Note: This is the quarterly update sent to Buffer shareholders, with a bit of added information for context. We share these updates transparently as a part of our ‘default to transparency’ value. See all of our revenue on our public revenue dashboard and see all of our reports and updates here.

Before I get into the numbers, please join me in celebrating a pretty big milestone this season — Buffer’s 10 year anniversary!

In late 2010, Joel launched the first version of Buffer and has led the company from that early twinkle of an idea to building a company that is now generating over $21,000,000 in annual revenue.

It’s wild to reflect on the different checkpoints, successes, and challenges that have been experienced over the past decade. The experiences, growth pains, and learnings have really shaped where we are today and where we’re headed next. We’ll be sharing more reflections in the very near future.

We have another piece of exciting news to share as well. As you may know, we’ve been looking for an experienced product leader to join Buffer for quite some time. We are thrilled to welcome our new Chief Product Officer, Maria Thomas, to our team. We look forward to partnering with Maria to expand on a unique strategy that helps us serve customers, differentiate Buffer, and continue to realize solid, sustainable growth over the next several years.

Let’s take a look at our financial results for Q3 and end of year outlook.

Financial results from Q3 2020

Q3 2020

- Total net income: $700,996

- EBITDA margin: 16%

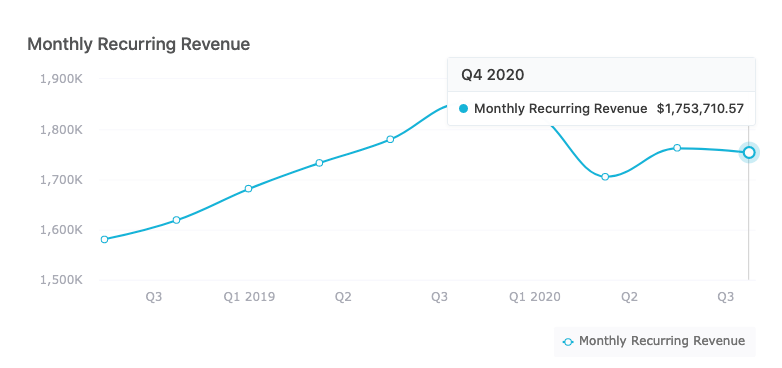

- MRR: $1,761,962 (up slightly from $1,705,370 MRR at end of Q2)

We’re projecting an overall end of year ARR at just over $21.1M. This projection is an overall ARR downturn compared to 2019 ARR and we can attribute it to a few factors:

- Our Q1/Q2 decision to sunset Reply and focus those resources on building a product more complimentary to the overall Buffer experience for SMB customers.

- Our Q2 response of extending payment relief to customers struggling to adapt to the detrimental impacts of the pandemic on their businesses.

- The volatility of financial markets due to the economic effects of the pandemic on U.S. businesses and global businesses. Businesses represent a significant portion of our customer base and revenue. We’re all adapting to a new normal, experiencing uncertainty in this next wave, and this certainly impacts consumer behavior even in the social media space.

We have a number of initiatives in motion expected to have a positive impact on new business and retention metrics. We’ll share more about those product features in our Q4 report.

*Our drop in bank balance is due to us paying off a bank line of credit balance.

Looking ahead

As we head into the final weeks of 2020, the senior leadership team is solidifying our company objectives for 2021 and setting down shorter term OKRs across all areas. We’re so happy to welcome Maria to the team and to continue to build on the endless learnings from the past decade.