, NAIROBI, Kenya, Jun 27 – Online traders have slammed City Hall plans to tax the sale products and services on e-commerce platforms.

The announcement was made by Nairobi Finance Executive Charles Kerich when he unveiled the county budget on Tuesday, saying the new tax directive would expand the county’s revenue basket.

According to Kerich, business people transacting goods and services online have been making profits yet they do not pay taxes.

“Fully aware that in a changing global economy there is general shift to online trading as a way of making businesses efficient and cost effective, the County shall be initiating amendments to the revenue laws to bring owners of online businesses into the revenue basket,” he stated then.

Some of the online traders who spoke to Capital Newsbeat said the introduction of such taxation would hurt small businesses which struggle to get clients from online platforms and may therefore not earn enough to comply with the tax requirement.

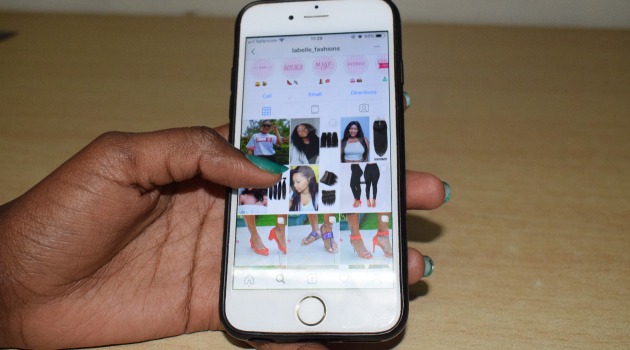

“For me this is unfair because this is a way of marketing my small business to attract clients, some of us boost pages to get views and by doing that we use money so adding to these expenses would kill our business ” said Hildah Kanini who runs an online boutique.

Martin Mutua who has both an online page and a shop at Imenti House along Moi Avenue, said that it’s unfair to invade the online space where small businesses have a voice to reach their clients.

According to Mutua the page only acts as a marketing tool to guide clients to his shop which he has already paid a license for, terming the new plan as double taxation.

“Already we have challenges in renewing the trading license issued to us by the County, the introduction of another tax means business will go down,” he said.

Others who share Mutua’s sentiments believe that small businesses leverage on the free marketing tools that are readily available like social media, website marketing, email and search engine optimization to engage their clients and reach potential customers.

The Kenya Revenue Authority is also eyeing online businesses which according to the agency neither pay taxes nor file annual returns with KRA seeking to meet a Sh2.1 trillion revenue target set by the National Treasury to fund the Sh3 trillion 2019/20 budget.