Quick Take

Youdao (DAO) has filed to raise $92 million from the sale of ADSs in a U.S. IPO, according to an amended F-1/A registration statement.

The company provides educational services to a wide age-range of students in China.

DAO has been growing quickly but producing increasing operating losses and cash burn. While the firm enjoys additional support from investors at the IPO, I’ll be watching this IPO from the sidelines.

Company & Technology

Hangzhou, China-based Youdao was founded in 2006 as part of NetEase (NTES) to provide pre-school, K-12, college, and adult learning solutions through its suite of online learning products and services.

Management is headed by Director and CEO Feng Zhou, who has been with the firm since 2007 and was previously a software engineer at ChinaRen.

Youdao offers most of its products and services for free and profits primarily through online marketing services and advertising to its base of over 100 million monthly active users [MAUs].

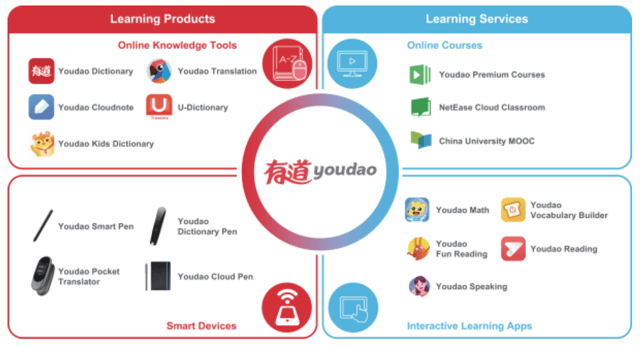

Below is a brief overview graphic of the company’s products and services:

Source: Company registration statement

Management says that Youdao Dictionary, the company’s flagship product launched in 2007, is China’s number one language app in terms of MAUs (Monthly Active Users) in H1 2019 with more than 51.2 million MAUs for the period, according to a Frost & Sullivan report commissioned by the company.

The firm’s flagship online course brand Youdao Premium Courses focuses on K-12 education, delivered through a “dual-teacher” large classroom live streaming model to maximize teacher-student interaction and best utilize the available resources.

Through DAO’s apps, students are able to learn math, English and other subjects through a virtual AI-based teacher on their mobile devices to aid in the forming of personalized learning habits while social media interactions with platforms such as Weixin/WeChat enables users to access these apps and share their activity with friends.

The company is also invested in the production of learning-focused smart devices and its current portfolio include the Youdao Smart Pen, Youdao Dictionary Pen and Youdao Pocket Translator.

Investors in Youdao also include Legend Capital and Muhua Jinxin Investment Management. Source: Crunchbase

Customer/User Acquisition

Youdao’s business model – primarily free with advertisements – means that it relies heavily on organic growth through word-of-mouth.

The firm also employs mobile marketing strategies, such as advertisements and marketing campaigns on app stores, mobile news apps and social media, as well as through search engine optimization.

DAO also engages in offline marketing, such as through “fan meetings” where prospective students and their parents interact with instructors and teaching assistants that showcase the company’s faculty and encourage conversion into enrollments.

Sales and marketing expenses as a percentage of revenue have been uneven but increased in the most recent period, per the table below:

Sales & Marketing | Expenses vs. Revenue |

Period | Percentage |

To June 30, 2019 | 33.9% |

2018 | 29.2% |

2017 | 29.9% |

Source: Company registration statement

The sales & marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of sales & marketing spend, was 1.2x in the most recent six month period, as shown in the table below:

Sales & Marketing | Efficiency Rate |

Period | Multiple |

To June 30, 2019 | 1.2 |

2018 | 1.3 |

Source: Company registration statement

Market & Competition

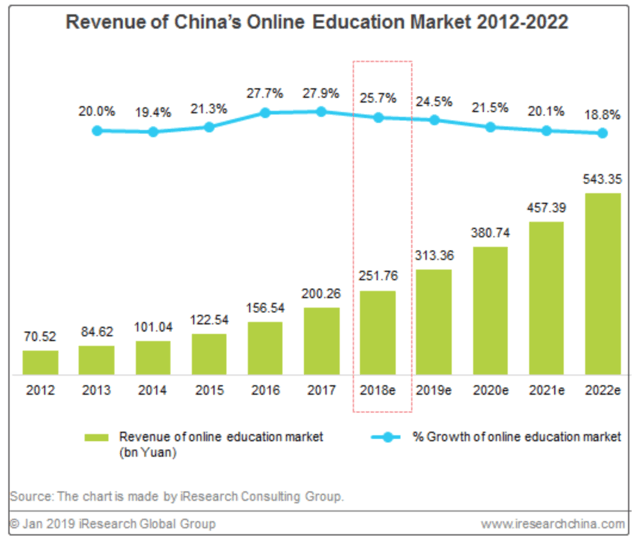

According to a 2019 market research report by iResearch, China’s online education market was valued at about $9.9 billion in 2012, reached $35.2 billion in 2018 and is expected to exceed $76 billion by 2025.

