Retail spend around the world is peaking.

Last year, according to Mastercard Advisors, consumers spent a record $853 billion dollars, with ecommerce sales achieving the most significant growth rate in over a decade – 18% year-on-year.

Three-quarters of internet users aged 16-64 are now purchasing products online.

With customers and competition in the online space clearly mounting, marketers need to understand who their online shoppers are, before they can hope to be influential – and capture consumer attention at the right touchpoints.

We’ve been tracking the online consumer journey to understand how it’s evolving over time, including:

- Online shopper purchasing habits: how they vary according to category.

- Key touchpoints and device preferences: how they discover, research, and pay for products online.

- Regional comparisons: which markets are driving ecommerce trends.

- Trends shaping the online shopping experience: what impact social commerce, voice commerce, and ‘new retail’ is having.

So how do consumers who shop online feel about brands and retailers, and how are their preferences and opinions reflected in their behaviors and the purchases they make?

Here’s what we know.

Shopper vs. consumer insights – and why brands need both

Shopper insights are exceptionally important for any CPG professional or retailer.

But along with shopper insights, why are consumer insights also part of the equation – and how do they compare?

Shopper versus consumer insights provide a different perspective. Why? Because the person making the purchase decision – the ‘shopper’- may or may not be the end user – the ‘consumer’.

Sometimes, the distinction is clear: for example, the buyer and consumer of children’s snacks aren’t the same person. But without access to the right data, things like cereal or a toothbrush for example, can suddenly become ambiguous – and it can be difficult to know if the shopper is in fact the end user.

To effectively market their products, brands need both types of insight.

Shopper insights usually revolve around:

- Distribution

- Retailer dynamics

- Promotional activity

- Online browsing and in-store experiences

Consumer insights typically revolve around:

- Brand health

- Perceptions

- Preferences

- Trends

While shopper insights tend to reflect how and when people purchase, along with what they buy (or don’t buy), in contrast, consumer insights reveal the attitudes, beliefs and motivations that subconsciously guide someone’s purchase decision.

Now, let’s explore how online shopping is shaping up in 2019.

