For years, banks have been warned that that the fintechs will relegate banks to handling infrastructure. It hasn’t happened. As David Murphy, SVP EMEA & APAC Banking Lead, Publicis Sapient argues, fintechs are small, so they feel “like ankle biters.” Sure, they put pressure on pricing but most haven’t been big enough to steal market share.

And while everyone has been looking over their shoulders at what Amazon might do, Apple quietly reinvented the credit card business. In concert with Goldman Sachs, Apple laid bare the weak spots and pain points of credit cards from the consumer’s point of view and launched a product that puts the Silicon Valley giant with the world’s most loyal customer base squarely in banking’s’ front yard. Not everyone agrees with that assessment, but no bank or credit union can afford not to pay attention to it.

“Apple is not a small fintech,” says Murphy. “They can put pressure on pricing and steal significant share.”

That may explain why the official launch of the new Apple Card, even though most knew it was coming, stirred up more commentary than all the fintech announcements of the past two years combined.

Apple Inc. is the original fintech, after all. The company’s whole culture — its vibe — has defined disruptive innovation for decades. Apple has stumbled a few times, and more than one analyst has said the iconic firm has lost its mojo since the death of co-founder Steve Jobs in 2011.

Maybe it has. And maybe the voices are right saying that the Apple Card product is just a slick presentation of ideas others have already invented and introduced.

But even a casual student of the Cupertino, Calif.-based company knows that part of Apple’s genius is that often it is not the first mover on a new technology, but the first to popularize it. Even the Macintosh computer and its mouse-based graphical user interface was a perfected version of technology developed by Xerox.

As author/analyst Brian Roemmele, Founder and President of Read Multiplex, observes in a blog on the new card, Apple does not need to invent new things.

“Apple has reengineered everything we have come to know about the entire [credit card] experience,” says Roemmele. Not just the technology, in other words, but the entire user experience.

Forrester Research Principal Analyst Alyson Clarke expands on that point, telling The Financial Brand that Apple Card is a true differentiator, because it was “born digital.” Contrast that, she says, with cards from traditional banking issuers which fundamentally have not changed for decades. “The only thing they’ve done is tweak rewards and maybe tweak pricing and stuck a digital front end on it,” Clarke states.

Referring to a customer advocacy report she does each year that ranks various financial institutions, the analyst states that “year after year the credit card banks and credit card divisions are at the bottom of the pack. So there is a gaping hole in the market for enabling people with credit and treating them well as opposed to just going after them for another fee.”

Apple recognized that as an opportunity to rethink the card experience. But it’s a bigger play than that.

“I completely expect to see Goldman and Apple extend this relationship into a day-to-day banking product. That should scare a lot of banks”

— Alyson Clarke, Forrester Research

“Everyone’s looking at this and comparing credit card to credit card,” Clarke states. “It’s not about that. It’s the start of a relationship and a very different way of banking — digital from the ground up. It’s more secure and it’s about helping you improve your financial position. I completely expect to see Goldman and Apple extend this relationship into a day-to-day banking product where you can put your salary and pay your bills with a savings product. That should scare a lot of banks including a lot of the digital banks.

Read More:

Reactions to Apple Card’s Most Innovative Features

That may or may not play out, but what is certain is that a very different card product — the co-branded Apple Card — is due to hit the market this summer. Its features deserve serious attention.

Issued by Goldman Sachs Bank, the Apple Card is primarily a virtual card built into the Apple Wallet app on users’ iPhone or any Apple device. The card, which runs on the Mastercard network, can be used online, in apps, and in all stores accepting Apple Pay (Apple’s near-field communication-enabled mobile payment system). Apple Pay is accepted at more than 70% of U.S. merchants, according to Apple.

Some other basics about the new card:

- Apple Card works only with Apple devices

- Cards are set up on the iPhone and can be functional in minutes

- Customer queries are handled by texting, available 24/7

- There are no fees associated with the card account, specifically no late fees, over-limit fees, or international fees

- Interest rates will range from 13.24% to 24.24% based on creditworthiness

Beyond those characteristics, the Apple Card boasts four noteworthy features that banks and credit unions should understand.

