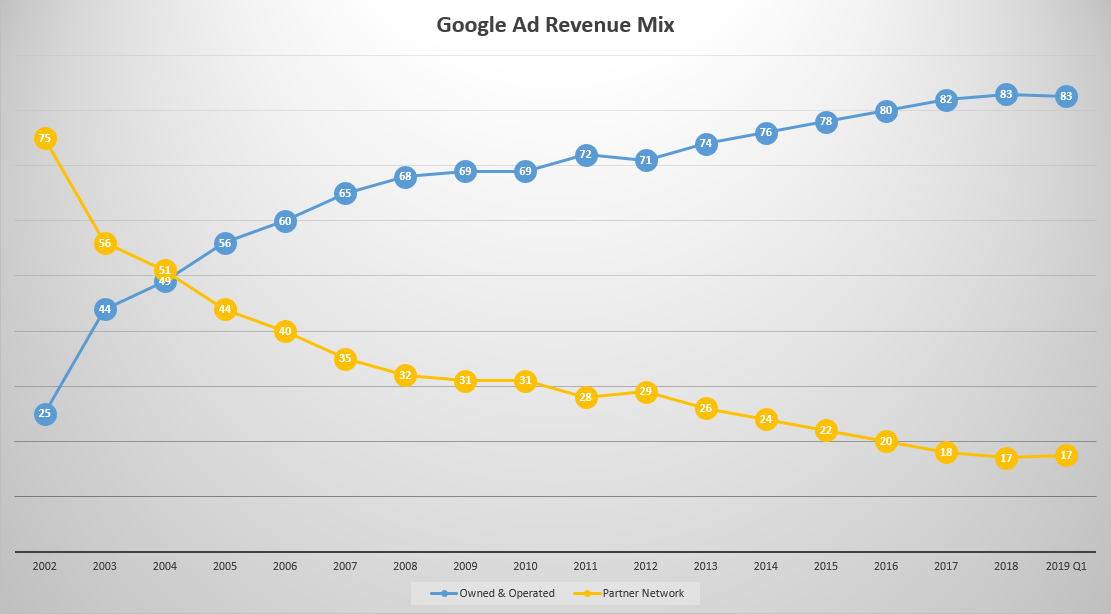

Beyond search Google controls the leading distributed ad network, the leading mobile OS, the leading web browser, the leading email client, the leading web analytics platform, the leading free video hosting site.

They win a lot.

And they take winnings from one market & leverage them into manipulating adjacent markets.

Embrace. Extend. Extinguish.

Imagine taking a universal open standard that has zero problems with it and then stripping it down to it’s most basic components and then prepending each element with your own acronym. Then spend years building and recreating what has existed for decades. That is @amphtml— Jon Henshaw (@henshaw) April 4, 2019

AMP is an utterly unnecessary invention designed to further shift power to Google while disenfranchising publishers. From the very start it had many issues with basic things like supporting JavaScript, double counting unique users (no reason to fix broken stats if they drive adoption!), not supporting third party ad networks, not showing publisher domain names, and just generally being a useless layer of sunk cost technical overhead that provides literally no real value.

Over time they have corrected some of these catastrophic deficiencies, but if it provided real value, they wouldn’t have needed to force adoption with preferential placement in their search results. They force the bundling because AMP sucks.

Absurdity knows no bounds. Googlers suggest: “AMP isn’t another “channel” or “format” that’s somehow not the web. It’s not a SEO thing. It’s not a replacement for HTML. It’s a web component framework that can power your whole site. … We, the AMP team, want AMP to become a natural choice for modern web development of content websites, and for you to choose AMP as framework because it genuinely makes you more productive.”

Meanwhile some newspapers have about a dozen employees who work on re-formatting content for AMP.

Feeeeeel the productivity!

Some content types (particularly user generated content) can be unpredictable & circuitous. For many years forums websites would use keywords embedded in the search referral to highlight relevant parts of the page. Keyword (not provided) largely destroyed that & then it became a competitive feature for AMP: “If the Featured Snippet links to an AMP article, Google will sometimes automatically scroll users to that section and highlight the answer in orange.”

That would perhaps be a single area where AMP was more efficient than the alternative. But it is only so because Google destroyed the alternative by stripping keyword referrers from search queries.

The power dynamics of AMP are ugly:

“I see them as part of the effort to normalise the use of the AMP Carousel, which is an anti-competitive land-grab for the web by an organisation that seems to have an insatiable appetite for consuming the web, probably ultimately to it’s own detriment. … This enables Google to continue to exist after the destination site (eg the New York Times) has been navigated to. Essentially it flips the parent-child relationship to be the other way around. … As soon as a publisher blesses a piece of content by packaging it (they have to opt in to this, but see coercion below), they totally lose control of its distribution. … I’m not that smart, so it’s surely possible to figure out other ways of making a preload possible without cutting off the content creator from the people consuming their content. … The web is open and decentralised. We spend a lot of time valuing the first of these concepts, but almost none trying to defend the second. Google knows, perhaps better than anyone, how being in control of the user is the most monetisable position, and having the deepest pockets and the most powerful platform to do so, they have very successfully inserted themselves into my relationship with millions of other websites. … In AMP, the support for paywalls is based on a recommendation that the premium content be included in the source of the page regardless of the user’s authorisation state. … These policies demonstrate contempt for others’ right to freely operate their businesses.

