By no means is ranking on Google a fair sport, but this is doubly true when looking at Google’s local listings. These listings are so closely tied to Google Maps that you might wonder how a legitimate local business with a great reputation in the local area but no physical, bricks-and-mortar location performs in search.

Does the lack of definable “pin on the map” lead to a lack of exposure? I thought I’d break down some of the data from this year’s Google My Business Insights Study to find out, exclusively for this column.

We whittled the original dataset of 45,000 business across 36 industries down to the seven industries which, in our experience, are least likely to have a physical location. These are:

- Repairs

- Plumbing and HVAC

- Construction and Roofing

- Landscaping

- Tradesmen

- Cleaning

- Locksmiths

Before we go on, I’d like to I’d like to give a huge shout out to researcher Rosie Murphy, without whom none of this analysis would be possible. A reminder, too, that all data points here are medians.

How do consumers discover service-area businesses on Google?

This data set is all about Google My Business listings and how they’re discovered, so we can’t account for all the appearances in organic SERPs and other listings sites that make up such a large proportion of localized organic SERPs.

But what we can learn is how consumers go about searching for service-area businesses like locksmiths and roofers.

Here’s what the below Google My Business Insights mean, according to Google:

Direct search: A customer directly searched for your business name or address.

Discovery search: A customer searched for a category, product, or service that you offer, and your listing appeared.

Here we can see that search type is weighted heavily in favor of “discovery,” which makes perfect sense. Because service-area businesses tend to be small, standalone businesses, they’re highly unlikely to have built up much of a ‘name’ for themselves, which would have led to more direct, ‘business name’ searches.

Infrequency of use also explains the minimal numbers of direct searches. People tend to only need businesses like plumbers and locksmiths for one-off projects or in emergencies, so it’s natural that they wouldn’t be able to build up enough of a reputation to lead to consumers knowing directly who to turn to.

As you can see, the Repairs industry takes the lead in a big way, dragging the service-area business average up. This could be because it’s a slightly broader category than the comparatively niche Locksmiths, for example, but for my money I’d say that things just need repairing more often than they do a lock fitted to them!

Do consumers look for service-area businesses on Google Maps?

As you can see below: oddly, it would seem they do! It’s not nearly as much as they’d look for these types of businesses using standard Google searches, but it’s very interesting to note that some consumers believe that proximity is key for service-area businesses.

(Either that or these users aren’t aware that standard Google search naturally localizes results to your device location anyway, and so they turn to Google Maps whenever they’re looking for a business that operates in their area.)

For the uninitiated, here’s the difference between Views on Maps and Views on Search in Google My Business Insights, as defined by Google:

Views on Search: A customer found the business via Google Search, including local pack results from search.

Views on Maps: A customer found the business via Google Maps.

As you can see, this data follows a very similar trend to Direct vs Discovery searches. The types of industries analyzed here really don’t lend themselves to being searched directly or via Google Maps, so this makes sense.

Something worth noting is that these types of businesses had the lowest numbers of Views on Search in the entire wider study. So what causes service-area businesses to be searched for less than other business types, apart from infrequency of use?

There is something service-area businesses have that other businesses don’t, and that’s their very own Google business listing and ad type: Local Services by Google, which rolled out in the USA over the time period this data was procured.

Our study from around this time last year showed how the presence of Local Services Ads right at the top of SERPs takes clicks on from other results, such as PPC ads, organic results, and, of course, the local pack, which saw a drop of 3.5% in click share when Local Services Ads were present. So it could be that these ads have affected the results seen here.

How do consumers contact service-area businesses?

So… a consumer has performed a discovery search on Google for a locksmith and found one in the local pack that they like the look of. What do they do next?

Well, not much, it seems.

Although we see the same high performers here as in the other two areas, overall these are some very low numbers of people calling businesses or clicking through to websites, even considering the aforementioned infrequency of need for some of these types of businesses. (Yes, you’re reading that right. The average locksmith gets just five actions on their Google My Business listing per month: two calls and three website clicks.)

