Charles Schwab is in advanced talks to buy TD Ameritrade for $26 billion, creating a brokerage with more than $5 trillion in combined assets. So far, Wall Street likes the proposed deal, as TD Ameritrade shares are up 15% (on pace for its best day in more than 11 years!) and Schwab shares are up 8%.

How Did We Get Here?

Earlier this fall, Schwab was the first major brokerage to announce plans to go to zero commissions, leading to significant market cap losses. Monoline firms like TD Ameritrade and E-TRADE were particularly hard hit, as TD Ameritrade draws 36% of its net revenue from commissions while E-TRADE draws 17% (compared to 7% at Schwab).

Since Schwab started the price war about a month ago, it has significantly hurt its major competitors, luring in 142,000 new accounts (and their assets) in October 2019 alone.

What’s Schwab Getting From TD Ameritrade?

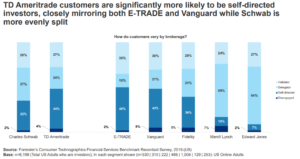

According to Forrester Analytics’ Consumer Technographics® data, Schwab’s customer base is evenly split across the three major investor segments: self-directed, validators, and delegators. But 44% of TD Ameritrade’s customer base comprises self-directed investors, adding a lot more active traders to Schwab’s base. Self-directed investors are quite particular about their trading platform and how they want to use it, so a key decision Schwab will need to make is whether to:

- Maintain two trading platform experiences as is, or

- Extend the experience of one of the platforms to the entire customer base to reduce costs.

Schwab must also have plans to target and upsell the 51% of TD Ameritrade’s base who are delegators and validators with financial advisory services, as these are the customers who are willing and able to pay for financial advice.

Another critical area of overlap are the advisor technology platforms and whether it will maintain two or consolidate into one. TD Ameritrade’s Veo platform has an open-architecture philosophy, is more modern, and is known by advisors as having the simplest setup process. Schwab has only recently started moving to a more modern architecture and is more burdened by legacy systems.

What Will Happen Next?

Being such a large brokerage will attract regulatory, anti-trust, and political scrutiny in the upcoming 2020 election year. However, there is no potential harm to consumers, as end customers are now benefiting from $0 commissions and a surging stock market, at least for now.

The price war has left E-TRADE vulnerable and a likely acquisition target. I think what Schwab started is only the beginning of more consolidation to come. Here are some potential firms that could acquire one of the remaining brokerage houses:

- JPMorgan Chase. It began offering free trading with its You Invest trading platform capabilities last year and launched a robo-advisor this year, indicating its seriousness about entering the retail brokerage business.

- Goldman Sachs. Acquiring a retail brokerage would further solidify its push into wealth management following its recent acquisition of United Capital and broader strategy to appeal to mass affluent customers with its Marcus offering, its planned robo-advisor, and recent stake in UK robo-advisor Nutmeg.

- Morgan Stanley. While it has traditionally served affluent investors, it can complement its offerings with a self-directed customer base like that offered by E-TRADE.

Read more on these topics in these recent reports, “Understanding Today’s US Investors” and “The Race To Zero Fees In Investment Management,” to learn the key actions firms must take now to better understand today’s investor and differentiate beyond price to win and retain investors.