It’s far too early in the coronavirus pandemic to be making absolute statements on what the world will look like once the outbreak passes, whenever that may be.

With the shock that followed the rapid scale of the pandemic’s spread, it’s easy to expect an upheaval of everything we once took for granted. But rather than expecting the most drastic outcome, we can be looking for clues as to what comes next by assessing the trended data before the outbreak, and monitoring what’s happening during it too.

Our job is to work out which behaviors and trends are being impacted by the pandemic, and then work out which of those are likely to subside to pre-pandemic levels, or continue growing.

In many cases, the outbreak has simply accelerated existing trends we were tracking before it started.

In the following blog, we cast a critical eye on the lasting impact of the pandemic, with a special focus on media consumption and brand expectations.

As the pandemic situation evolves, so do media behaviors.

At the beginning of the pandemic, we saw some strong media consumption shifts across various countries for fairly obvious reasons. Internet users across all of the demographic spectrum were suddenly streaming more music and audio, watching more TV, and were also turning to many offline behaviors like hobbies, pastimes and exercising in light of mass restrictions on movement.

In many cases, people may develop a taste for this new media they’re consuming, and will continue to use it once this is all over. But the mistake would be to assume that the majority of these behavior surges will outlast the outbreak.

Even during the pandemic, media behaviors are still changing, and these changes offer hints into which will last, and which will remain at the margins.

For one, people get bored, and once the novelty of unfamiliar behaviors and media formats wears off, many will revert back to what they’re used to and enjoy the most.

We’re seeing evidence of this even in the few weeks between our two international research waves. The first of which was collected between March 16-20th, and the second wave was collected between March 31st-April 2nd.

In our first wave of research in the 13 countries, the youngest cohort – 16-24s – were embracing a whole host of activities, online and offline. But it looks like many of them have quickly become bored of some of these behaviours.

Some of the most prominent examples here are for cooking, audiobooks and apps. Taking cooking as an example, 40% said they were cooking more as a result of the outbreak in the first research wave, but this now sits at just over 30% in the second wave. Hobbies and pastimes have also taken hits in this time period.

Now, if we consider these reductions against the increases in the same time period for younger consumers, we can get a general idea of what they’re doing with their time instead. And this is where we get back into familiar territory.

The only significant increases in terms of deepening engagements with media during the outbreak are for watching streaming services and using social media.

So while we might have seen a burst in engagement for a range of activities – particularly those often regarded as most wholesome like hobbies and phone calls – it seems that the novelty is quickly wearing off among some younger groups. We’re seeing these consumers revert back to their core media activities as a result.

For older age groups, it’s a slightly different scenario.

For 55-64 year-olds, for example, the data indicates a deepening of engagement across lots of media, but particularly for digital media which we’d usually associate with younger age groups.

Aside from a continued uptake of cooking activities, things like watching streaming services, using music streaming services, and using social media are where we’re seeing an even higher rate in increased adoption when compared to the first wave of research in mid-March.

Not only does this underline why brands and marketers need to constantly reassess their campaigns and touchpoints in light of the disruption, but it also hints at why the post-pandemic media landscape may not be as unrecognizable as the increasingly used “new normal” phrase would imply.

New users of media are flooding into the market.

