Note: This is the quarterly update sent to Buffer shareholders, with a bit of added information for context. We share these updates transparently as a part of our ‘default to transparency’ value. See all of our revenue on our public revenue dashboard and see all of our reports and updates here.

It’s been quite the year and it’s hard to believe that the first half of 2020 is already behind us.

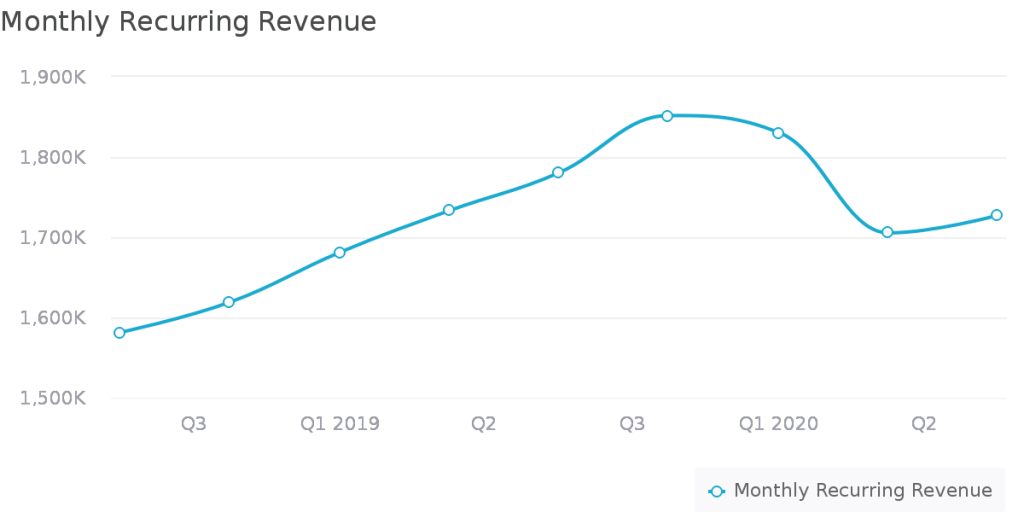

I’m happy to share that we’ve come out of our projected revenue downturn in Q2 with good MRR growth in July and renewed optimism.

We’re feeling motivated about what we’ll accomplish these next few months as we continue to focus on product strategy and adding significant value for customers as top priorities. Read the latest from our CEO Joel to hear about the evolution of product over the past 10 years and where we’re going from here. This includes our active search for a VP of Product and our plan to launch Engage, a social engagement product for small businesses that evolved from our experiences growing and sunsetting Reply.

Let’s take a look at the financial result highlights for Q2 and how we’ve been supporting our customers, communities and team.

