Exploring

the ways tech savvy consumers have innovated in their lives and how market

research practices can follow their lead.

Innovation is

impacting every part of our lives, with smartphones making the world available

from consumer pockets with a simple click, swipe or voice command. And now

Apple HomePod and Amazon Echo, teamed up with Siri and Alexa, are providing

direct access to information without the need to reach for a device.

In fact,

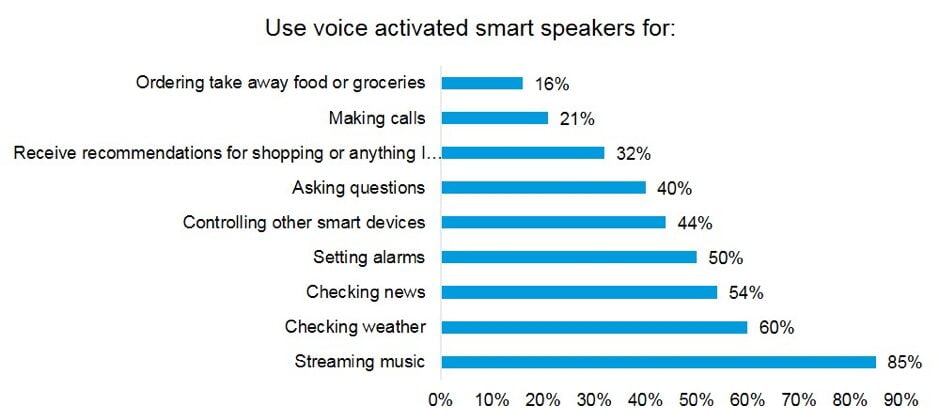

voice-control products are taking off. According

to Kantar’s latest research findings, 21% of people now own a smart speaker or

home assistant. Given that the

first smart speaker (the Amazon Echo) was only launched in 2014, this indicates

that the voice-activated smart device revolution is just getting started. And

while these devices become ubiquitous, smartphones are still the central place

that consumers store everything, make mobile payments, shop online and more.

The momentary panic when you think you’ve lost your device is gut wrenching

because of the heavy dependence on them to function even in the most basic

sense. And it’s evolving at an exponential rate.

But can the same be said for

market research? Technological development in the market research industry is

often focused on how a business can create the latest programme or app to

benefit their business. However, the fact that technological development is

becoming a technological dependence for consumers means market research is

already benefiting. Or rather, it should be. The opportunity exists, given

access to data from new sources like customer data platforms, conversational

AI, and all corners of the internet but now researchers need to tap into this

wealth of data to better understand today’s consumers.

Recognising this, Kantar has

been exploring what the industry can learn from advances in and adoption of

consumer technology, and how to maximize insights and personalise experiences

through understanding connected consumers and the digital landscape they’re

building.

So, let’s explore some of

the opportunities within our industry.

Searching

for answers that are already there

We’ve all been there, a

conversation at a dinner with friends where we can’t remember the name of the

actress in that film or who won the finals last year. It’s tough to imagine

what we did in the days when we couldn’t simply “Google it” or ask Alexa for

the answer without pause.

Having any and every answer

at your fingertips is an efficient, useful tool. If an answer exists, then

isn’t it better to know and be able to move on to the rest of the conversation?

Think about research in the same way to look for what could already be out

there. Researchers are accustomed to creating a survey that covers all the

queries they have. However, there is an abundance of data already available

from others having asked the same questions. So why not search as an initial

step in the research process?

Not only does leveraging

collective survey knowledge provide instant answers, it can enable the

reduction of questions needed in subsequent surveys – saving research budget

and gaining meaningful insight from a more tailored survey that succeeds it.

Being able to tap into data

that already exists offers a significant advantage for the marketing industry.

This capability allows brands, marketers and researchers alike to leverage

audience understanding, quickly and cost-effectively by using real,

permission-based data without even asking a question. The beauty lies in the

simplicity and speed of searching what’s already been collected and then

connecting this into a larger research project or directly into strategic

action.

Connecting

multiple consumer datasets

Survey research is a

critically important method of tapping into the attitudes and opinions of

consumers, but respondents have a digital life outside their online panel

community – as a consumer, an influencer and a potential buyer.

Consumers are leaving a

bigger digital fingerprint that increases exponentially by the minute, if not

by the second. It expands by source, by type and size. It is creating an

ocean-sized pool of third-party data, which we are still learning how to best

utilise in data collection and analysis.

Consumers are leaving a bigger digital fingerprint that increases exponentially by the minute, if not by the second.

How can we connect to and

access this ocean of data? How do we link survey data to it for a holistic,

enriched view of our customers and non-customers?

Connecting data across

first, second and third-party sources is both an art and science. There’s even

the concept of zero-party data, a subset of first-party, which refers to

attributes a customer intentionally and proactively shares with a brand.