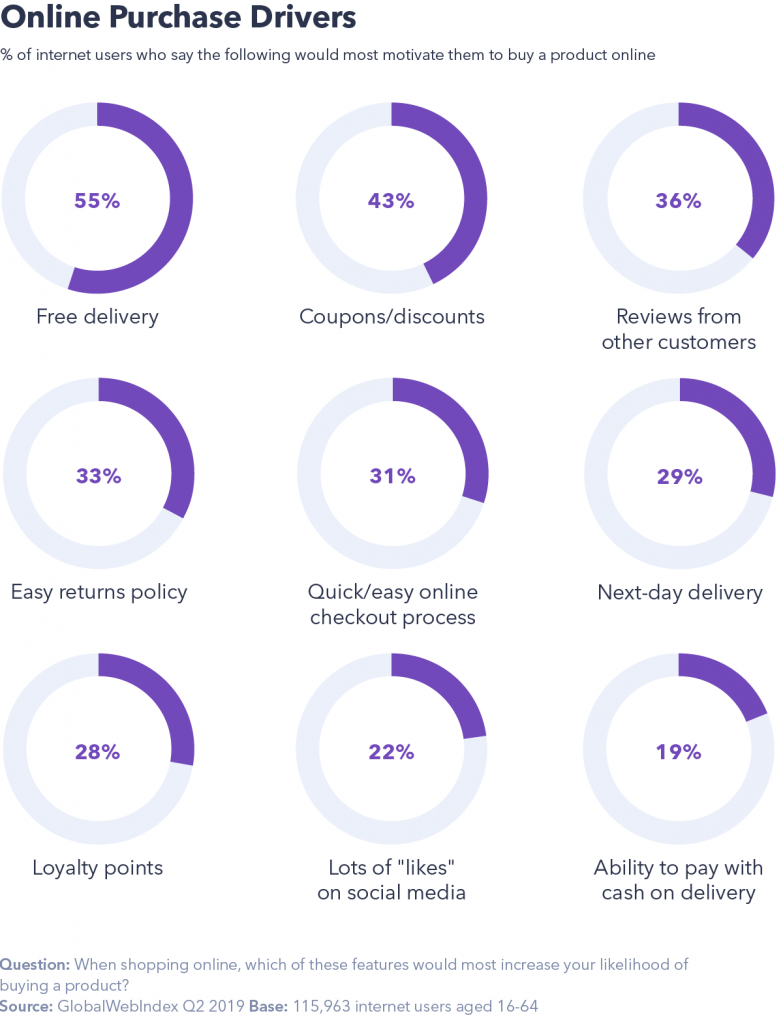

1. Free delivery is their primary purchase driver.

Online shoppers are heavily motivated by incentives.

In every country we track, online shoppers would much rather have a product delivered for free than fast.

Financial incentives (like rewards and discounts) and consumer reviews rank as the second and third most prominent online drivers in the last stage of the purchase journey.

According to Google shopper insights, 58% of shoppers believe they’ll get a better deal online compared to at a brick-and-mortar store.

And in certain parts (like in MEA), simplified return processes are catching up – even surpassing reviews and consumer endorsements.

What’s more, online shoppers’ appetite for finding the best deals can’t be ignored, as Google’s figures indicate:

- Mobile searches for ‘black friday deals’ have grown by 200% in the past two years.

- Mobile searches for ‘best deals’ have grown by 90% in the past two years.

- Mobile searches for ‘rewards app’ have grown by 90% in the past year.

What this means for brands: To avoid alienating potential customers, make free delivery a priority above all else.

2. Online shoppers will be advocates if a product or service meets their expectations.

48% of internet users say high quality products would motivate them to promote their favourite brand online.

Consumers also state receiving rewards (like discounts and free gifts) and simply ‘loving the brand’ as key reasons for wanting to positively promote a brand online.

Entertainment and social status are brand advocacy motivations of younger users especially. Consumers aged 16-24 are much more likely to want their favorite brands to make them feel cool, connect them with other fans of the brand, and provide entertaining content.

On the other hand, consumers aged 55-64 tend to value the more traditional factors of quality, convenience and customer service.

There’s also the issue of sustainability. For example, in the U.S. and UK, 53% of consumers feel reusable packaging is important, with 66% believing that brands promising to be sustainable are more trustworthy.

Younger demographics are particularly keen to take a stand: 2 in 10 Gen Zs in the UK and U.S say would promote a fashion brand that tackles issues like climate change and cheap labor.

What this means for brands: Prioritize quality always, but remember that generational differences play a key role when it comes to advocacy.

3. They crave a mobile experience (but not exclusively).

At a global level, for all stages of the purchase journey – from researching and buying through to reviewing – mobile is the device of choice.

PCs have traditionally been the default device for engaging the online shopper, but today, 52% of global internet users have purchased a product online on their mobile.

Though the shift towards mobile is obvious, online shoppers across the board aren’t prepared to commit themselves to the device exclusively – if they’re buying on mobile, they’re also likely to be buying on PC as well, and vice versa.

There’s a small generational gap, with internet users over the age of 45 still preferring to use larger screen devices – a major reason why PCs and laptops have maintained their lead in Europe and North America for commerce actions.

What this means for brands: Prioritise mobile along the journey, but not at the expense of other devices.

4. They differ more by region than by generation.

In the Middle East and Africa, online shopping is less prevalent.

We’re still seeing significantly lower rates of online shopping in MEA, with the proportion of internet users who’ve made purchases online sitting at 55%. This percentage is creeping up year-on-year, but is still far behind the other four regions.

Despite the prevalence of mobile payment apps, these markets retain many cash-first consumers who might explore products online before finalizing their purchases offline.

The top ecommerce markets are split evenly between Asian and Western markets, even though the digital landscapes in these places vary greatly. APAC leads the way, with 78% of shoppers having purchased an item online in the past month.

