Improve Your Business Credit with Tips from This Upcoming Webinar

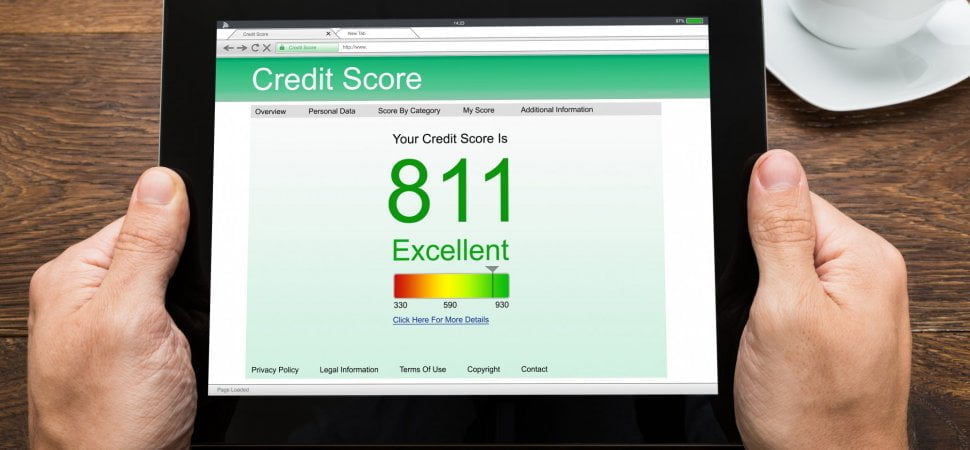

If your business doesn’t have good credit, it could prevent you from getting the financing you need to grow. But some entrepreneurs don’t fully grasp the importance of business credit or know where to start when trying to build up that score. That’s where an upcoming webinar can help. Small Business Trends and Biz2Credit are […]

Improve Your Business Credit with Tips from This Upcoming Webinar Read More »