Every marketer worth their salt is concerned about incrementality. Companies have, and should be, reevaluating their budgets, channels and service providers based on the ability to drive sales from advertising that they wouldn’t have captured otherwise.

When it comes to Amazon, this issue is particularly important, because current SERPs can naturally cannibalize an otherwise organic sale with an ad for the same product that shows up prior to the organic result. For marketers, the key to managing this issue and driving incremental sales is through a combination of segmented bidding strategies for brand, category, and competitor key terms, contextualizing Advertising Cost of Sale metrics, and proper campaign structure.

The non-incremental trap of branded keywords

Each of the larger term segments – branded, generic, and competitor – needs to be thought of in terms of the consumer’s place in the purchase funnel:

- Brand keywords capture shoppers deepest in your purchase funnel

- Competitor keywords capture shoppers that are deep in someone else’s purchase funnel

- Category keywords capture shoppers at the top of your purchase funnel

On Amazon, when a user searches for some variation on a brand name, the A9 algorithm generally does whatever it can to surface as many of those brand’s products as possible on that search page. That includes both top sellers, which will get the top organic placements, along with the long tail, which will occupy spots further down the page. Amazon takes the intent of the user – “I want to see products from this brand” – very seriously. This is borne out in the underlying data – it is much, much harder to rank organically on a category term, as compared to a branded term, as seen in the examples below.

This shows why it’s a real challenge for your brand’s keywords to be incremental. It’s almost guaranteed that your relevant products will show up organically on the SERP – with your top sellers showing up high in the results. Additionally, consumers are more likely to click on the top few results of a branded search, as compared to generic searches.

The biggest takeaway here is that advertising your top products on your own branded terms is a particularly bad practice. You’re capturing sales via paid placements you were likely to capture organically anyway. If brand defense is imperative, consider advertising new or longer-tail products on your branded terms instead. That way you’re defending your brand term, but you’re doing so by helping to sell products that aren’t yet ranking well organically, while still not cannibalizing sales of your top products.

Maximizing sales across category and competitor terms

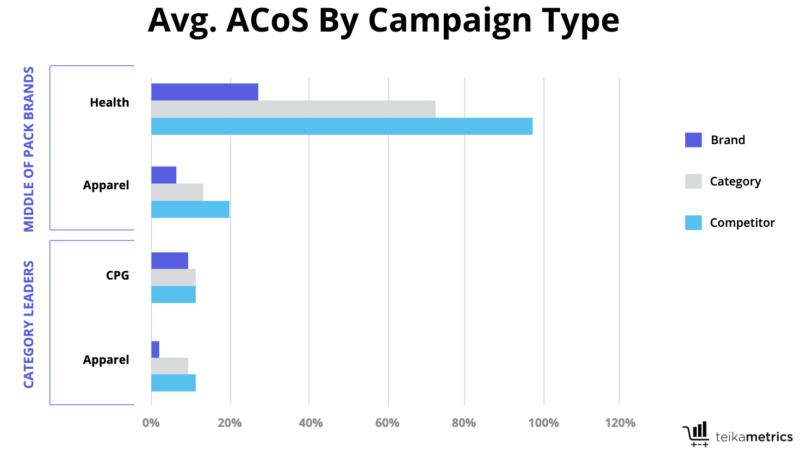

In terms of incrementality, nothing is better than capturing a sale from your competitor. However, you’re likely to find that the ACoS of competitor keywords is significantly worse than that of generic or category keywords, as shown in the example below.

The best strategy here depends a lot on your competitive landscape. Conquesting your competitor’s terms means having a deep understanding of the terms which you can reasonably bid against successfully. Terms relating to stronger competitors with deeper brand loyalty/recognition may necessitate a less aggressive strategy to control costs, while it may be well worth your while to bid forcefully against terms related to relatively weak competitors where it’s easier to pick off customers with your top products.

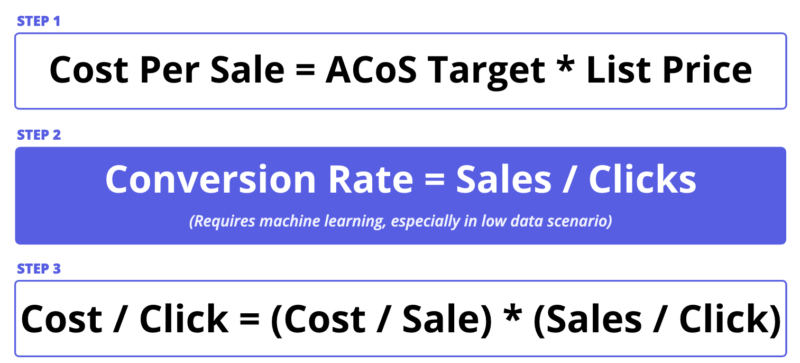

As opposed to branded terms, the universe of category keywords is understandably the largest on Amazon, with new relevant terms developing over time. In this larger and more dynamic environment, it’s important that you set bids based on the expected conversion rate of a given term.

The issue here, which I’ve written about in a previous column, is that over 90% of category keywords do not get more than one click per day, given a constant bid. Additionally, with roughly 80 clicks being necessary to get a confident estimate of the true conversion rate of a given keyword, running this test could take nearly two and half months. Meanwhile, conversion rates change roughly every month – as one extreme example, think of the expected conversion rate for “easter candy” in April versus May or June.

To succeed with category keywords you must have an exploration strategy that values the rate of data acquisition. At my current workplace, we use a probalistic binary search model, that adjusts bids from very high to low in order to more quickly determine the expected conversion rate.

Outside of this more refined statistical method, what marketers can do to better find and exploit meaningful keywords on Amazon is deploy a more granular campaign structure. Because keywords define audience segments, each audience segment needs a different set of considerations in terms of aggressiveness and expectations.

To spell this out, brand keyword campaigns should have high ROAS expectations, focus on emerging products, and get tested for incrementality. Competitor keyword campaigns should have the lowest ROAS expectations and focus on launching and dominant products. Finally, Category keyword campaigns should be expected to give you a break-even ROAS and must be handled with a strong exploration strategy. These overarching themes are important to keep in mind as you scale your marketing efforts on Amazon because they are critical to driving incremental sales growth.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.