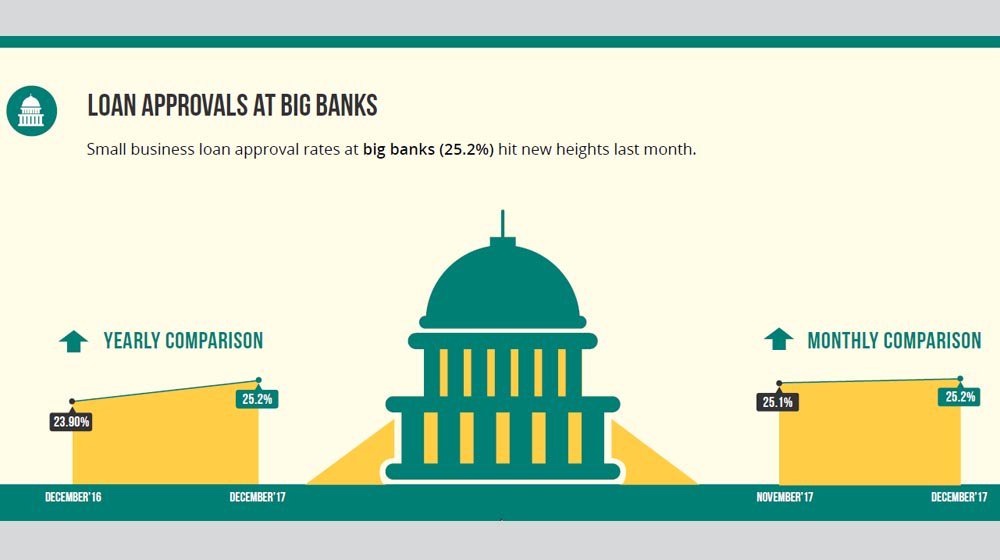

Loan Approvals at Big Banks Break Another Record, Biz2Credit says

Another month brings another record high small business loan approval rate by big banks. Biz2Credit Lending Index July 2018 The July Biz2Credit Small Business Lending Index reports this was a strong month for small business lending approvals. Strong economic numbers including higher wages are driving lenders to give small businesses the funds they need to […]

Loan Approvals at Big Banks Break Another Record, Biz2Credit says Read More »