Three big themes emerge from Episerver’s Reimagining Commerce 2020 report: mobile, social and personalization. The study is based on a survey of more than 4,000 consumers across five key international markets: U.S., U.K., Australia, Germany and Sweden.

Related: Get the Periodic Table of Digital Commerce Marketing

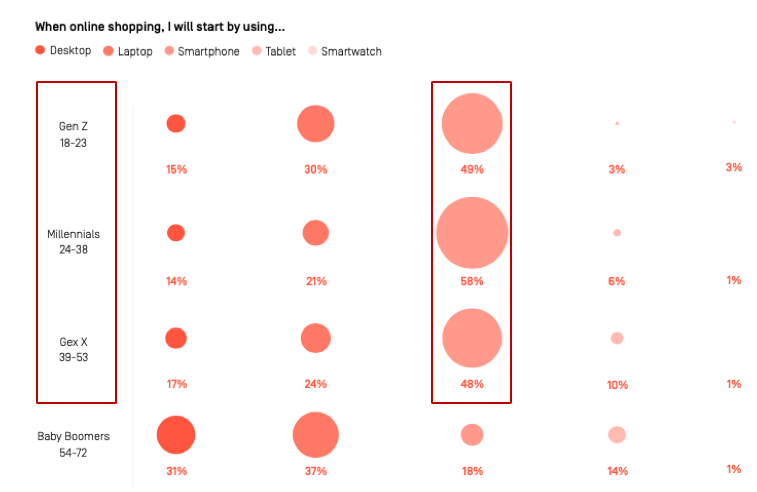

Mobile primary for all but Boomers. While there’s evidence that mobile search has stabilized and perhaps even retrenched in specific categories, the Episerver report is bullish on mobile. It found that smartphones are preferred by all audiences except Baby Boomers as the default or favored platform for online shopping:

- 25% of consumers use smartphones to research or shop online multiple times per week; 18% use them to complete a transaction multiple times per week –- 2% higher than in 2019

- Smartphones lead all other device categories as the “default” for online product research and shopping: 58% of Millennials prefer smartphones; 49% of Gen Z

- Yet only 18% of Baby Boomers prefer smartphones to other devices

Where consumers start their online shopping

Even though smartphones are preferred, conversions typically happen somewhere else (on a PC or offline). Episerver says desktop traffic to retail websites has not risen above 43% since 2018. Yet, “despite website sessions on mobile devices trending upward over the past three years, conversions are still lower (2%) on mobile compared to desktop (3%).”

Social and influencer-generated buying. Social commerce and influencer-generated purchases are both growing according to the survey. Episerver found that roughly 20% of consumers bought something “directly because of a social media influencer’s product post.” The numbers are considerably higher, roughly 50%, for Gen Z and Millennials. In addition, 31% of consumers bought something directly from a social media ad, which was a 10-point gain over last year.

Despite the growth in mobile shopping and social commerce, Episerver also found a degree of shopping fatigue, among survey respondents. The report says the number of online consumers shopping at least weekly declined from 26% in 2019 to 19% in 2020. The company also argues, “the more consumers use their mobile devices and engage in social media activity, the more they’re bombarded with advertisements and marketing messages.”

Privacy vs. personalization. The antidote for this deluge of marketing messages is personalization, says Episerver. However, consumers are ambivalent about personalization to the extent it requires disclosure of their personal data:

- 62% are interested in personalized experiences, unchanged from 2019

- Last year 26% consumers wanted more personalization; that number dropped to 17% this year

- And 25% want brands and retailers to make shopper anonymity a greater priority

Globally, Episerver found that the majority of consumers across geographies wanted the same or greater emphasis on privacy from brands and retailers compared with a year ago. Among the countries surveyed, the U.S. saw the largest percentage of respondents asking for more privacy.

Why we care. There were additional findings in the report around voice shopping and the influence of Amazon on the customer experience. The survey also found, for example, that 48% of consumers start their online shopping at Amazon, compared with 39% who started at Google and 9% who start on a specific brand website.

After reading the document, one is left with a strong sense of the challenges and complexity retailers and brands face as they try to reach multiple audiences on multiple devices, though a growing array of marketing channels.