Editor’s Note: This subsection is featured in the GreenBook Market Leaders Report. The GreenBook Market Leaders Report is your #1 guide to brand success in the insights industry, featuring the U.S. Top 50, and in-depth analysis from leading CEOs. In its inaugural edition, you’ll learn who is in the lead, who is rising towards the top, and where your company fits into it all.

Market Research has always had a complementary (but separate) relationship with the broader business intelligence/data analytics space. Whereas arguably market research has been historically focused on collecting data to answer discrete business questions, the data and analytics category has been more focused on using available data to derive broader business insights for effective business decision-making.

The Differences

There is certainly an overlap of the tools and methods between these segments, but the use cases have been different. As the market research space has morphed into the insights and analytics space, these sectors have become more enmeshed in many ways, while continuing to be differentiated by how the businesses are structured around process and deliverables. Therefore it should be no surprise that we are seeing many companies that were previously considered stalwarts of the research industry now identifying as data and analytics providers, and building out new business models based on utilizing data in a variety of ways to answer a broad range of business issues. This has also opened the door for companies that have only peripherally been considered research suppliers to now being very much part of the competitive set that buyers evaluate.

Utilizing what we know about these companies from the GRIT Report and other data sources, some common themes recur for the leading Data & Analytics providers, including size, culture, technology usage, and solution focus. Common themes include:

- More likely to focus on leadership in

- Using new types of data

- Synthesizing data from multiple sources

- Analyzing data from multiple streams

- Multi-disciplinary recommendations

- More focused on measurable ROI

- More likely to:

- Focus on ROI

- Benchmark against other orgs

- Participate in client staff meetings

- Use multiple data streams

- Focus on future growth

- Give access to dashboards etc

- More optimistic about the company

In addition to the common themes, Data & Analytics providers often stand out for their focus on a limited number of industries or verticals.

Comparing this segment to others a bit more, a few interesting points come out.

Key Takeaways

Full-Service Providers and Data & Analytics Providers, large Full/Field Service, and Data & Analytics providers have many similarities, suggesting that a typical path to growth for Full/Field Service providers involves adding data and analytics services and, conversely, the path to growth for Data & Analytics providers includes complementing their core offerings to include more complete solutions. The two groups share the same top three revenue sources: full service, strategic insights, and analytical services, although the proportion of Full/ Field Service claiming each is higher. For large Full/Field Service, the next most common revenue sources are quantitative data collection, nonconscious measurement tools, and brand strategy. For large Data & Analytics, the next most common also includes quantitative data collection, but there is less consensus across them than there is within Full/Field Service, suggesting that this category has a more diverse history and a less mature identity.

Large Full-Service providers separate themselves from smaller ones by developing data-dependent revenue streams such as unstructured data solutions, nonconscious measurement tools, and analytical services.

Unlike smaller providers, larger ones focus on competing based on more diverse use of data: new types of data, synthesizing multiple data sources, analyzing multiple data streams, and meta-analysis. In comparison, large Data & Analytics providers separate themselves from smaller ones by developing “full service” as a revenue source. Similar to large Full-Service, they are more likely to focus on competing based on new types of data, synthesizing multiple data sources, and analyzing multiple data streams. In addition, they are more likely than smaller providers to focus on competing based on multi-disciplinary recommendations.

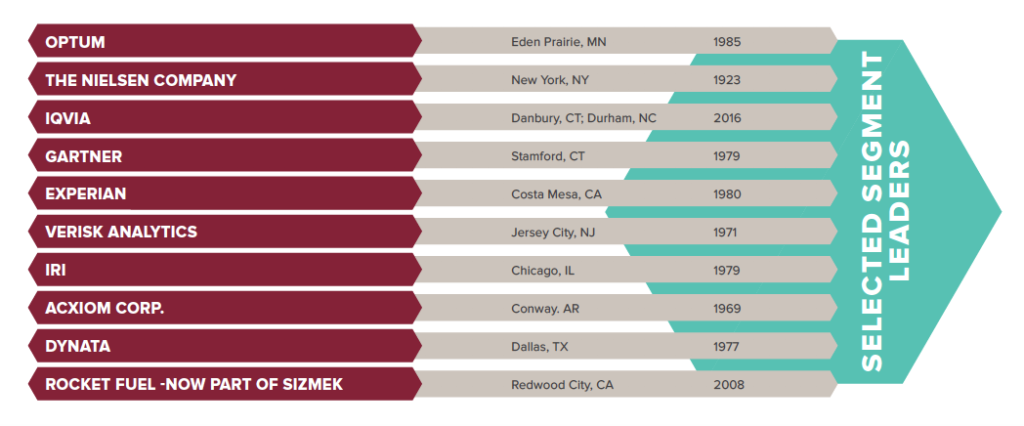

Data & Analytics Leaders

Large Full-Service and Data & Analytics providers have similar proportions to increased revenue and department sizes, as well as optimism about their companies and the industry. However, large Data & Analytics providers are much less likely than Full/ Field Service providers to be ‘very’ optimistic about their companies, perhaps suggesting that the transition from specializing in a particular area to offering a more complete solution is more challenging than having a more complete solution and adding to it.