As marketing teams prepare for the holiday season, it’s important to consider the lasting impacts of your peak season email sending.

Seven years ago, “Black Friday” was a US-specific holiday. Now, we’re seeing several other events take place in the last few months of the year that generate spikes in email volume.

These spikes affect senders long after they’ve packed up the decorations—and most don’t even know it.

Put on your detective hats. In this article, we’ll tap into Validity’s Reputation Network—which collects and analyzes over 10 billion data points per day—to investigate a few key questions:

- When are we seeing email volume spike?

- How does the average consumer react to this spike in email?

- Do these spikes cause issues for senders, and if so, for how long?

- What is the impact of sending to an older list during the holidays?

Peak Season is Getting Longer

In 2020, Black Friday was on November 27. But we all know that promotions around the globe now start in early October and ramp up at the beginning of November.

To establish a clear benchmark for email performance during this time, we want to look at baseline data both before and after the holiday rush.

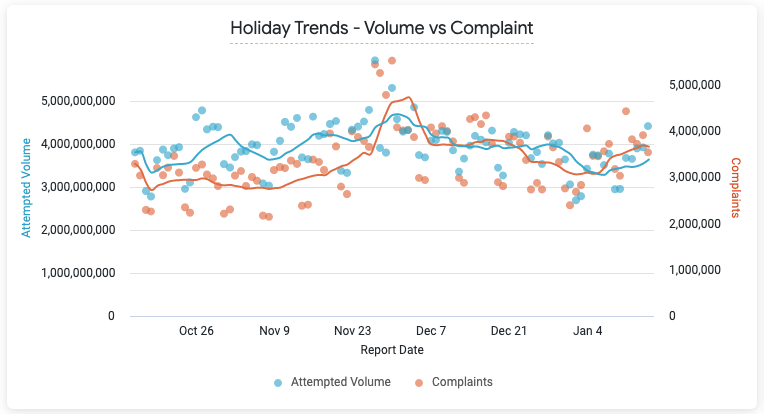

This chart shows us a comparison of total send volume relative to the total complaint count around the peak holiday season (plotting daily data with a seven-day moving average).

In looking at the daily data, we see a distinct spike in both sending volume and total complaints from Black Friday through Cyber Monday (November 27–30).

This is to be expected. B2C retailers are in in full “Buy now! Best deal ever! Send to everyone!” mode. Consumers come out of their turkey comas and find their inboxes exploding.

When are we seeing the biggest email volume spike?

On November 27 – November 30.

Per the above chart, total complaint count doesn’t decrease along with send volume after the holidays. This suggests subscriber email fatigue may last well beyond the final “holiday doorbuster” email blast.

How does the average consumer react to this spike in email?

We see a distinct spike in complaints.

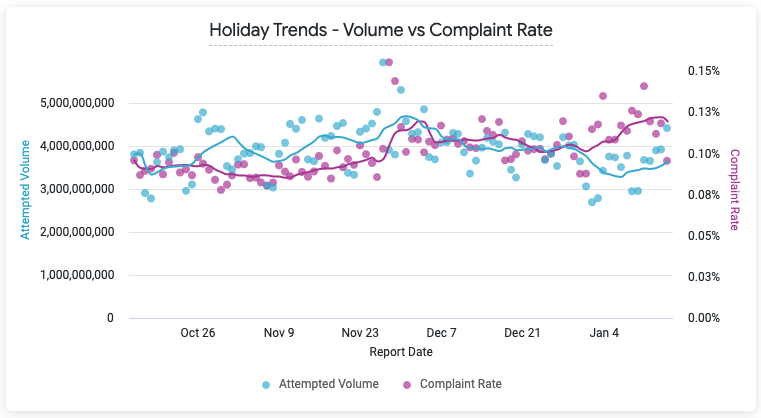

Comparing send volume to complaints in another way, we can look at the overall complaint rate (total complaint count / total send volume).

This data shows a noticeable change in the complaint rate starting on Black Friday (November 27) and continuing to trend upward into January. Before mid-November, the complaint rate was consistently below 0.1 percent. After Black Friday, it stays consistently above that mark.

Do these spikes cause issues for senders, and if so, for how long?

Complaints persist into the New Year.

