Introduction

Our only certainty in the vacation rental industry is change, and 2019 did disappoint those who enjoy the adrenaline rush of disruption.

Google Travel is not just another channel; it will continue to cause the convergence of organic search engine strategies, pay-per-click advertising, channel/distribution management, and revenue management more so than any other new opportunity in our space during the last decade.

This topic is broad, complicated, and evolving faster than we can likely get to print, so I have taken a research point of view while trying to simplify the landscape as much as possible.

For those of you taking a “device break,” or if you just have not looked at search results for your destination in a while, there is a new, bold box of vacation rentals showing up where you might have seen individual listings on Google Maps even a few weeks ago.

Organic vs. Google Travel Placements

Not to be controversial here, but I have seen several articles label traffic from the Google Travel module on the search results page as “organic” traffic. This is incorrect for many reasons, even if the traffic to this content is “free” as of now.

Organic placement means showing up based on Google bots querying available content, indexing it, and deeming it relevant for search results related to specific queries.

Google Travel is curated through inventory fed from a handful of early integration partners that are sending Google property content, availability, and pricing through the Google Hotels application programming interface (API) feed. So yes, as of now, this traffic is “free,” but it is certainly not “organic.”

Organic ranking strategies are generally handled by search engine optimization (SEO) teams. In contrast, you need distribution/ channel management, pay-per-click advertising, and revenue management teams to tackle Google Travel.

The Changing Anatomy of Google Search Results

There are at least three different versions of a Google Search Engine Results Page (SERP) for queries that contain “destination + vacation rentals,” and it largely depends on whether the destination has inventory being fed through the Google Travel API or via one of the authorized integration partners.

Google started with partners that could provide the largest sets of inventory so it could spread across the map as fast as possible and be as relevant as possible. The reality is OTAs have the most aggregated inventories, so Google started there and has been working down the food chain ever since as it continues to test and iterate the experience for the traveler in search results.

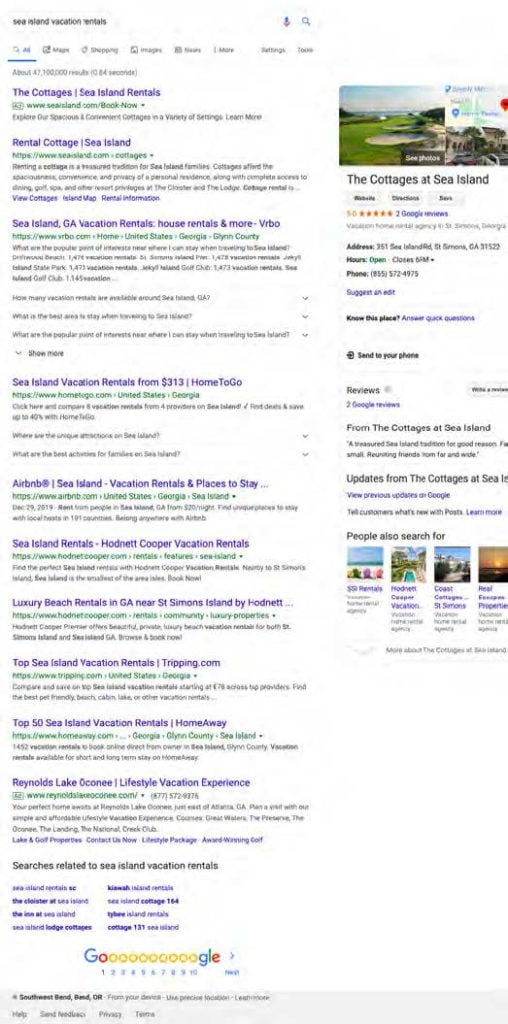

Google SERP Format 1—Legacy/No Google Travel Module

As I am writing this article, “Sea Island, Georgia Vacation Rental” queries still produce search results consistently without Google Travel.

There are several key elements to these pages that are likely to be few and far between—if not completely extinct by this time next year—but offer the most organic real estate on the page.

Listing Placements in Legacy/No Google Travel Page Format Module

Google Business listing in the right gutter

Three AdWords results at the top of the page

Eight organic search result listings

One AdWords result at the bottom of the page

In the Legacy SERP format, of the available space on the first page of search results, approximately 25 percent of the page is paid listings versus 75 percent organic content.