After enough publishers adopted AMP Google was able to turn their mobile app’s homepage into an interactive news feed below the search box. And inside that news feed Google gets to distribute MOAR ads while 0% of the revenue from those ads find its way to the publishers whose content is used to make up the feed.

Appropriate appropriation. 😀

Each additional layer of technical cruft is another cost center. Things that sound appealing at first blush may not be:

The way you verify your identity to Let’s Encrypt is the same as with other certificate authorities: you don’t really. You place a file somewhere on your website, and they access that file over plain HTTP to verify that you own the website. The one attack that signed certificates are meant to prevent is a man-in-the-middle attack. But if someone is able to perform a man-in-the-middle attack against your website, then he can intercept the certificate verification, too. In other words, Let’s Encrypt certificates don’t stop the one thing they’re supposed to stop. And, as always with the certificate authorities, a thousand murderous theocracies, advertising companies, and international spy organizations are allowed to impersonate you by design.

Anything that is easy to implement & widely marketed often has costs added to it in the future as the entity moves to monetize the service.

This is a private equity firm buying up multiple hosting control panels & then adjusting prices.

This is Google Maps drastically changing their API terms.

This is Facebook charging you for likes to build an audience, giving your competitors access to those likes as an addressable audience to advertise against, and then charging you once more to boost the reach of your posts.

This is Grubhub creating shadow websites on your behalf and charging you for every transaction created by the gravity of your brand.

Shivane believes GrubHub purchased her restaurant’s web domain to prevent her from building her own online presence. She also believes the company may have had a special interest in owning her name because she processes a high volume of orders. … it appears GrubHub has set up several generic, templated pages that look like real restaurant websites but in fact link only to GrubHub. These pages also display phone numbers that GrubHub controls. The calls are forwarded to the restaurant, but the platform records each one and charges the restaurant a commission fee for every order

Settling for the easiest option drives a lack of differentiation, embeds additional risk & once the dominant player has enough marketshare they’ll change the terms on you.

Small gains in short term margins for massive increases in fragility.

“Closed platforms increase the chunk size of competition & increase the cost of market entry, so people who have good ideas, it is a lot more expensive for their productivity to be monetized. They also don’t like standardization … it looks like rent seeking behaviors on top of friction” – Gabe Newell

The other big issue is platforms that run out of growth space in their core market may break integrations with adjacent service providers as each want to grow by eating the other’s market.

Those who look at SaaS business models through the eyes of a seasoned investor will better understand how markets are likely to change:

“I’d argue that many of today’s anointed tech “disruptors” are doing little in the way of true disruption. … When investors used to get excited about a SAAS company, they typically would be describing a hosted multi-tenant subscription-billed piece of software that was replacing a ‘legacy’ on-premise perpetual license solution in the same target market (i.e. ERP, HCM, CRM, etc.). Today, the terms SAAS and Cloud essentially describe the business models of every single public software company.

Most platform companies are initially required to operate at low margins in order to buy growth of their category & own their category. Then when they are valued on that, they quickly need to jump across to adjacent markets to grow into the valuation:

Twilio has no choice but to climb up the application stack. This is a company whose ‘disruption’ is essentially great API documentation and gangbuster SEO spend built on top of a highly commoditized telephony aggregation API. They have won by marketing to DevOps engineers. With all the hype around them, you’d think Twilio invented the telephony API, when in reality what they did was turn it into a product company. Nobody had thought of doing this let alone that this could turn into a $17 billion company because simply put the economics don’t work. And to be clear they still don’t. But Twilio’s genius CEO clearly gets this. If the market is going to value robocalls, emergency sms notifications, on-call pages, and carrier fee passed through related revenue growth in the same way it does ‘subscription’ revenue from Atlassian or ServiceNow, then take advantage of it while it lasts.

Large platforms offering temporary subsidies to ensure they dominate their categories & companies like SoftBank spraying capital across the markets is causing massive shifts in valuations:

I also think if you look closely at what is celebrated today as innovation you often find models built on hidden subsidies. … I’d argue the very distributed nature of microservices architecture and API-first product companies means addressable market sizes and unit economics assumptions should be even more carefully scrutinized. … How hard would it be to create an Alibaba today if someone like SoftBank was raining money into such a greenfield space? Excess capital would lead to destruction and likely subpar returns. If capital was the solution, the 1.5 trillion that went into telcos in late ’90s wouldn’t have led to a massive bust. Would a Netflix be what it is today if a SoftBank was pouring billions into streaming content startups right as the experiment was starting? Obviously not. Scarcity of capital is another often underappreciated part of the disruption equation. Knowing resources are finite leads to more robust models. … This convergence is starting to manifest itself in performance. Disney is up 30% over the last 12 months while Netflix is basically flat. This may not feel like a bubble sign to most investors, but from my standpoint, it’s a clear evidence of the fact that we are approaching a something has got to give moment for the way certain businesses are valued.”