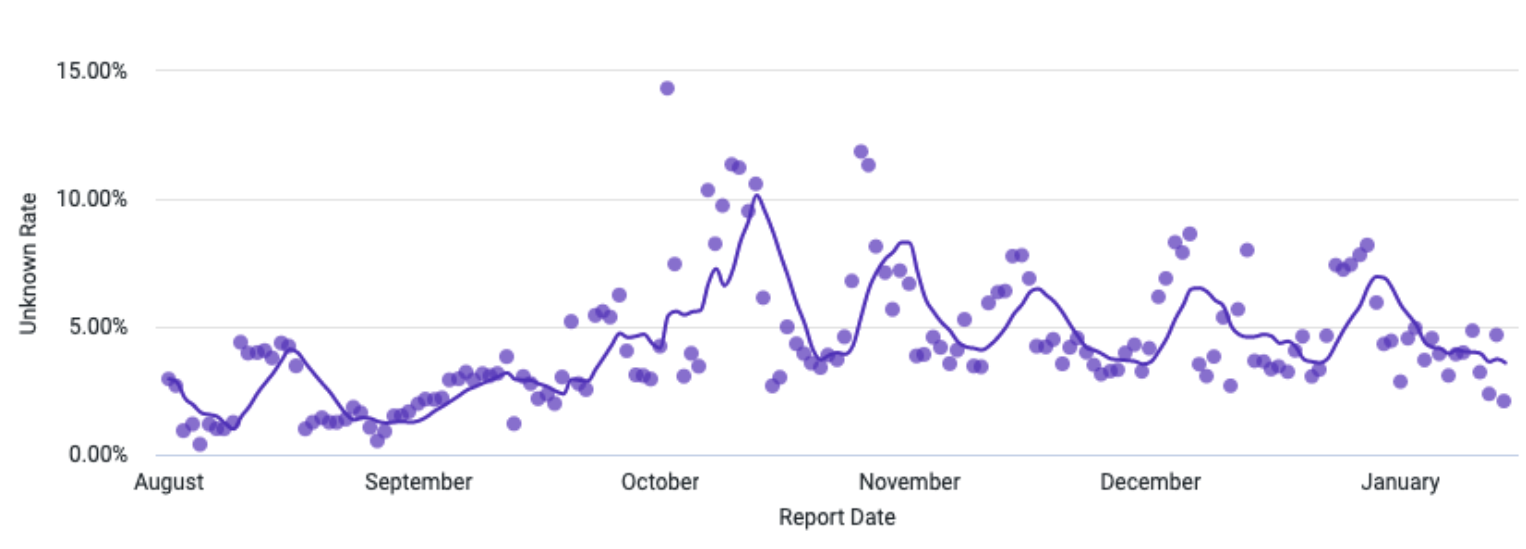

Many marketers take the peak sales season as a cue to dust off their old, lesser engaged lists of subscribers to maximize their short-term revenue. Looking at the data, this is not an anecdote. We see hard bounces (sends to unknown users) almost triple during the lead-up to the holiday season as senders incorporate them into their lists ahead of holiday frenzy.

Next, we segmented the groups with higher hard bounces vs. lower hard bounces.

We can see the results are exactly as we might expect. The higher bounce rates (>5 percent) generally lead to lower inbox placement rates. Whereas senders with lower bounce rates (<2 percent) see measurably higher inbox placement rates, 13 percent higher than the former group.

What is the impact of sending to an older list during the holidays?

You’re likely to see lower inbox placement overall.

Of course, there are many unknown variables. In speaking with our clients and prospects, we know that concerns like how mailbox providers will react to lower sender engagement due to MPP adoption, or how the global supply chain crisis will impact holiday sales, are top of mind.

We are living in unprecedented times. This phrase has become cliché, especially in the marketing world, but it has never been truer than right now.

What decisions will marketers face this year?

To answer this, let’s look at a sample scenario: Company X has a list of one million email addresses that they would normally use to promote their Black Friday sale.

They also have an old list of 250 thousand additional addresses they haven’t used in the past year. Should Company X include them in their large send too?

Current State:

- Addresses: 1,000,000

- Hard Bounce Rate: 2 percent

- Inbox Placement Rate: 86.5 percent

Proposed State:

- Addresses: 1,250,000

- Hard Bounce Rate: 8 percent

- Inbox Placement Rate: 73.2 percent

You would think growing your list by a quarter of the current size just to lose about 13 percent inbox placement will result in a short–term gain, right?

Is this worth it?

Email success solutions like Everest, from Validity, can help marketing teams achieve maximum ROI from their email programs in any climate.

To learn more about what Everest can do for you, schedule a demo with our team of experts today.