The U.S. Justice Department (DOJ) is talking with multiple publishers and ad-tech companies as it scrutinizes Google’s third-party ad tools, as part of the DOJ’s antitrust investigation, the Wall Street Journal reported Wednesday. Companies the DOJ has reached out to include the New York Times, Gannett, Condé Nast, Oracle, Yelp and DuckDuckGo among several others.

Focus on Ad Manager. The reported focus of the investigation is Google Ad Manager. Google Ad Manager is the combination of DoubleClick for Publishers and DoubleClick Ad Exchange, which were rebranded in 2018. Google acquired DoubleClick in 2007 for more than $3 billion.

The core inquiry, according to the report, revolves around two related issues:

- Google’s integration of its ad server and ad exchange

- Google’s decision to require advertisers to use its own tools to buy ad space on YouTube

Google says server-exchange merger creates ‘better experience.’ Some of Google’s rivals contend that the company has too much power “over the monetization of digital content,” as the WSJ put it. Google counters that the merger of its exchange and ad server created a better advertising infrastructure and experience for customers and that the market for advertising technology and programmatic media is highly competitive.

This past week, DOJ Assistant Attorney General for Antitrust Makan Delrahim was compelled to recuse himself from the inquiry because he advised Google during the DoubleClick acquisition in its negotiations with the Federal Trade Commission.

Selling the DoubleClick tech? The WSJ also reports that Google executives are discussing whether to sell the technology behind Ad Manager, although Google explicitly denied to the publication this was being considered. One of the reported challenges of divesting the third-party ad technology is its integration into the broader Google ads infrastructure.

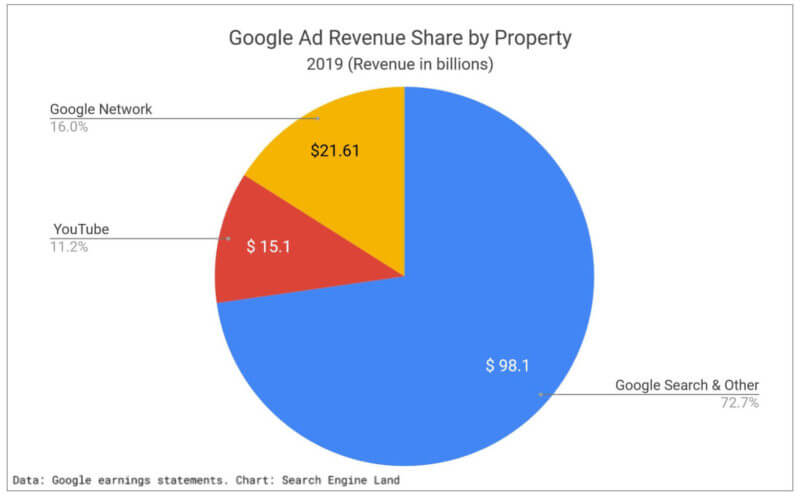

Ad Manager falls under Google Network Members’ properties, which generated roughly $6 billion in Q4 and $21.6 billion in full year 2019. Google’s total 2019 revenues were $162 billion. Google Network Members’ properties thus represented about 13.2% of total 2019 revenue (16% of total ad revenues).

Why we care. While much of the DOJ’s scrutiny focused on the publisher side of the Ad Manager tech stack, the WSJ reports attention has turned to the “buy side” of the business in the past two months. “The investigation puts the agencies in a delicate spot, as many of them use Google’s tools and rely on Google as a major advertising client,” the article said. The deep integration of Google’s buying and measurement tools make it easy for agencies and in-house media buyers to transact across Google’s owned and operated properties, including its ad exchanges.

Google’s focus on its Network business has waned in recent years, however. Ad revenue for that segment grew by just 8% year-over-year in 2019, compared to 17% growth for its own properties. The company highlighted this shift on its quarterly earnings call this week in discussing the drop in traffic acquisition costs (TAC). “Total TAC as a percentage of Total Advertising Revenues was down year-over-year,” said CFO Ruth Porat, “reflecting once again a favorable revenue mix shift from Network to Google Properties”