REGISTER FOR THIS FREE WEBINAR

What Bankers Can Learn From Netflix

In this webinar, Silvercloud will provide actionable tips you can use to ramp up your digital channels in just 30 days, as well as a free template that you can use to get started today!

wednesday, May 14 2:00 PM (ET)

1. Apple Card as Financial Coach

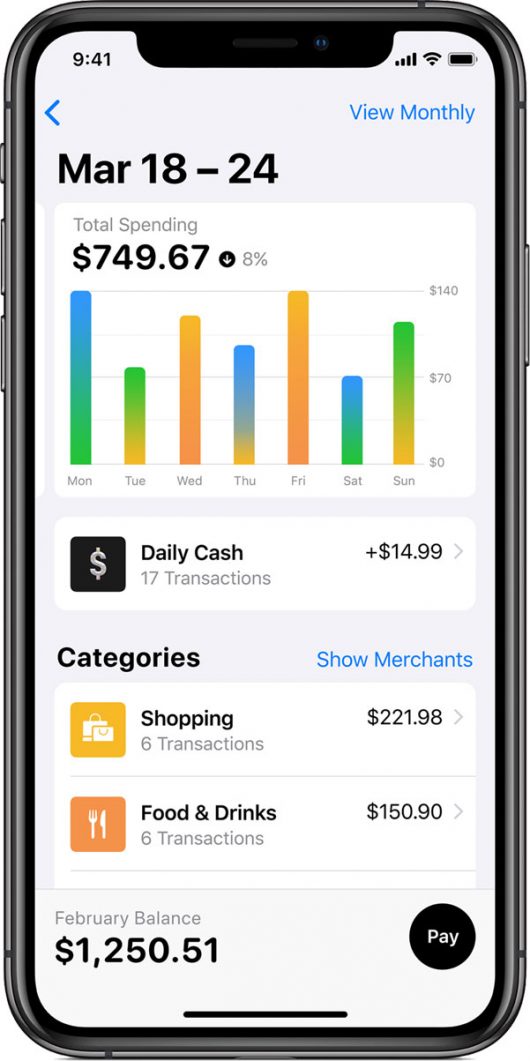

Apple is taking its success with its Health app on the iPhone and Apple Watch and adapting it to financial health. As Apple says, Apple Card encourages consumers to pay less interest and gives them a better understanding of how much it will cost if they want to pay over time. The card app provides weekly and monthly spending summaries. It groups them into color-coded categories such as “Food and Drink” and “Travel.” It also uses machine learning and Apple Maps to translate often-cryptic merchant names appearing on card statements into names and locations people can easily recognize.

Apple is taking its success with its Health app on the iPhone and Apple Watch and adapting it to financial health. As Apple says, Apple Card encourages consumers to pay less interest and gives them a better understanding of how much it will cost if they want to pay over time. The card app provides weekly and monthly spending summaries. It groups them into color-coded categories such as “Food and Drink” and “Travel.” It also uses machine learning and Apple Maps to translate often-cryptic merchant names appearing on card statements into names and locations people can easily recognize.

The card bills on a calendar month cycle and does not have a minimum payment. However, as Jennifer Bailey, VP for Apple Pay says, Apple’s goal is to help consumers save on interest. The app includes an interactive circular tool that allows users to see what they owe, and determine what amount of payment they wish to make. Moving a button on the circular slider shows how much interest will accrue at any amount.

In addition, cardholders can elect to make monthly, twice-a-month, or weekly payments. And Apple Card will send reminders when the due date is approaching, using Apple Wallet push notification, according to Brian Roemmele.

“These features align well with what Apple did when they pivoted away from having an Apple Watch as a fashion accessory to be more health focused,” observes Nick Hassebrock, Senior Research Analyst, Mintel Comperemedia. Clarke agrees, adding “I completely expect with the power of Apple for us to start to see true financial coaching. Just telling me where I’m spending my money is not financial coaching. Helping me pay down my debt, be smarter about how I spend, is.” Clarke states that Apple and Goldman are repositioning the credit card business with this approach, thinking about the customer first and helping them stay out of excessive debt.