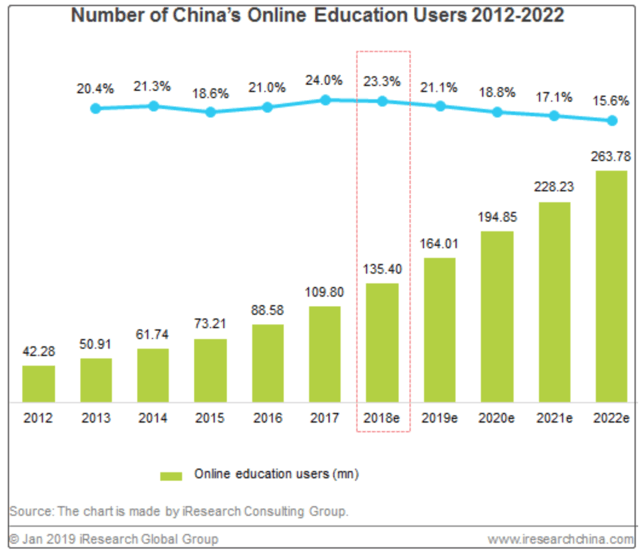

The number of China’s online education paying users reached an estimated 135.4 million in 2018, an increase of 23.3% year-over-year, as shown by the chart below:

The main factors driving forecast market growth include the increasing acceptance of online education among users, improving online service payment willingness and enhancements in online learning experience and effectiveness.

Youdao competes with providers of online dictionary and translation solutions, note-taking services, as well as manufacturers of hardware or smart devices.

Additionally, the firm competes for advertisers and their budgets, not only with internet companies, but also with other types of advertising media, such as newspapers, magazines, and television.

Financial Performance

DAO’s recent financial results can be summarized as follows:

Increasing and accelerating topline revenue growth

Sharply higher gross profit but reduced gross margin

Negative operating profit and fluctuating negative operating margin

Increasing cash used in operations

Below are relevant financial metrics derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

To June 30, 2019 | $ 79,904,000 | 66.1% |

2018 | $ 106,570,000 | 59.0% |

2017 | $ 67,021,471 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

To June 30, 2019 | $ 23,155,000 | 46.3% |

2018 | $ 31,532,000 | 32.4% |

2017 | $ 23,814,559 | |

Gross Margin | ||

Period | Gross Margin | |

To June 30, 2019 | 28.98% | |

2018 | 29.59% | |

2017 | 35.53% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

To June 30, 2019 | $ (23,620,000) | -29.6% |

2018 | $ (31,921,000) | -30.0% |

2017 | $ (19,123,676) | -28.5% |

Net Income (Loss) | ||

Period | Net Income (Loss) | |

To June 30, 2019 | $ (24,458,000) | |

2018 | $ (30,487,000) | |

2017 | $ (24,107,647) | |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

To June 30, 2019 | $ (29,252,000) | |

2018 | $ (14,615,000) | |

2017 | $ (12,814,412) |

Source: Company registration statement

As of June 30, 2019, the company had $43.8 million in cash and equivalents and $206.3 million in total liabilities, of which $127.9 million were short-term loans from NetEase. (Unaudited, interim)

Free cash flow during the twelve months ended June 30, 2019, was a negative ($40.2 million).

IPO Details

DAO intends to sell 5.6 million shares of ADSs representing Class A shares at a midpoint price of $16.50 per share for gross proceeds of approximately $92.4 million, not including the sale of customary underwriter options.

An existing director, the current CEO of parent company NetEase has indicated an interest to purchase ADSs of up to $20.0 million at the IPO price. This is a positive signal for prospective IPO investors as to valuation at the final IPO price.

Class B shareholders will be entitled to three votes per share versus one vote per share for Class A shareholders. The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Additionally, Orbis has executed an agreement to purchase $125 million in a concurrent private placement transaction.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO would approximate $2 billion.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 4.7%.

Per the firm’s most recent regulatory filing, the firm plans to use the net proceeds as follows:

to further invest in technology and product development;

to expand our branding and marketing efforts;

to further grow our user base; and

to satisfy other general corporate purposes.

Management’s presentation of the company roadshow is available here.

Listed underwriters of the IPO are Citigroup, Morgan Stanley, CICC, Credit Suisse, and HSBC.

Commentary

Youdao is attempting to attract U.S. public capital at a difficult time for Chinese companies going public in the U.S.

Firms are under increasing regulatory scrutiny and many Chinese companies have performed disappointingly post-IPO, sapping investor interest.

The company’s financials indicate it is growing total revenue and gross profit at an accelerating rate.

Sales and marketing expenses as a percentage of total revenue have fluctuated with an upward bias.

However, the firm is generating increasing operating losses and burning through significantly higher cash from operations.

The market opportunity for online education tools in China has grown sharply in recent years, as consumers have flocked to online sites featuring quality content.

As a comparable-based valuation, it is difficult to find public online-only education stocks with which to compare to DAO.

But, management is asking U.S. investors to pay an EV / Revenue multiple of nearly 15x at IPO, which is rather expensive given the firm’s increasing operating losses and cash burn. Its EV / EBITDA stands at a negative -47.35x.

Contra the above, parent company NetEase’ CEO intends to buy shares at the proposed valuation, and Orbis will also make a significant investment as part of the transaction. Both of these investments are a support for the firm’s valuation at IPO.

I remain unconvinced. The overall stock market volatility combined with the IPO market’s negative sentiment and continuing uncertainty with China’s economy and regulatory policies toward education firms operating there keep me on the sidelines.

Expected IPO Pricing Date: October 24, 2019.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.