Financial results from Q2, 2020 and July, 2020

Q2, 2020

- Total net income: $832,000

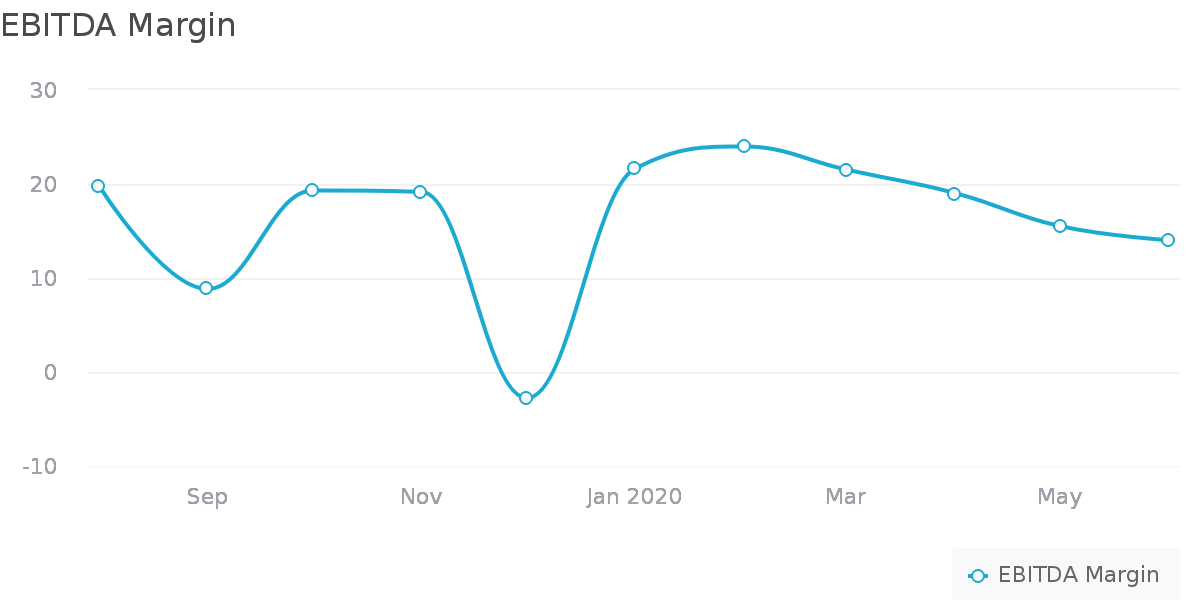

- EBITDA margin: 16.2%

- MRR: $1,704,768 (down from $1,830,267 MRR at end of Q1)

July

- MRR: $1,728,259

- ARR: $20,739,108

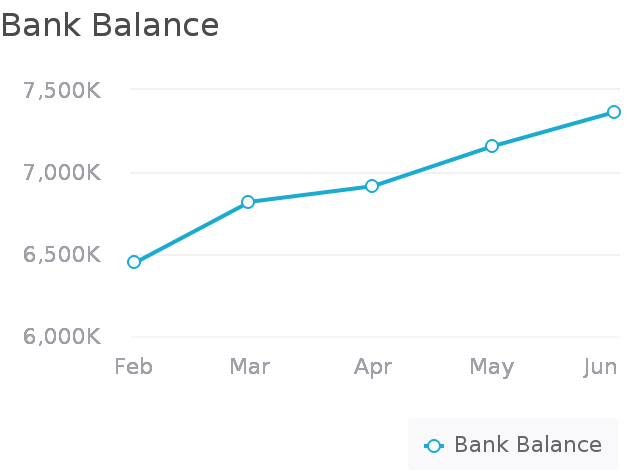

Our bank balance at end of July was $7.2M, with a net cash balance (after paying off our line of credit) of $5.9M. We generally aim to keep three to six months of operating expenses on hand. This position has been instrumental in navigating the uncertainties of 2020 from a proactive position.

We look at revenue per employee from the lens of growth by taking ARR divided by total number of employees and contractors. We generally aim for $200k (or higher) in ARR per teammate.

Supporting our customers, communities, and team

We expected this revenue downturn in Q2, a majority of which is a result of extending payment relief to customers whose businesses have been adversely impacted by the pandemic. We’ve helped over 1,200 customers and extended a total of $191,000 in payment relief.

In May, we experimented with a 4-day work week in response to the added stress and pressures individuals have experienced due to the pandemic. After a successful first month, we decided to pilot this model through the rest of this year.

In June, we committed to anti-racism work in solidarity with the Black Lives Matter movement. We’ve donated a total of $100,000 to organizations that our Black teammates selected: The Marsha P. Johnson Institute, The Marshall Project, and Brave Space Alliance, while also doubling the charitable contributions made by our teammates. To date, we’ve made $120,000 in donations to more than 40 different organizations working towards anti-racism.

Looking ahead

In June and July, we’ve seen an increase in new business, expansion revenue, and reactivation revenue along with lower levels of customer churn. We are happy to see that Q2 growth decline shift towards a positive level of MRR growth for July and we’re seeing the same trend for August.

For the rest of Q3, we’re expecting the small growth rebound to continue while we also make an impact on customer retention and value by focusing on product strategy. Metrics and numbers are moving in a conservative, yet positive direction.