Apart from Repairs, these are some of the lowest numbers of interactions we’ve seen in the broader study, and suggest there’s a lot of room for improvement in these types of businesses. If I continue to use locksmiths as an example, the average locksmiths listing gets viewed 210 times a month but this only leads to five clicks or calls! That’s a fairly dismal action rate of 2.4%.

One explanation for these low figures could be the growing prevalence of Google My Business listing features that circumvent traditional clicks and calls, such as the ‘Request a Quote’ feature, which is obviously highly relevant for service-based businesses. However, these have only really come to fruition in 2019 so may not have a bearing on this data, which was taken in the 15 months preceding December 2018.

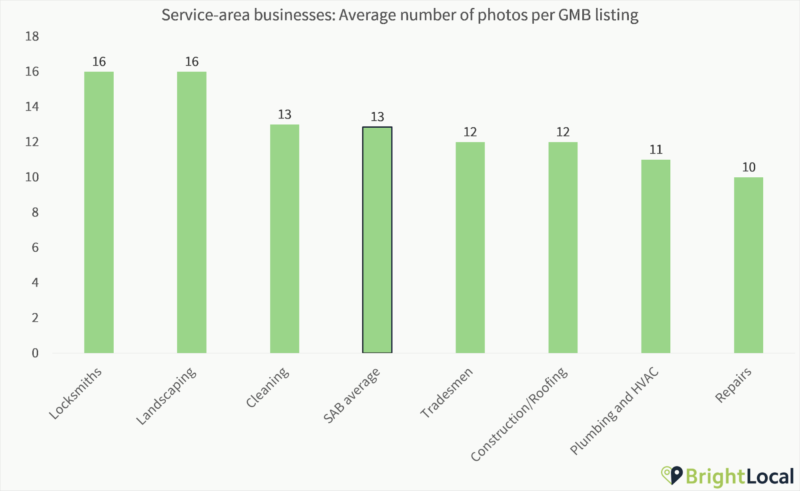

How many images do service area business’ Google My Business listings have?

Finally, let’s take a look at something that’s going to be very relevant for some service-area businesses and very hard to come by for others: images on Google My Business.

Thanks in part to Locksmiths and Landscaping pulling the average for service-area business up, these types of industries actually have a slightly higher number of photos per listing than the average business in the wider study. Way to go, service-area businesses!

The other shocker here is that, in the reverse of what we’ve seen in every other chart above, Locksmiths are here leading the way while Repairs are trailing behind. Although we can’t directly say that “more images

It’s, of course, worth noting that businesses like Landscaping are far more likely to get photos than, say, Plumbing. Even if I’m bowled over by my new power shower, I am not going to be taking a photo of it, let alone uploading it for public viewing. My beautiful new begonias, though? You can’t stop me!

If you combine the lower likelihood of customer-submitted photos with the fact that these businesses probably don’t have premises to photograph, you get a picture of a group of businesses really punching above their weight in the photography department.

So, what should service-area businesses do to improve their Google My Business listings?

For service-area businesses in particular, where Google Maps and Knowledge Panels aren’t really viable first points of impression by consumers, it’s all about optimizing for rankings in the local pack (and Local Services Ads, of course), and that all comes down to building a great reputation and generating links and website authority.

Having said that, there’s no harm in taking on board these tips for an exceptional Google My Business listing should your potential customer come across the expanded version:

- Make sure your service area is set up correctly in Google My Business for the best chance of appearing in localized searches

- Encourage customers to review your business (and get them to upload a photo, too)

- Add FAQs about your services to Google My Business Q&As

- Add your service details and pricing to the Services section of Google My Business

- Make your listing visually appealing with a well-designed logo and well-chosen imagery

- Don’t resort to Google My Business spam – it’s just not worth it

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.