Thesis Introduction

Expedia Group Inc (EXPE) is a leader in the online travel agency market and most investors have probably used the company’s websites at some point. The company recently reported Q3 2019 earnings and the stock had the single worst one-day drop in its history of about 27% decline. The drop got my interest since the company also pays a growing dividend. In fact, Expedia is a Dividend Challenger having raised the dividend for nine consecutive years. But despite the large drop in stock price the yield is still low, the company is facing increasing competition, and operating and net margins have declined substantially in the past 10-years. For these reasons, I view Expedia as a sell.

Source: Expedia Group

Overview of Expedia

Expedia Group traces its history to 1996 and is now the world’s largest online travel agency. The company offers services for business travelers, recreational travelers, tour operators, and travel agents. Expedia’s major brands and online sites include Expedia.com, Hotels.com, Travelocity, Orbitz, Wotif, AirAsia, Engencia, HomeAway, Classic Vacations, Hotwire.com, CheapTIckets, VacationRentals.com, ebookers, Trivago, and Vrbo. In 2018, the company had about $99.7B in gross bookings leading to $11,223M in revenue of which the great majority was for lodging (69%). The remainder of revenue was air tickets (8%); rental cars, cruises, and other (14%), and advertising revenue (9%). Expedia has three operating segments that are: Core OTA, Vrbo, Egencia, and Trivago for financial reporting purposes. Note that Trivago is an independent company that is majority owned by Expedia. Notably, the Chairman, Barry Diller, owns 28.5% of the Class A stock and 100% of the Class B stock effectively giving him control of the company.

Expedia’s Major Brands

Source: Expedia 2018 Annual Report

Source: Expedia 2018 Annual Report

Expedia’s Revenue Growth, Profitability, And Risks

Expedia derives its revenue primarily from fees from online bookings. The company has about 5.9% total travel booking making it the market leader ahead of competitors Booking Holdings Inc (BKNG), TripAdvisor Inc (TRIP), and private Airbnb Inc (AIRB). The company’s business model is simple. In order to grow revenue, the company must grow the number of bookings since Expedia receives a fee from each booking. From this perspective, the company has been wildly successful. Revenue has increased more than fourfold driven by organic growth and acquisitions. Organic growth was driven by adding booking sites to now over 200 in 70+ countries, and also adding to supply. At end of 2018, Expedia had 1M+ properties, 500+ airlines, 35+ activities, 175+ rental car companies, dozens of cruise lines, and 1.8M+ HomeAway Online bookable listings. In addition, Expedia is an acquisitive company and has completed acquisitions of Orbitz (2015), HomeAway (2015), and Liberty Expedia Holdings (2019) adding to its bookings.

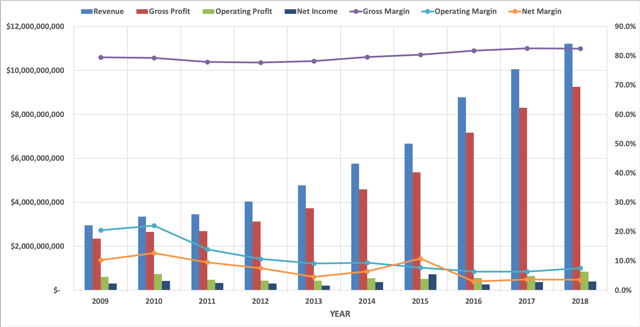

Expedia’s Revenue and Margins

Source: Dividend Power based on data from Morningstar

Source: Dividend Power based on data from Morningstar

But the difficulty for Expedia is that it has become less profitable with time. Revenue is increasing and gross margins have trended up, but operating margins and net margins have trended down. In fact, operating margins are now ranging from 6.3% to 7.5% or about one-third of 10-years ago. Similarly, net profit margins are now about 3.0% – 3.7% or about one-third of 10-years ago. I do not foresee margins recovering to the levels of 10-years or even 5-years ago. Some investors have attributed a narrow or even possibly a wide moat to Expedia. This may have been true 10-years ago when the two major competitors in online travel bookings were Expedia and Booking Holdings. The large number of online sites owned by Expedia combined with the large and growing inventory of lodging resulted in a network effect. But since then, the online travel industry has become more competitive and barriers to entry are low. In 2008, privately held Airbnb was founded and has grown rapidly. Airbnb is a direct competitor to Expedia’s Vrbo segment. Another major competitor now includes Costco Wholesale Corporation (COST), which offers discounted travel through its warehouses. Costco is a direct competitor to Expedia’s Core OTA segment. In addition, most airlines, such as United Airlines Holdings (UAL), and hotel chains, such as Marriott International Inc (MAR), offer direct online travel bookings. This now often includes offerings that are not only their own services and products, but those of other companies.