We can also see the extent at which mobile payment adoption rates vary according to region. For example, in the past month, the most consumers who’d used a mobile payment service were based in Hong Kong, with mobile payment services being least prevalent in Ghana.

Interestingly, local mobile payment solutions are prevailing over global players like PayPal in these markets.

What this means for brands: Pay attention to where your audience is – a consumer’s location has influence over their attitudes towards online shopping.

5. They treat major and minor product categories differently.

Major purchases

For the most part, higher-priced products are researched online more than they are bought.

But there are certain larger purchases that lend themselves more to being bought online.

Household furniture, for example, sees more buying than researching online. Only 10% of those who have bought furniture on the internet have looked it up online beforehand, compared to more than half for other high-ticket purchases. Showrooming, whereby consumers make online purchases after visiting retail sites, is part of the explanation.

Minor purchases

Cheaper items such as packaged food and household supplies are bought online more than they are researched.

Purchased more frequently, and requiring less research, these categories may be best placed for voice commerce purchases as this area continues to develop. (Unsurprisingly, the big players in grocery retail are going head to head in a bid to own this space.)

Other minor purchases, such as skin treatments and flu medicines, are researched at the same rate as they’re bought online. These are slightly more complex products and likely have perceived higher stakes.

It’s also worth mentioning what people are buying as well as how they’re buying it.

Eco-conscious consumerism is one such trend that appears to be influencing more and more consumers’ purchase decisions. If we look at millennials, for example, 66% of them say they try to buy natural or organic products.

What this means for brands: If you know which products consumers are most likely to research, you can ensure to provide all the information they’ll need – at every relevant touchpoint.

