Be honest: when’s the last time you conducted market research?

If it’s been a while or hasn’t happened at all, we don’t blame you.

So much of modern marketing is about taking action and chasing immediate results.

And taking the time to do research might not seem like much of a priority.

But consider that the majority of consumers today feel that brands don’t understand them. This is all despite the fact that we have greater access to customer data than ever before.

Given the wealth of tools and information available, businesses today can’t ignore the importance of regular market research. Conducting research not only helps you better understand how to sell to customers but also stand out from your competition.

In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Why is market research so important, anyway?

First, let’s define what market research is. It’s the process of gathering information surrounding your business opportunities. From customer personas to trends within your industry, market research identifies key information for you to better understand your audience’s desires from your products and services.

Taking time out of your schedule to conduct research might seem like a drag but doing so is crucial for your brand health. Here’s are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Again, most marketers out are out of touch with what their customers want.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants, needs and desires aren’t static. Your customers’ behaviors today might be night-and-day from what they were a few years ago.

According to CMO Council’s Loyalty That Lasts report, 43% of marketers note that they’re looking to build deeper, more personal relationships with customers. Market research isn’t just about reading graphs and digging through data: it’s about having meaningful conversations with people too.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace.

Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind.

Finding those opportunities goes hand in hand with researching your market. In fact, 52% of B2B marketers note that rich and reliable customer insights are key to becoming a market leader.

Maintain a stronger pulse on your industry at large

Again, today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools.

There’s a reason why 55% of people are overwhelmed when trying to learn about a new product. They’re being bombarded with sales messages from all angles.

However, brands are tasked with seeing the forest through the trees. By monitoring market trends through research, you can figure out the best tactics for reaching your target audience.

Where should I conduct market research?

If you don’t know where to start with your research, relax.

There’s no shortage of market research methods out there. For the purpose of this guide, we’ve highlighted research channels for small and big businesses alike.

Considering that a staggering 50% of online purchases start with a Google search, there’s perhaps no better place to start.

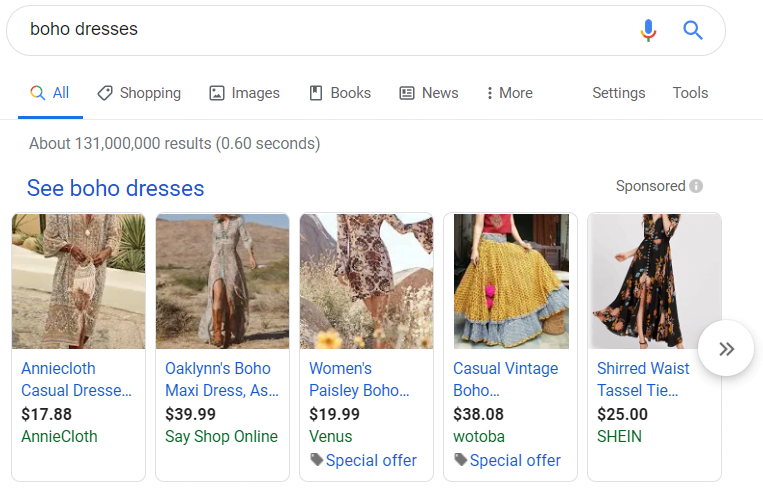

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research.

Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 59% of marketers cite email as their largest source of ROI.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

Email is also invaluable for gathering information directly from your customers. This survey message from Squarespace is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore.

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog and invaluable resources like the 2019 Sprout Social Index to keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media.

From what your customers want to see in future products to which brands are killin’ it, social media represents a massive repository of real-time data and insights that’ instantly accessible.

The importance of social media market research

Why conduct market research on social media? Here we’ve highlighted why it’s so valuable:

It’s transparent

With social media, keeping tabs on competitors and your own customers isn’t a guessing game.

Everything from marketing messages to new offers and beyond is all front-and-center, no digging required. The same rings true for seeing who’s running ads on social media too.

Social also offers a glimpse into the human side of brands and how they go back-and-forth with their own customers.

It’s timely

Social media market research is based on real-time data, plain and simple.

Want to know what’s trending in your industry? Interested in conversations your target audience is having? Trying to assess the health of your brand or a competing brand?

The immediate answers to these questions are available on social media. Meanwhile, real-time research means that you aren’t dealing with outdated information.

