Consumers are focusing on leading health-conscious lifestyles now more than ever. Monthly usage of health and fitness apps has grown from just 11% in 2012 to 27% in 2019.

The appetite for natural and organic products is also on the rise, with Gen Z and millennials leading the way.

This is having an impact on the weekly shop too. Gen Z and millennials are now buying healthy food at a higher rate than frozen and ready meals.

It’s only a matter of time before we see the same pattern among Gen X and baby boomers.

And it’s only now that the growing unease about personal health and desire for more natural and environmentally friendly lifestyles has started to create a change.

According to a report by the Centers for Disease Control and Prevention, after a 20-year increase, new cases of diagnosed diabetes in the U.S. decreased by 35%.

In this blog, we share a few snackable insights from our latest report on the future of food, looking at how the health-conscious era we live in has impacted consumer diet preferences.

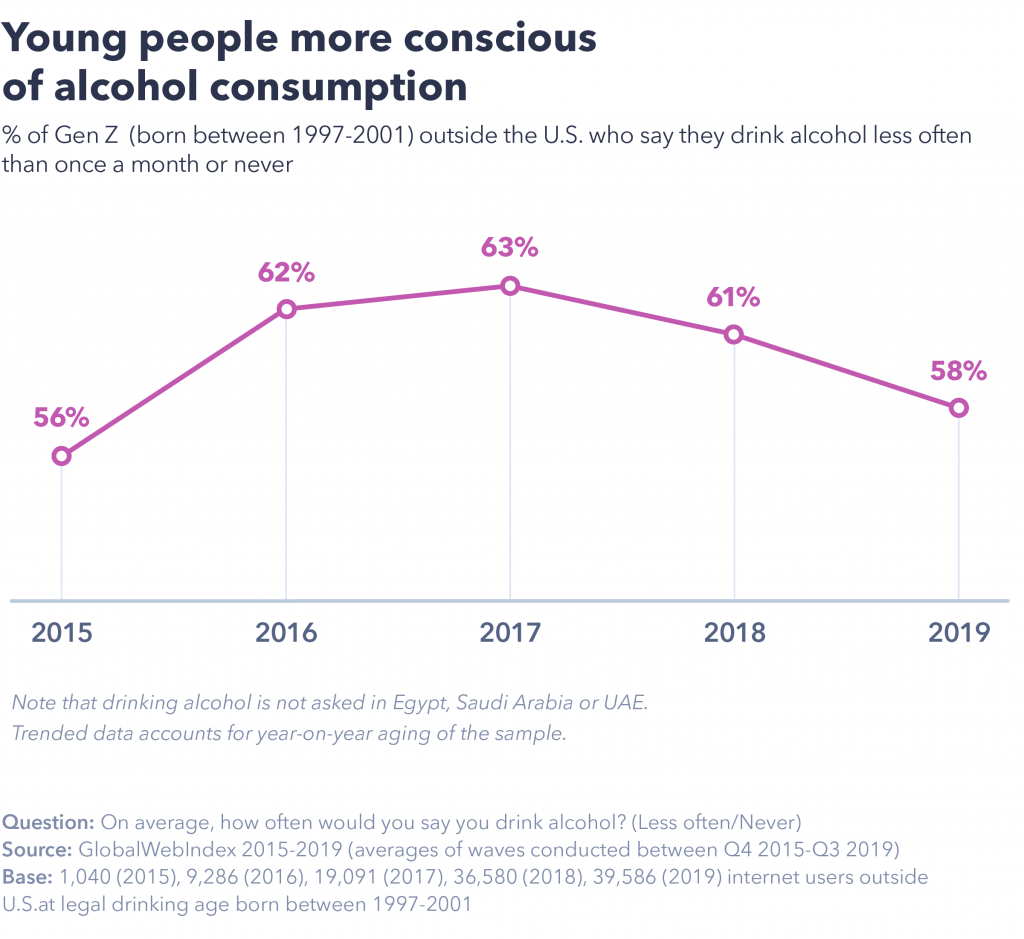

Drinking alcohol isn’t as cool as it used to be.

The healthy living trend isn’t only fuelled by people’s increased physical activity, reducing meat intake or eating organic food, but also by boycotting alcohol.

Our data shows that an increasing number of young adults are turning their backs on alcohol and are looking for no, or low, alcohol beverages instead.

In 2015 56% of Gen Z of drinking age outside the U.S. said they drank alcohol less often or never. Since then, this number started growing until it reached 58% in 2019, compared to 39% of millennials, 38% of Gen X and 41% of baby boomers.

Despite a slight decline from 2017 onward, there’s a clear demand for low-alcoholic beverages among youngsters, but the pattern suggests they could eventually embrace alcohol in the same way as their older counterparts in the future.

What we found from our follow-up custom study, though, is that the no-/low-alcohol revolution doesn’t only come from non-drinkers or youngsters.

27% of the UK/U.S. online population want more alcohol-free alternatives from drink brands and 25% want clear guidelines on non-alcohol vs. low alcohol drinks.

The demand is here, and it’s set to grow, with brands already capitalizing on this emerging opportunity.