Various financial apps developed by fintechs have similar features. The difference is that Apple is integrating them into its huge product ecosystem and pitching it to its enormous worldwide user base.

2. Cash Rewards, Paid Daily

Apple and Goldman elected not to try to be top-of-chart on cash-back rewards rankings. Their reward levels are about average — 2% cash back for every transaction using Apple Card with Apple Pay, 3% for all purchases made directly with Apple, and 1% for purchases made with the physical card.

Apple and Goldman elected not to try to be top-of-chart on cash-back rewards rankings. Their reward levels are about average — 2% cash back for every transaction using Apple Card with Apple Pay, 3% for all purchases made directly with Apple, and 1% for purchases made with the physical card.

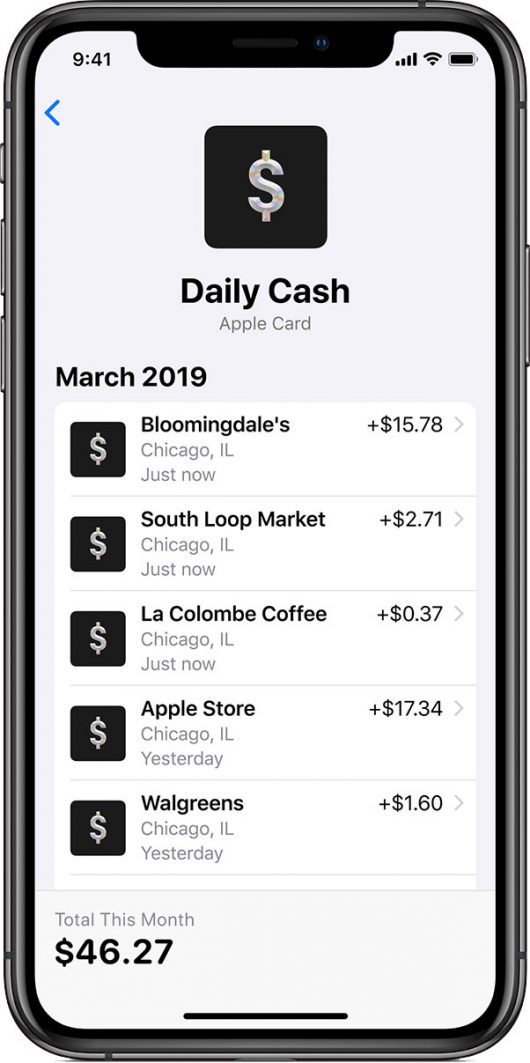

What the two companies are counting on is a feature called Daily Cash. Rewards are paid in cash — daily — to an Apple Pay Cash card set up in the Apple Wallet. The reward is paid immediately. These cash balances can be used for purchases, to reduce card balances, or to send to someone using Apple Pay Cash, Apple’s person-to-person payment platform. There is no limit on the amount of Daily Cash that can be earned.

Various experts consider this feature unique. “No one pays daily cash rewards that are instantly redeemable,” Richard Crone wrote in a LinkedIn blog. The CEO of Crone Consulting believes that even though Apple didn’t mention it, Daily Cash balances likely will be available through Mastercard, Maestro and Discover-connected ATMs.

Brian Roemmele calls this feature “pure brilliance” and “profoundly important.”

“Apple in effect is creating ‘new money’ that has no net cost to Apple,” he states. The analyst believes that this “new money” ultimately will form the basis of a new payment system in which micro-transactions (below $1) and nano-transactions (below 1¢) will become popular and move the internet away from an advertising model.

Some observers are not so enthused. Mercator card analyst Brian Riley, quoted in The Financial Times, says that a consumer spending $20,000 a year on Apple Card — about $55 a day— would earn cash back of $1.10 per day (at 2%), which Riley describes as in the “so-what zone.” A Lightspeed analysis of credit card cash-back redemptions from 11 issuers found that the average number of redemptions per month was 1.2 and the average amount redeemed was $68.