There are three main ways to

connect available data sources, privately and compliantly.

1. By person: The

first way to match an individual or their household to a data segment or index

is via Personally Identifiable Information (PII). Name, address, postcode,

mobile number, email address, are all data points that can be used to make the

connection. This is called a deterministic match.

2. By tagging: Second

in line is cookie drops or pixel tags. This match is done on a device level,

where a cookie is dropped on a computer, or a pixel tag is implemented in an

app on a smartphone to track behaviour and build a profiling data set around

who a consumer is. This is called a probabilistic match.

3. By device: Finally,

there is Device IDs. This is a match at a device level and driven by smartphone

technology. Every Android and iPhone has a Device ID that is created as part of

a Google Account or Apple ID. Originally conceived for delivery of targeted

digital advertising, it has become an essential driver in identifying profiles

between data sources. It’s still a probabilistic match like cookies and pixel

tags, but it reduces uncertainty.

The ability to connect

profiles through connection approaches is key to enhancing datasets. Once done,

it unlocks richer, more actionable data for targeting or even media activation.

Survey

segments for programmatic advertising

“Hey Siri, what’s the

address of the airport?” Although we can’t order an Uber to the airport through

a survey-based research project, we have seen how innovation in platform

connectivity and enrichment has increased the value of the research we are

delivering to clients each day.

In addition to the more

obvious ways that data and connectivity increase the richness of our research

and the speed with which we deliver, we now have more ways of making our

deliverables actionable – such as utilising the segments derived through survey

research with programmatic advertising.

In the past, the linkage

between customer segmentation and media buying or ad targeting was indirect at

best. Media planners and media buyers would use proxies such as demographic

profiles of their customer segments to indirectly target ads digitally (e.g.,

“my segment is more heavily weighted to females, age 26-34 in the Northeastern

US”).

As programmatic ad buying

has become the norm and more data has been introduced into the ad targeting

process, we can now more directly use custom segment data to display ads to

consumers who are more likely to fall into the segment (or audience) of

interest.

So, how does

it work?

Survey and segment: Conduct

research among respondents who have agreed to participate in this use-case and

who are connected into a Data Management Platform (DMP). Use the survey data to

define a segment of interest and identify the specific survey responders who

are in-segment (usually n=500 to n=1,000).

Scale: Using statistical

techniques and the data housed in the DMP, data scientists/modellers will

identify many more online profiles that are similar to the survey responders

identified via the survey (this larger group is known as a “scaled audience”).

Distribute (target and activate):

After ensuring that the survey responders are removed, the anonymous

identifiers of the scaled audience (e.g., cookie IDs or mobile ad IDs) are made

available to media buyers via the programmatic advertising process. Access to

the scaled audience is typically paid for by the advertiser based on the number

of ad impressions served.

Measure: Execute brand-lift

or sales-lift research to measure the results of the targeted campaign.

Brands are looking for every

possible way to make their digital marketing dollars go further, and custom

survey-based audience targeting offers this value add. We’ve seen incredible

results from custom research-based audience activation across industry

verticals, from consumer goods where we have measured a 400% increase in product

sales, to a 500% increase in site bookings for a travel industry client, to

double-digit increases in brand conversion across other FMCG and specialty

retail. By taking action on the wealth of data captured through research

projects, brands can now ensure that digital audiences take into account those

all-important consumer attitudes about a brand and its products.

Using AI to

create a conversation

Research innovation is

moving into AI. And the key for AI in market research is in conversation;

striking a conversation in an environment where respondents are already

familiar and active allows the research to blend seamlessly into the medium so

they feel like they are communicating with a friend. By doing this it opens the

door to more personal, open and honest responses. Through a dynamic script a

question can evolve to build on an idea in real-time and develop a deeper

understanding on a topic, allowing a richer view of audiences.

Chatbots are one way to

provide the opportunity for respondents to participate in a more interactive,

conversational manner than a typical typed response and in turn can deliver

deeper understanding and richer data.

For example, imagine

conducting a diary study using conversational AI. The respondent can be in the

kitchen testing the product as they make dinner and record an in-the moment

voice response – a convenient way for them to go about their day while

providing brands feedback. And it’s not only about convenience; a qualitative

and quantitative hybrid approach like this allows the researcher to obtain

greater detail. Not only does speaking a response tend to provide additional

information than typing, details can come in the form of images and videos from

people in the moment — a self-reporting data enrichment that is particularly

useful for diary studies seeking real-life behaviours.

And AI continues to learn

and improve, meaning the way we conduct research can too.

Connecting to the innovative

consumer and leveraging vast, new sources of data tied to them is key to

building richer, more useful audience profiles. As consumers and their tech

habits evolve, it’s imperative market research does too – this is something we

can learn from Siri and Alexa and from the audiences we are seeking to

understand.