Brewdog opened what they called “the world’s first alcohol-free beer bar” in early January after it saw a 50% increase in no- and low-alcohol drink purchases in 2019.

We’re also seeing links between meat-free diets and low-alcohol lifestyles. Meat-free consumers are much more likely than meat-eaters to want more alcohol-free alternatives from brands (37% vs. 27%).

Healthier drink options are also more desired by those that don’t eat meat (53% vs. 34%), suggesting that vegetarians and vegans would be a profitable target segment for brands innovating in that space.

Personalized nutrition could change how we go about dieting.

From high-fat, low-carb, to low-sugar and calorie counting, new diet types are gaining popularity every day.

Taking everything into account, the average adult is estimated to try around 126 different diets in their lifetime; an average of 1.7 diets per year.

And what better time to start a diet than the beginning of the new year.

A custom survey we ran in November 2019 in the UK and U.S. showed 35% of internet users have committed to a healthier diet as a New Year’s resolution.

For some, this means limiting their sugar intake or not eating too late. For others, it translates to following strict regimens.

We found that 53% of online adults have tried for a month or longer at least one of the diets listed on the chart below.

When it comes to awareness, organizations like Weight Watchers, which help people lose weight and maintain it, are the most popular. Weight Watchers is known by almost 7 in 10 individuals, but only 10% have actually tried its dieting programmes.

This tells us that brands are certainly more recognized than stand-alone diets, but not as accessible due to associated costs.

Fasting, on the other hand, is the most-tried diet in the UK and U.S. at 14%.

Intermittent fasting, in particular, has exploded throughout 2019. It was Google’s top diet search last year, with popular figures like Jennifer Anniston promoting it.

It appears that when testing a diet, consumers are more likely to respond to how trendy it is, rather than how suitable it is for their body type.

This is because what constitutes a healthy diet for each individual still remains inconsistent and unclear. Personalized nutrition (receiving nutritional advice tailored to one’s unique genetic profile) could be a game-changer.

As this trend is increasingly supplemented by emerging technology and gains more traction due to increasing frustration with ineffective diets, personalized nutrition is likely to become more affordable and penetrate our lives at scale.

Personalization is already an ingrained part of consumer’s lives, and as they increasingly seek to balance indulgence with health-conscious diets, personalization will become a greater expectation.

Meat-free consumerism is going mainstream.

Our custom survey from December 2019 indicates that only 4% in the U.S. and UK have a vegetarian or vegan diet. On top of this, flexitarians (those still consuming meat, but trying to reduce its levels) make up 15% of the online population.

But this is only a small part of the full picture and fails to shed light on the rising influence of plant-based alternatives.

The global plant-based food market is predicted to reach $80 billion by 2024 – a figure driven by the world’s flexitarians and Veganuary enthusiasts.

This revenue opportunity hasn’t gone unnoticed by the leading QSRs either. McDonalds, for example, made its first-ever vegan burger a permanent option, while Burger King reduced the price of its Impossible Whopper.

Meanwhile, the namesake charity behind Veganuary released final sign-up figures for 2020, amounting to 400,000 participants committed to cutting all animal-based products for a month.

This broke last year’s record of 250,000 and the impact of the campaign has been tremendous. So how has it changed consumer expectations of food brands?

Our data shows that regardless of consumer diet preferences, sustainable packaging should be brands’ top priority. It’s desired by 58% of meat-free consumers and 49% of meat-eating consumers, it will be top of mind for consumers of all diet preferences going into 2020.

But what the figures also point to is the enormous opportunity yet to be taken advantage of in the plant-based meat alternatives food market.

A quarter of meat-eating individuals in the UK and U.S. want more plant-based protein alternatives, rising to 47% of flexitarians.

With this growing demand, the days when plant-based alternatives were targeted to niche consumer groups are gone.

But there are two main challenges to wider adoption:

- More variety of flavors and textures is needed.

- Most offerings are still premium-priced.

Only 35% of fast foodies (those who eat fast food more than once a week and don’t buy organic products) globally say they tend to buy the premium version of a product, compared to 75% of health foodies (those who are interested in health foods/drinks, have purchased it in the last month and try to buy organic products).

Affordability will be a key requirement for brands seeking to expand their reach beyond the health-conscious segment of the population.

Key takeaways for food and drink brands:

- Health and fitness are consumers’ top priorities today. We buy more healthy, organic and natural products; we try to exercise regularly, and we use technology to help us stay fit.

- Fast food brands are under pressure to innovate to stay competitive. To today’s health-conscious consumer, junk food is not as appealing as it used to be. With healthier diet being the new year’s resolution of 35% of consumers this year, keeping up with consumer demand for healthier alternatives proves a challenge to QSRs.

- Brands should be prepared for a wave of meat-free enthusiasts coming their way. Although still a niche consumer segment, the demand for plant-based alternatives expands beyond those already on a diet. A quarter of meat-eating adults said they want plant-based protein alternatives from brands, but affordability and taste remain the biggest barriers to adoption.

- These enthusiasts won’t be alcohol fans. There’s a clear demand for low-alcoholic beverages among youngsters, but the pattern in our data suggests that they could eventually embrace alcohol in the same way as their older counterparts. Drink brands should therefore grasp the opportunity while it’s here.