Alphabet Inc (GOOG) is reportedly making changes that impacts search engine optimization or ‘SEO’ as Google deemphasizes free links. Google is now favoring its own HotelFinder platform and paid links. This will have a real impact in two ways. First, Expedia will need to pay more in advertising fees to Google for its websites to rank higher in searches. Second, Google is now in effect a direct competitor to Expedia. During the recent Q3 2019 earnings call, the CEO of Expedia has highlighted the changes and impacts:

We saw incremental weakness in SEO volumes and a related shift to high-cost marketing channels. We saw lower average daily rates than we expected, which weighed on our lodging results, and profit was softer than expected at trivago and Vrbo. The majority of the ADR impact was in North America, which slowed more than we anticipated…

Google continues to experiment with new products related to SEO as it seeks to get more revenue per visitor. This will have a direct impact on Expedia and other online travel agencies. Google is at top of pyramid and online travel agencies are dependent on search to direct traffic to their websites. The possibility exists that Google will make further changes that would negatively affect Expedia’s top line.

Competition is not limited to Google. Amazon.com Inc (AMZN) and Facebook Inc (FB) also have the potential to be direct competitors. They both have large captive audiences and are seeking to monetize these audiences further. I believe that it is only a matter of time before these two companies enter the online travel agency market.

Expedia’s Dividend and Safety

Expedia initiated a dividend in 2010 and has grown it for nine consecutive years. The current yield is about 1.4% after the steep decline in stock price. Dividend growth was at a healthy double-digit pace. Recently, the growth rate has slowed to about 6.5%. The lack of meaningful bottom line growth due to declining margins and rising payout ratio will likely limit dividend growth in the near future. The payout ratio in 2018 was 46.8% based on a dividend of $1.24 and diluted 2018 EPS of $2.65. This is below my threshold of 65% so it is a good value in my opinion. The dividend is also well covered by free cash flow. In 2018, the dividend required about $0.19B in cash and FCF was $1.10B giving a dividend-to-FCF ratio of 17.3%. This is an excellent value and well under my criteria of 70%. This low value is prudent since Expedia does not operate in a recession resistant industry. Travel is largely discretionary and during recessions it is likely that bookings would decline.

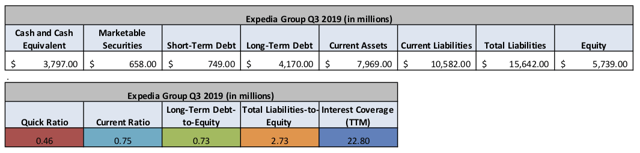

Despite being an acquisitive company, Expedia makes fairly conservative use of debt. In addition, the debt metrics are decent from the perspective of the company paying its obligations and dividend safety. Short-term debt is $749M and long-term debt is $4,170M offset by cash and securities of $4,455M. Interest coverage is strong at over 22X due to healthy EBIT relative to interest expense. Debt seemingly does not place the dividend at risk.

Expedia Group Balance Sheet and Debt Metrics

Source: Dividend Power based on data from Expedia Q3 2019 earnings release

Source: Dividend Power based on data from Expedia Q3 2019 earnings release

Expedia’s Valuation

Now let’s examine Expedia’s valuation. Expedia’s stock price had the largest one-day decline in the company’s history after the Q3 2019 earnings release. However, the stock is likely now trading near fair value after adjusting for the prospect of slower growth and increased competition.

The forward P/E ratio based on consensus 2019 EPS of $6.11 is now about 15.8. Applying a sensitivity analysis using P/E ratios between 15.0 and 17.0, I obtain a fair value range from $91.65 to $103.87. The current stock price is ~93% to ~105% of my estimated of fair value. The current stock price is ~$96.63 suggesting that the stock is trading near fair value.

Estimated Current Valuation Based On P/E Ratio

P/E Ratio | |||

15.0 | 16.0 | 17.0 | |

Estimated Value | $91.65 | $97.76 | $103.87 |

% of Estimated Value at Current Stock Price | 105% | 99% | 93% |

Source: dividendpower.org Calculations

How does this compare to other valuation models? We next apply the Gordon Growth Model. We make the assumption that the dividend will grow at 6.5% rate and that we want an 8% return. This gives a fair value estimate of $90.67. In another method, Morningstar is known to use a fairly conservative discounted cash low model and provides a fair value of $170, which is very high. But an average of these three models is ~$119.48. Seemingly, Expedia is very undervalued at the current price. But with that said, there is a lot of uncertainty with Expedia from the context of SEO and new competition, which makes me think that a 30% discount is warranted. This suggests that a price below $84 is prudent.

Final Thoughts On Expedia

Expedia is a major player and currently the leader in online travel agencies. But the company is very dependent on SEO and Google to drive traffic to its websites. Furthermore, competition is increasing. I do not believe that the company has a significant moat despite the possibility of a narrow one from the network effect. The barriers to entry for online travel agencies are seemingly not that high especially for large tech companies that can easily spend on capital investments. Expedia has become less profitable with lower margins despite increasing revenue and scale in the past 10-years. These are not good combinations. Hence, I am not a buyer and view Expedia as a sell.

If you would like notifications as to when my new articles are published, please click the orange button at the top of the page to “Follow” me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.