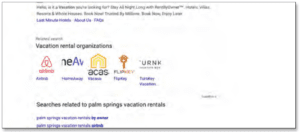

Google SERP Format 2—Vacation Rental Organizations Call-Out Box

This is an interesting version of Google search results that I was surprised to stumble upon in my research on organic results across the industry and the impact of Google Travel. This query for “Palm Springs Vacation Rentals” shows what looks like regular paid and organic search results, except that it has a call-out box labeled “Vacation Rental Organizations” toward the bottom of the page, which contains the logos of several different vacation rental companies.

Listing Placements in Page Format with Vacation Rental Organizations Call-Out Box

Vacation Rental Organizations

Call-Out Box

No Google Business listings in the right gutter—it is left blank

Four AdWords listings at the top of the page

Eight organic listings

Three AdWords listings at the bottom of the page

“Vacation Rental Organizations” logo box

It is not clear how Google chooses which brands to show in this vacation rental organizations box, but it does not look like there has been much time spent on it because the logos are mostly cut off or outdated. Not all of the partner logos showing are integrated directly into Google Travel, so it might be pulling from business listings, but it is not clear.

Regardless, if you click a logo in this box, it actually takes you to another Google SERP with the brand as the query parameter. I would not be surprised if this box was created by accident, and someone forgot to take it down; it is utterly useless, poorly designed, and loosely related to my original query.

This layout provides about 40 percent paid ad space and 60 percent organic listings on the first page.

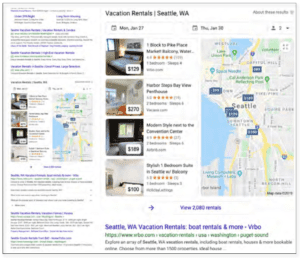

Google SERP Format 3—*New* with Google Travel Module

For destinations where Google Travel integration partners are actively feeding inventory, the first page of Google SERPs for most queries for “[destination] + vacation rentals” returns a page with a new “Vacation Rentals” travel module that displays right below the AdWords listings at the top of the page and before any organic search results.

Listing Placements in *New* Google Travel Page Format

No Google Business results in right gutter

Three or four AdWords listings at the top of the page

Google Travel module with four search results based on prefilled dates

Seven organic listings

Three AdWords listings at the bottom of the page

With this layout, the first page of Google search results is 60 percent paid or API generated versus 40 percent organic listings.

Consumer Experience on Google Travel

Although this is incredibly rich content that is being fed through the Google Hotel API—and it is certainly an attractive module in search results—and much better than the original map listing view that rolled out—the click journey to research rentals on Google Travel can be a bit confusing and inconsistent, depending on the integration partner feeding the content.

Search Experience

For every destination that I searched, the same arrival and departure dates were prefilled in the Google Travel module, basically three weeks from today for a three-night stay.

If a consumer tries to update the arrival dates in the box, it opens a new tab with full search results on the Google Travel website and does not update the results on the original search results page.

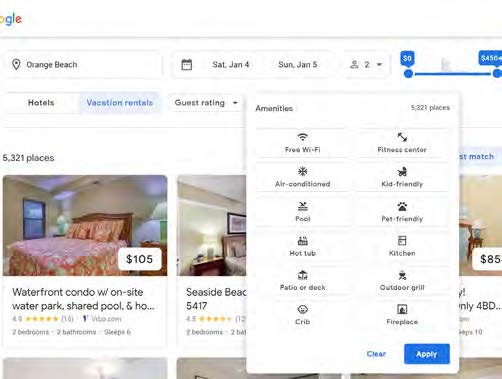

The Google Travel search results page looks like a simplified OTA layout with dates, occupancy, and filterable search options such as amenities across the top and visible listings on a map in the right gutter that highlight as you click or scroll.

Listings have a hero image with a per-night pricing call-out box, a property title, average star rating with the number of reviews, the logo of the Google Travel inventory feed provider, the number of bedrooms, and max occupancy.

This all seems pretty simple and straightforward until you realize that Google has a lot to learn related to search filters, and partners must update amenity mapping for individual listings.

No matter which destination I searched across the globe, Google Travel used the same 12 amenities to filter for every destination. This makes for a poor consumer experience, and some of the amenities are irrelevant based on the destination.