Circling back to Google’s AMP, it has a cousin called Recaptcha.

Recaptcha is another AMP-like trojan horse:

According to tech statistics website Built With, more than 650,000 websites are already using reCaptcha v3; overall, there are at least 4.5 million websites use reCaptcha, including 25% of the top 10,000 sites. Google is also now testing an enterprise version of reCaptcha v3, where Google creates a customized reCaptcha for enterprises that are looking for more granular data about users’ risk levels to protect their site algorithms from malicious users and bots. … According to two security researchers who’ve studied reCaptcha, one of the ways that Google determines whether you’re a malicious user or not is whether you already have a Google cookie installed on your browser. … To make this risk-score system work accurately, website administrators are supposed to embed reCaptcha v3 code on all of the pages of their website, not just on forms or log-in pages.

About a month ago when logging into Bing Ads I saw recaptcha on the login page & couldn’t believe they’d give Google control at that access point. I think they got rid of that, but lots of companies are perhaps shooting themselves in the foot through a combination of over-reliance on Google infrastructure AND sloppy implementation

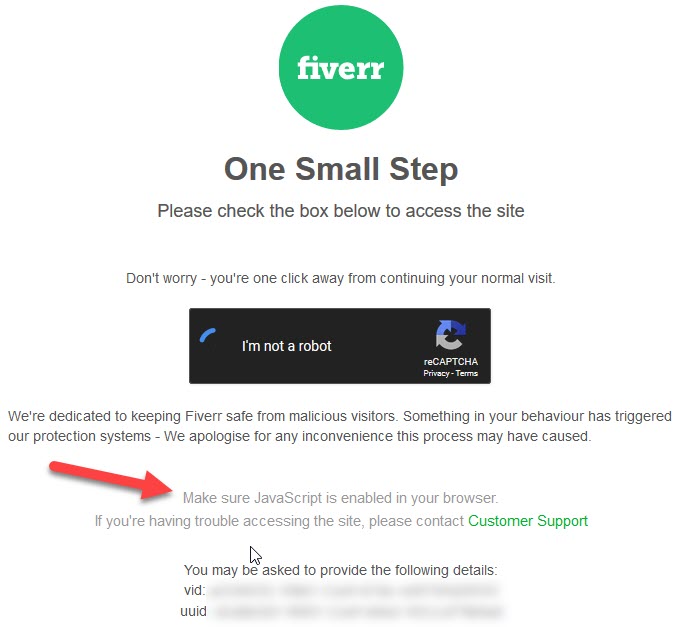

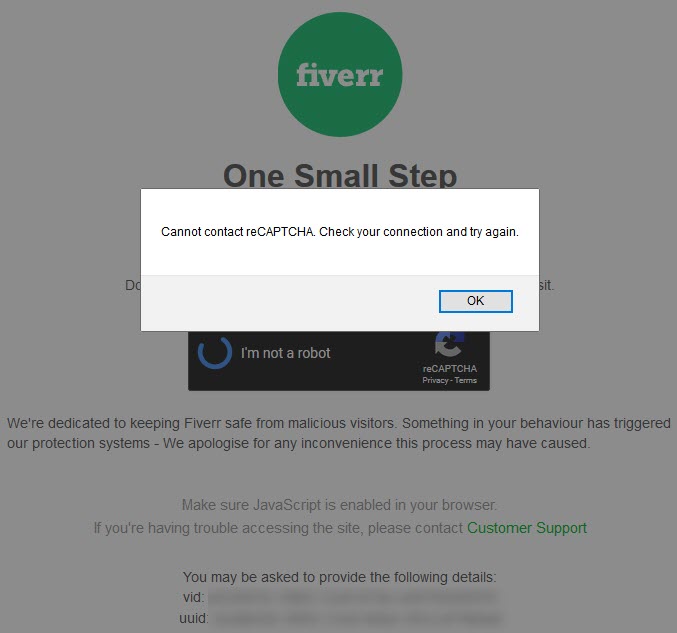

Today when making a purchase on Fiverr, after converting, I got some of this action

Hmm. Maybe I will enable JavaScript and try again.

Oooops.

That is called snatching defeat from the jaws of victory.

My account is many years old. My payment type on record has been used for years. I have ordered from the particular seller about a dozen times over the years. And suddenly because my web browser had JavaScript turned off I was deemed a security risk of some sort for making an utterly ordinary transaction I have already completed about a dozen times.

On AMP JavaScript was the devil. And on desktop not JavaScript was the devil.

Pro tip: Ecommerce websites that see substandard conversion rates from using Recaptcha can boost their overall ecommerce revenue by buying more Google AdWords ads.

—

As more of the infrastructure stack is driven by AI software there is going to be a very real opportunity for many people to become deplatformed across the web on an utterly arbitrary basis. That tech companies like Facebook also want to create digital currencies on top of the leverage they already have only makes the proposition that much scarier.

If the tech platforms host copies of our sites, process the transactions & even create their own currencies, how will we know what level of value they are adding versus what they are extracting?

Who measures the measurer?

And when the economics turn negative, what will we do if we are hooked into an ecosystem we can’t spend additional capital to get out of when things head south?