Rheem’s yesteryear announcement of integrating its products with Nest Thermostat is an apt instance of gas water heater industry depicting the signs of penetrating the home automation arena. A profound vertical of the water heater sphere, gas water heater market has been garnering an appreciable momentum in recent times, as is evident from the numerous innovations brainstormed by reputed corporations. The incorporation of the Nest Learning Thermostat in Rheem’s EcoNet-enabled water heaters is an example of the aforementioned. If reports are to be believed, through this integration, when the Nest Thermostat is set to the Away mode, Rheem’s EcoNet-enabled water heaters are designed to enter an energy-efficient operating mode that will most certainly reduce the amount of energy the water heater uses, which will eventually help to save money on utility bills. Rheem’s innovative integration with the connected thermostat is an example that other gas water heater industry players are likely to pursue.

The incessant efforts by companies partaking in gas water heater industry share to bring about a pathbreaking innovation in gas heater mechanisms stems from the fact that heating, cooling, & water heating systems collectively account for more than 60% of the energy utilized at home. The water heating system alone holds around 20% of this value, which has led to the consensus that regulating these systems may undeniably bring forth a plethora of savings on an annual basis. This unanimity of thought is thus certain to augment gas water heater industry size, pegged at more than USD 8 billion in 2016.

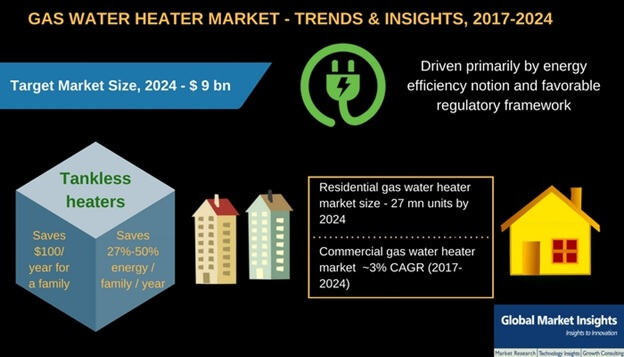

The underlining theory that lurks behind the development of innovative products in gas water heater market is energy efficiency and reduced energy consumption, pertaining to the globally enforced norms regarding environment safety. Regional governments and regulatory bodies have deployed a slew of directives, the adoption of which by companies is a major factor driving gas water heater industry.

- The Government of China has introduced the National Gas Utilize Policy for implementing standards to track gas usage in residential utilities for water heating and cooking – this may promote the development of energy-efficient heaters, gradually propelling gas water heater market.

- Recently in 2017, the Canadian government implemented the new Federal Energy Efficiency Regulations, abolishing the older norms with an aim to increase energy efficiency standards for consumer products.

- General Electric, in collaboration with the DOE, launched the ‘Geo Spring Hybrid Water Heater’ that is designed to consume 62% less energy than the standard heater. The DOE has also introduced the Building America program to enable energy efficiency across the residential sector, which may considerably augment gas water heater industry share from residential buildings.

The aforementioned axioms are evidence enough to testify that gas water heater market is indeed quite regulatory-driven. Lately, this fraternity has also been witnessing transformative trends and severe competition from rival markets. The below mentioned paragraphs provide a glimpse into two of the most robustly prevalent trends in gas water heater industry.

Tankless heaters

Storage tanks have had an unparalleled tenacity in gas water heater industry for a considerably long while. In recent times however, the trend of deploying tankless systems have come to the fore, pertaining to the widespread array of their benefits. On the grounds of occupying lesser space, they can be extremely convenient to be used in small residential spaces, creating a profitable growth avenue for gas water heater market. Markedly distinct from a traditional storage heater, tankless systems accounted for more than 75% of the overall gas water heater industry share in 2016, subject to their indispensable attributes. Some of these are mentioned below, supported by instances that validate the parameters.

Unlimited supply of hot water

Tankless heaters systems provide hot water only when needed, but when they do, there is no plausible limit on the supply. Their convenient and overtly clever mechanism of cold water passing over the gas burner and then getting released through taps ensures an unlimited, consistent supply of hot water whenever required. This is deemed as one of the biggest advantages of tankless systems, and possibly one of the rather effective drivers fueling tankless gas water heater industry size.

Longer lasting

As opposed to conventional systems, most tankless water heaters are sold with a guaranteed lifespan of 20 years, in addition to an unbelievable warranty of 12-15 years. The systems also have parts that can be easily replaceable, making them one of the most preferred heaters. Inadvertently, this parameter would contribute toward increased tankless heater sales, leading to the creation of a massive commercialization scope for tankless gas water heater industry.