Available amenities for filtering rental results are as follows:

Free Wi-Fi

Air Conditioned

Pool

Hot tub

Patio or deck

Crib

Fitness center

Kid friendly

Pet friendly

Kitchen

Outdoor grill

Fireplace

Here is an example for Gulf Shores, Alabama, on Google Travel and what happens if a consumer tries to use these filters.

Original Query: January 18 arrival/January 21 departure; two guests = 4,746 rental results

Refined Query: January 18 arrival/January 21 departure; two guests + Air Conditioned = 3,626 rental results

Refined Query: January 18 arrival/January 21 departure; two guests + Kitchen = 3,219 rental results

Refined Query: January 18 arrival/January 21 departure; two guests + Crib = 9 rental results

If you have been to Orange Beach in July or August, you probably share my skepticism that there are really over 1,100 rentals that do not have air conditioning, 1,500 that do not have a kitchen, or just nine rentals for the entire destination that have a crib available.

Oddly, there is no refinement option for property type, such as condo or vacation home, and as you can imagine, there are other refinements that are much more relevant than air conditioning at ski and winter destinations; many winter destinations have heat but no air conditioning, and most travelers are eager to refine their search by proximity to ski lifts.

Sample Booking Experiences

When you click on a specific rental on the Google Travel search results page, you come to a Google Travel version of a property details page.

This page is a simplified version of what you might see on any vacation rental website and contains an image gallery, reviews, pricing, an oddly titled “about” tab (which is the property description), and a photos tab with all available images at a glance.

Original search parameters carry over to this property details page so that calculated pricing displays with a “Book Now” button in blue. This is where the consistent Google Travel experience ends. Depending on the integration partner feeding the inventory, clicking “Book Now” leads you away from Google Travel to a landing page from the inventory partner in a new tab.

Following the Book Now Button

VRBO and Airbnb

Inventory being fed from VRBO and Airbnb yield similar experiences after you click “Book Now.” A new tab opens and lands you on a search results page instead of a similar property details page where you can complete the booking.

The search results page has the property that you were reviewing on Google Travel highlighted as the first result, but then it has dozens of property listings below under a heading that leads you to believe that there are many more similar properties to review if you actually are not ready to book.

I found this experience the most confusing because most consumers click “Book Now” to either start the reservation confirmation process or to see further booking details like cancellation policies, terms and conditions, or other information relevant to making a decision.

My assumption is that both VRBO and Airbnb are trying to treat the traffic like organic traffic and drive consumers to use their platforms for additional research and clicks/ engagement rather than just a landing page to finalize a transaction.

I think there could be a better hybrid approach that allows the consumer to get the details they are looking for when they press “Book Now” while also giving them more options since booking funnels have notoriously high abandonment pages.

Conversions on Airbnb and VRBO that originate on Google Travel are subject to channel commissions, and the brand of the individual property manager was not visible.

Red Awning

Red Awning has a slight variation on the experience that VRBO and Airbnb provide in that after the consumer clicks “Book Now” on a property detail page on Google Travel, the new tab opens to a Red Awning property detail page obstructed by a modal urging the consumer to complete the booking process.

This is less c o n f u s i n g than landing on a search results page, but it felt a bit intrusive. Also, the modal lacks any branding, which makes it feel more like a phishing pop-up window.

Consumers cannot tell they have been brought to a Red Awning landing page until they close the booking modal and review the property details page, which has the Red Awning branding clearly visible.

However, dates and rates pass over to the Red Awning website and match what was displayed on Google Travel, making it simple to continue booking.

TripAdvisor/HolidayLettings

TripAdvisor and HolidayLettings have a similar approach to Red Awning without the modal pop-up, so once a consumer clicks “Book Now” on Google Travel, a new tab opens that lands the guest on a property details page from the respective aggregator website with TripAdvisor or HolidayLettings branding.

For my research, I searched for “San Diego vacation rentals” from the warmth of my home in Bend, Oregon, and, oddly, a US-based property manager listing was listed by HolidayLettings (a UK website). If I were ready to escape the cold and head south to sunny San Diego, I would not book on a UK website, so I am not sure this is the ideal channel to list this property for an American consumer.