

Now, millennials and Gen Z consumers are taking greater ownership of their finances. They’re on the lookout for banks that are secure and suit the demands of their lifestyles.

Insights into the lifestyles, attitudes and perceptions of customers like the above cannot be gathered only through the dwindling first-party data available to banks.

Instead, being able to understand what drives consumers to choose their bank involves deeper insights offered only through innovative solutions.

Driving better solutions with enriched consumer data

High street financial institutions want alternative data sources that allow them to get closer to their audiences.

Thanks to innovations in data science, banks can now combine their most valuable data sets (like FRESCO) with GlobalWebIndex – the world’s most in-depth consumer study – to help them truly understand the consumer landscape, forecast the future of their brand, and identify key areas for innovation.

The 40,000 data points gathered from our online survey have helped some of the largest brands globally shape their innovation strategies.

Now, alternative data integration in the financial space provides the extra depth and breadth of insight to enrich their audience understanding and deliver the right solutions.

The kind of data you need

- Behavioral – Consumer interactions with products and other brands. This can include how and where they engage with finance brands, device usage, social media usage, and the consumer journey.

- Demographic – Criteria includes gender, age, income, education, social class, religion and nationality.

- Geographic – Information on where they’re located. This can be subdivided by nation, state, town and so on.

- Psychographic – This can include personality variables such as introvertedness and extrovertedness, lifestyles, spending preferences, brand advocacy drivers, purchase drivers and wider perceptions.

What alternative data allows you to do

Profile consumers with pinpoint accuracy – Define your audiences in detail to identify key segments within the banking arena and new markets to go after.

Connect at every touchpoint – Know what drives consumers to make financial decisions at every stage of their journey. Bake advocacy factors and purchase drivers into your messaging and deliver it via the most relevant channels.

Reach your audience effectively – Knowing what media is consumed by your core markets will lead to more effective budget allocation, especially when appealing to a younger consumer base that’s spread over a range of digital media platforms.

Drive better decisions – Identify consumer trends, behaviors and attitudes that can guide more strategic investment decisions.

Bringing insights into your strategy

High street institutions are likely to face tough times as their loyal customer base ages and the finance arena becomes more saturated with digitally-native brands.

But, perhaps surprisingly, our data shows that when it comes to choosing a bank, millennials still look for traits held by traditional banks such as security, ease of access to credit and educational resources.

It’s the lifestyle factors such as warnings on spending habits, chatbots and other in-app functions that challengers are running away with.

Innovation, therefore, may not be such a difficult step. It just takes the right combination of data to identify where the market is headed and what really matters to your target audiences.