Reduced energy consumption

As per reliable estimates, for households using 41 gallons/less hot water/day, tankless heaters can be 24%-34% more energy efficient than traditional systems, while for homes using more than 85 gallons/day, energy efficiency rate can between 8%-14%. In fact, statistics claim that a mammoth 27%-50% energy can be saved if a tankless system can be installed at every hot water outlet. On the grounds of the projection that a family can save close to USD 100 per year with tankless systems, gas water heater industry is forecast to garner extensive momentum over 2017-2024.

The profitability quotient of tankless gas water heater industry is also quite evident from Rinnai’s recent announcement of being the first company in North America to construct tankless heaters at Griffin. The incessant efforts by companies coupled with the undeniable system benefits are certain to ensure that the trend of using tankless systems will prevail for a long while in gas water heater industry.

Automation heaters

In the era of smart appliances and a compelling demand for energy savings, smart gas heaters are undoubtedly the next trend in the making. Numerous gas water heater industry players have come up with Wi-Fi and smartphone-enabled gas heaters to save up on the energy coffers, conserve the environment, and contribute toward enhanced home automation. One of the most novel developments that gas water heater market has witnessed in this regard is the launch of the programmable Gas Water Heater Timer.

This product apparently saves a ton on your energy bills and contributes toward extending the lifespan of the heater. Deemed to be aptly suitable for property managers and homeowners, the Gas Water Heater Timer is integrated with M1 using plug-in modules from wireless technologies such as Z-Wave, X-10, UPB, and Insteon, and is likely to bring about an appreciative metamorphosis in gas water heater industry share.

Enlisted below are two product innovations that demonstrate the influence of the smart space on gas water heater market.

- A.O. Smith Corp., a dominant player in North America gas water heater industry, launched the Polaris High Efficiency, a unique condensing gas water heater that apparently can be installed with domestic space heating systems and recirculating systems, and is designed to function at a thermal efficiency of close to 95%. The product is expected to bring about a dynamic transformation in gas water heater market, while simultaneously bolstering A.O. Smith’s position on the North American turf.

- Rheem, one of the most iconic gas water heater industry giants, is already miles ahead of its counterparts. The company had launched a Wi-Fi module to be used in conjunction with gas heaters that allows the monitoring of device performance, provides warnings in case of malfunctions, and controls energy usage. This innovation is an apt instance of the home automation and green technology nosiness fusion that is likely to continue its supremacy on gas water heater market.

These instances only serve to affirm that the trend of home automation is indeed here to stay, and will drive gas water heater industry for a considerable long while in the years to come. With more and more gas water heater market players gearing up to outbid each other in the race to manufacture smart heaters, it is indeed legitimate to claim that gas water heater industry has rather bright future prospects.

Information furnished by The U.S. EIA states that in 2014, a 17% rise in a regular home’s energy consumption was observed, solely due to heating water – perhaps, pertaining to the fact that a traditional gas water heater stores around 40 gallons of water hot in the tank at all times. This accounts for a tremendously shocking amount of energy wastage (20%-50%), as every time the heater’s thermostat detects a temperature drop below the set frontier, it will reheat the water. This has prompted the necessity of an on-demand water heater that fires up the heating element only when needed, which has led to the launch of The Aquanta Smart Water Heater Controller in 2016 by Sunnovations, a modestly strong gas water heater industry player.

This innovation prevalent in gas water heater market has been designed to be self-installed without expert guidance. Equipped to be compatible with gas water heaters incorporated with electronic gas-control valves, Aquanta will also deliver energy consumption and other details when utilized with older gas heaters integrated with mechanical controls.

Sunnovations’ innovation is a classic instance underlining the adoption of varied growth strategies pervading gas water heater industry. This business space has been witnessing an abundance of technological advancements such as highly efficient electronic thermostats and digital temperature control. The existence of regulatory organizations striving tirelessly to ensure strict implementation of enforced norms is also an essential factor driving gas water heater industry size. Endowed with the advantage of a powerful competitive spectrum experimenting with product differentiation tactics, gas water heater market, unquestionably, will surpass a revenue collection of USD 9 billion by 2024.

Global Market Insights, Inc. has a report titled “Gas Water Heater Market Size By Product (Storage, Tankless), By Application (Residential, Commercial {College/Universities, Office, Government/Military}, Industrial), Industry Analysis Report, Regional Outlook (U.S., Canada, Mexico, Denmark, UK, Germany, Netherlands, Sweden, Italy, Russia, Spain, China, Japan, South Korea, India, Saudi Arabia, UAE, South Africa, Brazil, Argentina, Chile), Price Trends, Competitive Market Share & Forecast, 2017 – 2024” available at

https://www.gminsights.com/industry-analysis/gas-water-heater-market