Online shoppers’ purchase journey

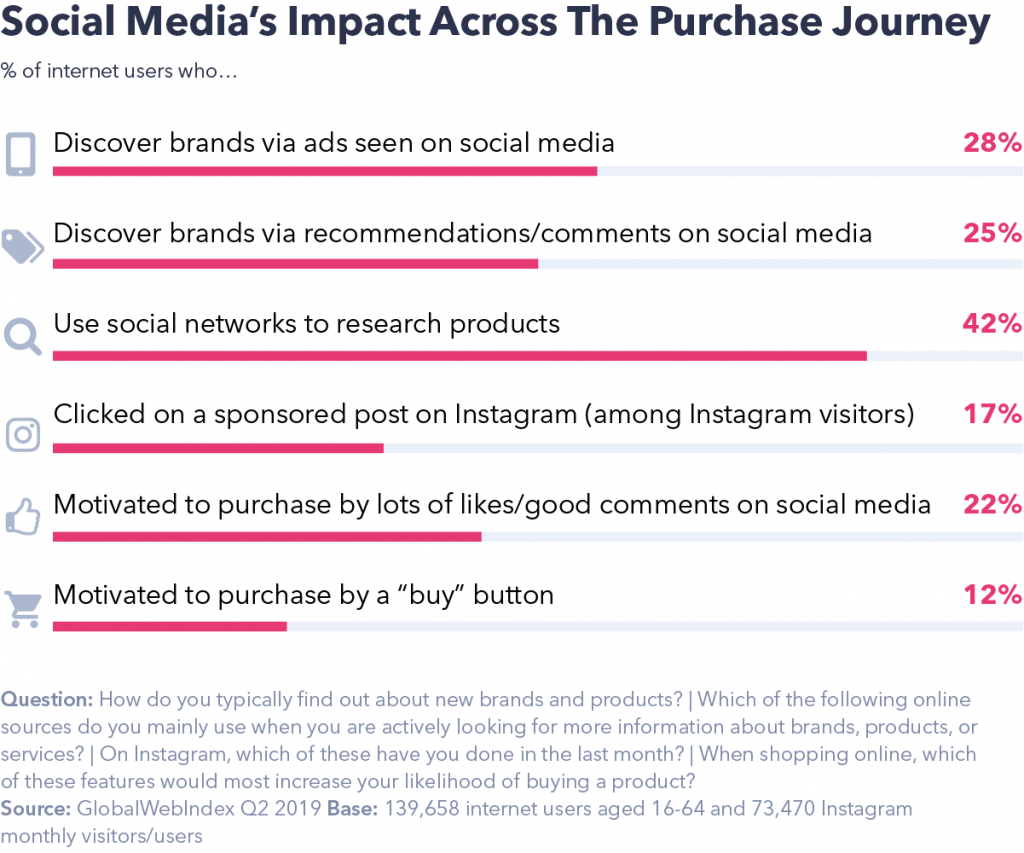

Social media is a go-to in the research and discovery stages of the purchase journey.

If we focus on brand discovery specifically, search engines surpassed TV ads as the most influential source of brand discovery in 2018, and they’re still consumers’ go-to.

But there are some differences when we factor in consumer income:

- Ads on TV are on par with search engines as the primary brand discovery source for those in the bottom 25% income bracket.

- More affluent consumers however, have been more eager to explore new products through search engines.

24% of online shoppers discover brands through review sites, with 58% of the online population interacting with reviews in some way during their purchase journey.

While 51% of the online population have used an ad-blocker to stop ads being displayed in the past month, online ads still feature high on the list, with 1 in 4 discovering brands this way.

The effectiveness of online ads garnering users’ attention is prevalent in younger generations especially: 3 in 10 Gen Zs and millennials typically discover new brands through ads seen on social media

Although vlogs and influencer-based content are widely discussed in the industry, they’re most suited to younger demographics, since 16-24-year-olds are 38% more likely to discover brands through vlogs.

When it comes to product research, younger consumers – and this is most true of Gen Z – look to social media before search engines to get more information on products.

For millennials, visiting certain brands’ websites regularly remains a popular form of brand research.

92% of millennials visit an online retail site or store such as Amazon each month.

In addition, 12% of internet users interact with brands when doing research on messaging apps, showing the importance of convenience and immediacy in social brand consumer relationships, and indicating the growing potential for chatbots.

What this means for brands: Maintaining a strong social media presence is a prerequisite to reach consumers who follow and research brands on social media, but traditional content and SEO strategies haven’t lost their appeal- and are still more important in most cases.

The impact of social commerce

Social platforms provide important brand-consumer touchpoints.

Increasingly social media has evolved into a space that serves the needs of businesses – everything from advertising, to brand-consumer engagement and ecommerce sales.

At present, 38% of internet users follow their favorite brands on social media, with 25% following brands they are thinking of buying something from.

But to what extent does buying take place on social media?

Our data shows that the purchase journey on social media has yet to come full circle. Only 12% of internet users say that a social “buy” button would drive them to buy something online.

But certain markets have been more successful than others in the extent to which they have accommodated social commerce.

Our data indicates that the predominantly fast-growth regions of Latin America and the Middle East & Africa see the highest proportion of social shoppers.

What this means for brands: Consider integrating social commerce in your strategy. Consumers are using social media for more purpose-driven activities and our research suggests it has the potential to become mainstream.

Online shoppers: what to remember

Decisions we make related to online shopping are largely influenced by what we’re buying and where we live.

And while generational differences factor into this, it’s important to remember that regional differences are of equal value.

Brands looking to target consumers who shop online should take a multi-device approach throughout the entire purchase journey – the PC isn’t dead, and consumers can checkout with either device regardless of where their path began.

But there’s one last thing we’ve yet to address, and it’s the elephant in the room – consumer privacy.

In a recent survey we conducted in the U.S. and UK, 30% of consumers said they would be concerned if a company had access to details about where and how they spend their money. A further 36% said data about their online browsing habits is what they are most wary about organizations collecting.

However brands choose to entice online shoppers, being open and transparent about the way shopper and consumer data is collected is the most sensible way forward – for shoppers’ peace of mind, and for brands’ own bottom line.