Forrester’s Clarke notes that high net worth customers would be better off with something like the Chase Sapphire or American Express Platinum rewards cards. However, cash rewards are the number one type of program people look for, says Clarke, and Apple Card is on par with what’s out there. Plus, she points out, Apple (and anyone else) can change reward levels at any time.

Read More:

3. Laser Focus on Privacy and Security

An Apple hallmark — security integrated between hardware and software — is applied to the Apple Card. When consumers are approved for an Apple Card on their phone, a unique per-device card number is created and stored in the phone’s “secure element” chip. After that, each payment uses a one-time dynamic security code. Also, users are authenticated by the touch or facial ID capabilities of the iPhone.

All payment tracking and categorization happens on the phone so Apple does not see purchase details. Further, Goldman Sachs Bank, the card issuer, will not share or sell Apple cardholder data to third parties for marketing or advertising, according to Apple.

Given Apple’s very public stances on privacy issues, from CEO Tim Cook’s stonewalling the government’s request for “back-door” access to iPhones, to his criticism of privacy practices at competitors, it’s no surprise the company made privacy a pillar of Apple Card. Roemmele believes the nonsharing of transaction data with marketing partners is unique. It indicates that Apple is ahead of the curve on an issue becoming more important every month.

4. The Titanium Card — Instant Status Symbol

Few companies do product design as well as Apple. The company’s take on the lowly credit card made the crowd gasp when it came up on the screen at the launch event. The slick, white, titanium card, laser-etched with the cardholder’s name and the Apple logo, will be issued to Apple Card account holders to be used wherever Apple Pay is not accepted. (The company did not indicate if the metal card will be free.) The titanium card is mag-stripe and chip enabled (but not NFC), but does not show an account number, expiration date, or CVV code. Those data are accessible on the user’s iPhone if needed.

Banker Chris Nichols, Chief Strategy Officer for CenterState Bank, summed up best the overwhelmingly positive reaction to the physical Apple card: The card has “a look that will turn heads,” he says. The thin, all-white titanium card “has become a status symbol literally overnight.”

Read More:

Game Changer?

The two analysts cited earlier clearly believe the Apple Card — and the payment system it is part of — is a major development in consumer credit and retail payments. More than significant, they feel it’s a game changer. Others, however, don’t see it that way.

“Frankly, I’m underwhelmed,” says Ted Rossman, industry analyst at CreditCards.com. He thinks people will sign up for the Apple Card, but only because they love Apple. The card’s features are no better than anything that already exists.

“My reaction when I saw the announcement was all of the features that are in that card are offerings we have today.”

— Catherine Bessant, Bank of America

Bank of America’s Chief Technology Officer Catherine Bessant, said on CNBC: “My reaction when I saw the announcement was, first competitively, all of the features that are in that card are offerings we have today.” She did add, however: “I think it’s an interesting announcement. We’ll pay a lot of attention to it.”

Even Goldman Sachs’ own analysts weren’t particularly impressed with the new venture. The equity analysts, assessing the new product’s impact on Apple’s earnings, felt that card uptake would be hindered by the limited reach of Apple Pay, which, according to Loup Ventures, is active on just 24% of all iPhones in the U.S. compared with 47% of international iPhone users.

Apple CEO Tim Cook reported at the launch event, however, that Apple Pay is on track to hit ten billion transactions this year and has reached greater than 70% merchant acceptance in the U.S. Acceptance is even higher in some of the more than 40 countries where Apple Pay is used, including 99% in Australia. Transit systems in Portland, Ore., Chicago and New York City will begin accepting Apple Pay later this year, which could help give the platform a boost.

To be sure, Apple Pay has been growing after a slow start. In the U.S., however, digital wallets in general have not taken consumers by storm. Apple and Goldman Sachs appear to be betting that a turning point has been reached. As Forrester’s Alyson Clarke observes, “I believe this is a long-term game and I would never underestimate Apple or Goldman — the capital they have behind them, the digital drive, and the innovation. They are not looking at this like a traditional bank looks at products. It’s more about helping people with their finances as opposed to making money on every single transaction.”