It’s trackable

With the help of social listening and monitoring tools, brands can gather relevant data to make more informed marketing decisions.

According to the 2019 Sprout Social Index, 63% of marketers note that social listening will become more important for conducting customer and market research.

Every @mention, conversation and #tag is a valuable data point. Through social listening, brands can monitor these points as well as industry keywords to have a constant pulse on where they stand with their marketing efforts.

What should I be looking for during market research?

Your market research process shouldn’t be a time-sink.

To ensure that you’re spending your time efficiently, here are the key details and data points to keep track of:

Products and services

In short, what are you offering when it comes to products and services? How does it compare to the competition? This means drilling down to specific product features and benefits, highlighting what sets your product apart from the rest.

For example, Copper‘s pricing page showcases a variety of features that’d speak to an audience interested in a robust CRM to meet their specific needs.

For B2C brands, digging through product reviews from brands can clue you in on what makes a physical product compelling to customers. This product review from Room & Board showcases specific details that customers liked (and disliked), for example.

Brand voice

Your brand voice ultimately determines how you to speak to your customers. Ad copy, emails and social captions can highlight how a brand positions themselves via voice.

Let’s look at two totally different brands in the same industry as an example.

Otterbox tends to highlight their phone cases in settings where customers are “roughing it” and enjoying the great outdoors. They likewise emphasize the rugged, reliable nature of their products. They adopt a conversational tone with talking to their customers.

Meanwhile, Caseify emphasizes the loud nature of their phone cases via eye-popping imagery and bright colors. They likewise take a conversational tone with their customers.

Although there are common threads between the brands, they take a totally different approach to reaching their customers. And both are effective.

Figuring out your own messaging means looking at what your audience responds to and likewise what isn’t being said by those in your industry.

Customer demographics

One of the most important aspects of positioning and marketing at large, you need to know the demographics of your customers inside and out.

Demographics will influence everything from ad targeting to messaging and more. This will also determine your pricing, too. Think about it: comparing the spending power of Gen Z versus millennials versus boomers is apples and oranges.

You probably already have a rough idea of what your ideal customer looks like demographic-wise. Running paid ads can further inform whether or not your demographic targeting is on point. For example, tools such as predicted demographics in MailChimp can highlight this information for you based on the past performance of your marketing campaigns.

Price points

Are you offering a “premium” service? Looking to reach customers on a budget?

Researching price points can help you highlight your own unique selling proposition and opportunities to reach a new audience based on price. You can likewise determine what the expectation for pricing is across your industry.

This pricing breakdown from G2 showcases how brands offering a similar product can vary drastically by price point.

Ask yourself: what’s the value you’re offering customers and how can you justify your pricing because of it? You can ask the same of your competitors as well.

Marketing channels and tactics

An important piece of competitive analysis for your brand is to make note of which marketing channels are the most common among your industry.

For example, is most of your target audience on Instagram? Are your competitors running influencer campaigns? Social ads? This can help you hone in on your priorities and likewise explore new channels that your competitors are taking advantage of.

Note that you can keep track of competitors running ads on Facebook and Instagram with Facebook’s Ad Library

What market research tools should I be using?

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth research. Such tools are essential for creating a market research report you can use internally or present to your clients and colleagues.

Social listening and analytics

Social analytics tools like Sprout Social can help you keep track of engagement across social media, including that of your competitors. Considering how quickly social media moves, a third-party analytics tool allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in their audience’s inbox.

Sites such as MailCharts, Really Good Emails and Milled can provide insight on how specific brands across all industries run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing among competing brands.

Content marketing research

If you’re active in the content marketing world, tools such as BuzzSumo can help you understand top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz in terms of engagements and shares and on which social networks.

SEO and keyword tracking

As noted in our guide to competitor analysis tools, monitoring industry keywords is a great way to uncover competitors and opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix to highlight how you stack up side-by-side against others in your market. This social media competitive analysis template from Sprout offers a place to organize your competitors’ online and social presence and compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together as you create a profile of your ideal customer. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

What does your market research strategy look like?

Taking the time to analyze your audience and competitors is worth it in the long-run as you determine by the numbers how to stand out from your competitors.

With the process outlined above and the help of tools such as Sprout, you can run conduct that ever-so-important research quickly and efficiently.

We still want to hear from you, though! What does market research mean for your business? How often do you research your target market? Let us know in the comments below!