One in every four US dollars spent on Technical Consumer Goods (TCG) today are for transactions made online, but it’s not a consistent global story of expansion. Therefore it’s time to rethink if your global e-commerce strategy on a local level. The growth of online shopping has slowed in some markets and where spend happens varies hugely by country and region. E-commerce share ranges from almost zero to more than one-third of turnover. The perception of online retail also varies, from a premium destination driven by promotion to a mass-market channel offering value-for-money solutions.

In this article, we discuss the regional differences in sales dynamics, pricing and assortment to evaluate the characteristics of e-commerce.

Global online shopping keeps growing, but…

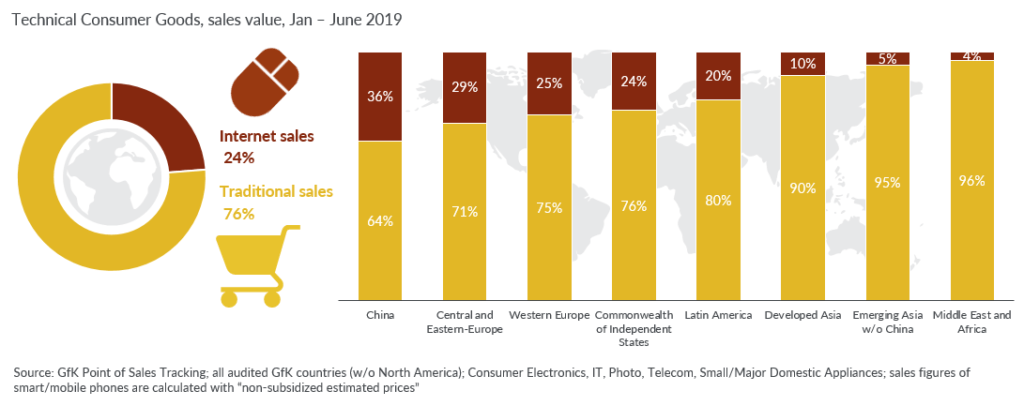

Where does the natural equilibrium between online and offline retail sit? There are already indications that growth is slowing in countries where online shopping is more mature. Globally in the first half of 2019, e-commerce increased to about 24% of total revenues (+1.6 percentage points), a flattening dynamic compared to past years, when almost three percentage points were gained annually.

However, the global view masks local nuances. China is leading the online retail sector with a share of 36%. In the Chinese and other advanced markets, there’s a blurring of online and traditional retail concepts. For instance, e-commerce players have been moving from pure online stores and integrating traditional shops into their retail ecosystem to reach customers regardless of channel. Many brick and mortar retailers have been adding e-commerce operations and technology to add digital experiences to the traditional in-store shopping trip. Offering a seamless omnichannel approach is challenging the definitions of e-commerce and ‘traditional’ retail used today.

Other regions are at a much earlier phase of the online retail evolution, such as Middle East/Africa and Emerging Asia (excluding China). Here, online sales account for about 5% compared to 36% of turnover in China.

E-commerce pricing reflects a region’s socio-economic developments

How online retailers are seen in different markets is not just about the assortment mix offered or their pricing, it’s about the socio-economic market situation and the adoption level of online shopping. In some markets, it’s predominantly the more affluent consumers whohave access to online shopping. Retailers have responded by offering premium items. This is the case in Brazil, where online retail offers a premium assortment mix and generates high average prices. Facilitated by online promotions, consumers buy premium product segments at an attractive price which is reflected in an above-average price index of almost 140% compared to the total market covering online sales.

It’s a different story in the huge Chinese online market: internet shopping is highly adopted by consumers and online retailers employ a mass-market approach, facilitated by simple-to-use app-based payment systems, to sell lower-end product segments at entry-level prices. Hence, the price index is below 60%. For both markets, a convergence is visible – but they are still distant from a 100% price index average.

Getting the assortment spot on: Balancing conflicting customer needs

It’s not only socio-economic considerations adding to the challenge of creating the right e-commerce strategy – individual consumer needs and wants are also important. Where consumers are in their purchase journey determines how they view the product assortment on offer. For instance, shoppers in the exploration phase who are unclear about what to buy may perceive too many choices as a barrier for their decision-making. On average, shoppers have 2.7 times more choice online compared to what is offered by a traditional retailer. However, overwhelming choice is a common concern among consumers: 59% agree globally that “there are too many choices in many of the categories I shop” (GfK FutureBuy study, 2019). On the other hand, for a shopper who is at the end of a purchase journey and ready to buy, tan online retail store with a large assortment can maximize their advantage.

No one-size-fits all approach to e-commerce strategy

It is essential to understand local and regional differences that affect your strategy: from the level of online shopping adoption to the assortment and pricing of your range, to how channel dynamics are changing, to where consumers are in the various stages of the purchase journey. GfK’s Point of Sales Tracking can help you keep up-to-date with how online and offline sales channels are developing at a country level. This will enable you to adapt your e-commerce strategy to stay relevant for consumers and the market—wherever that may be.

Stay on top of sales channel dynamics

with GfK’s POS Tracking