Intuit (NASDAQ: INTU) today unveiled a series of new features for QuickBooks aimed at helping small businesses that work with freelancers and independent contractors. And it can potentially make life easier for those contractors as well.

New QuickBooks 1099 Features

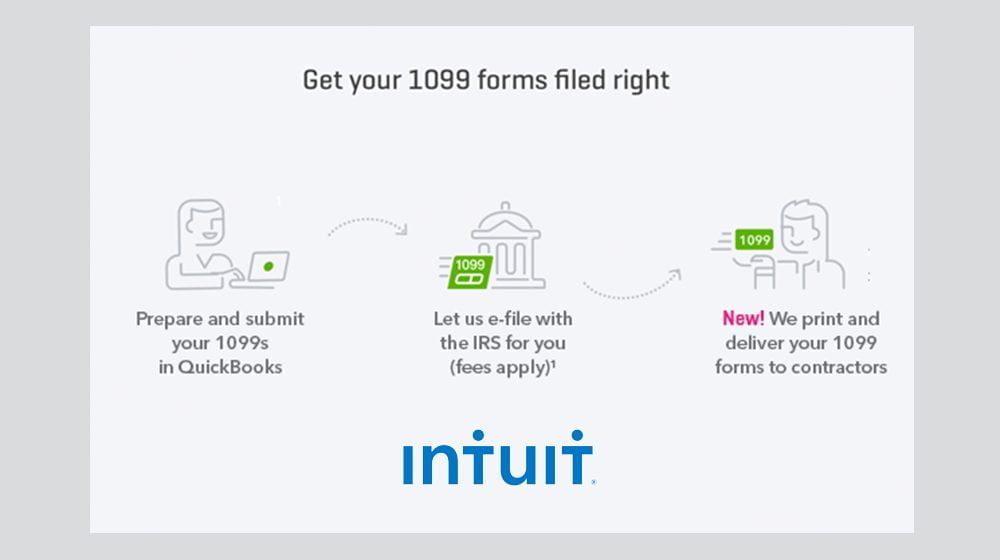

The features, which are automatically available with every version of QuickBooks, including QuickBooks online, let businesses send employment and tax forms to contractors within the QuickBooks software, so they can collect the relevant information without having to print and scan actual paper forms. And it lets contractors more seamlessly and securely share their information as well.

Small businesses are becoming increasingly reliant upon contract workers, with Intuit estimating that 43 percent of the U.S. workforce will be made up of contractors by 2020.

Tad Milbourn, leader of the contractor ecosystem at Intuit, said in a phone interview with Small Business Trends, “We already have this great functionality for small businesses, and this great functionality for self-employed individuals. But until now they mainly functioned separately. Now, we can actually connect those two groups and help both of them work more efficiently.”

Here’s how it works. Within the QuickBooks dashboard, there’s an option on the sidebar called “Workers.” That section includes both employees and contractors. In the contractors subtab, you can invite a new contractor simply by entering their name and email address. Once the contractor receives your invitation via email, they’ll be directed to QuickBooks Self-Employed, where they can log in if they already have an account or sign up for a free account. From there, they’ll be walked through the process of filling out a W-9 form. Once that’s completed, their information will be automatically updated to the small business’s records within QuickBooks.

Then during tax season, businesses can quickly check through their Workers section to ensure they have all the required information for their 1099 forms, which must be sent out to contractors by January 31 every year. You can even e-deliver those to contractors within QuickBooks and file them immediately with the IRS.

All of this eliminates the need for businesses and contractors to send paper documents back and forth or scan documents to send via email when they have sensitive information like Social Security numbers included. It can also simply make the process move a bit faster for both parties. And since time is such a valuable asset for both small businesses and the contractors they work with, this simple new feature could potentially make a big difference for all parties involved.

Images: Intuit