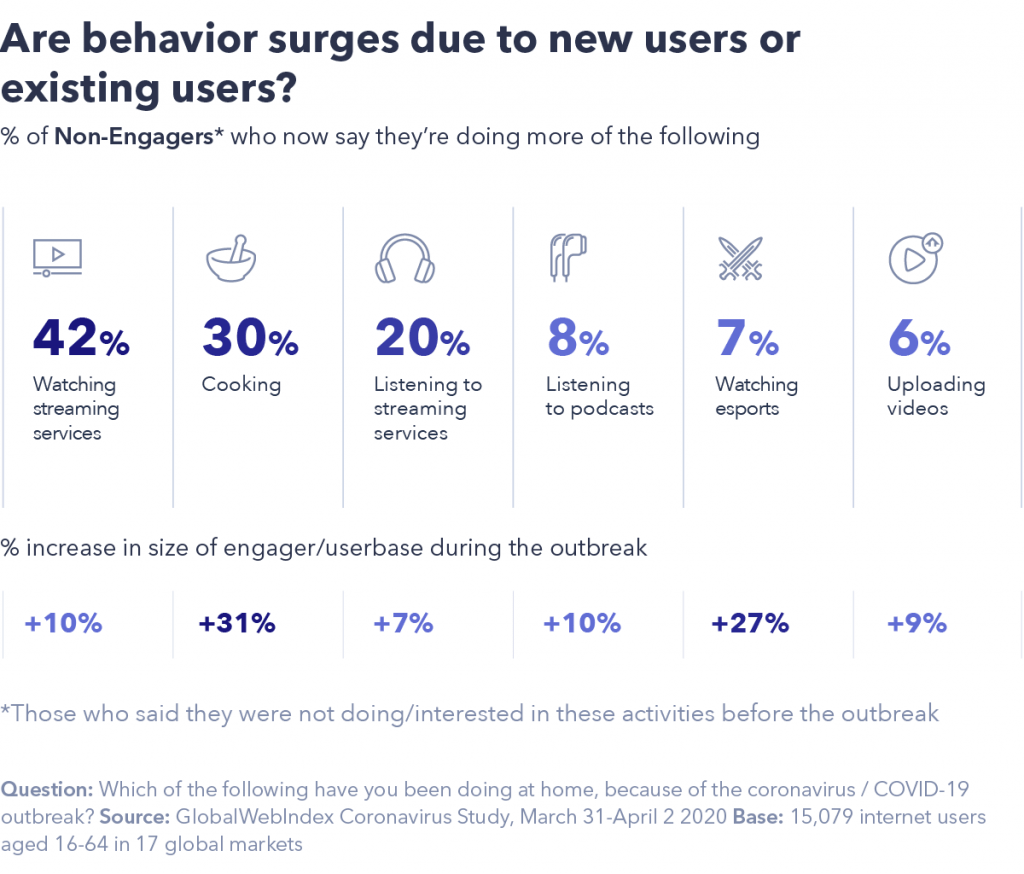

The important thing to understand when looking at the changes in media consumption during the outbreak is whether or not these are the result of existing users doubling down on their engagement, or new users carrying out these activities for the first time.

As these are recontact research studies, we’ve interviewed these respondents in the past year in our ongoing global research, and we have over 40,000 other data points to overlay on top of these recent studies.

This means that we can isolate those who before the pandemic reported never using each type of media, and see how their behaviors have changed in light of the outbreak.

Going one step further, we can then see what kind of growth is represented by adding these new users to the existing groups of users for each media or activity.

Looking at the data this way shows us how well TV and film streaming subscription services are doing during the outbreak.

In the 17 countries surveyed in the second wave of coronavirus research, more than 40% of people who said they weren’t watching streaming services before the outbreak now report doing so. When we add these fresh users to the existing base of TV and film streamers, this represents a 10% growth during the outbreak.

That might not sound a lot, but it is. Watching streaming services is one of the most popular online activities we track in our research, so adding 10% on top of that user base is very significant.

There’s also a very positive story to be told about music streaming in this respect. A fifth of internet users who were not streaming music before the outbreak now report doing so as a result of the outbreak. That represents a 7% growth in the music streaming user base during the pandemic at this stage.

In previous covid-19 research we’ve also touched on the demand for gaming and esports content from traditional sports leagues in light of event cancelations and postponements.

Esports are well positioned to quench peoples’ competitive appetites at a time when sports entertainment appears to be put on hold.

The dominant conversation surrounding esports in the past couple of years has been centered around its growth into the mainstream. That was definitely happening before the outbreak, and it appears that during the outbreak, that growth seems to have accelerated even more.

We can now see that 7% of those who never watched esports before the outbreak now report doing so during it. But before we cast this off as being a fairly low number, we should remember that esports engagement was pretty modest compared to say, movie streaming, before the pandemic – a lot of people weren’t watching esports before all of this happened.

So, that 7% actually translates into a 27% growth in the esports engagement base in these 17 countries during the outbreak; an impressive development when you put it in context.

Many consumers don’t anticipate continuing the activities keeping them occupied.

These are sizeable gains made across many entertainment industries at this stage of the pandemic, but our data shows these industries will need to work hard in continuing to capture consumers’ attention after the outbreak.

When we asked people what they intend to carry on doing following the outbreak, it’s no surprise that exercise tops the list by quite an incredible distance. 40% say they plan to keep exercising, and in every single one of the 17 countries surveyed as part of our second research wave, it’s the top choice out of 20+ possibilities.

Of course, it’s hard to know the extent to which these plans and expectations will convert to reality, but this is a clear sign that consumers have an appetite to stay healthier.

Beyond exercise, there are plenty of other opportunities for brands to respond to consumer intentions.

At least 20% say they plan to watch more news coverage, watch more streaming services, watch more videos, or spend more time socializing together as a family.

It’s when we look at this in real terms – i.e. singling out the future media intentions of fresh users – that we start to get an idea of what the future media landscape holds n store.

We need to apply caution here, because there’s often a discrepancy between what people say they’ll do and what they actually do. Even so, it’s a useful yardstick to understand whether or not different entertainment industries will hold onto these gains.

When we do this, we see that the projected lasting growth for different entertainment industries is relatively modest in these 17 countries.

For example, by taking the number of fresh users of music and TV/film streaming services who say they’ll keep using them after the outbreak, and adding them to the existing respective user bases, we see a hypothetical growth of just 2%.

Trust in businesses is high, but needs to be maintained.

It looks as though behaviors can be fickle, especially during a protracted lockdown. But the same isn’t likely to be true about beliefs.

If there’s one thing the pandemic has done to the brand-consumer relationship, it’s led to consumers placing stronger expectations on brands – including their place and purpose in society.

Brand purpose is something we’ve spoken at length about before (and during) the pandemic, and corporate social responsibility is anything but new. But the coronavirus has amplified these expectations dramatically at a time when society is in most need of organizations that can muster the resources to help out.

Our data on what consumers expect of brands during the pandemic makes this very clear. Respondents answered these brand purpose questions using a likert scale of agreement, from strongly agree all the way to strongly disagree.

Using an average score approach, we can see which statements have the strongest agreement levels.

The statement that consumers show the strongest appreciation for is in brands providing information to help people deal with the situation. There’s also a strong appetite to see how brands are responding to the coronavirus through advertising campaigns and direct outreach methods such as email.

There’s a good argument to say that large businesses have, on the whole, been nimble and proactive in responding to the crisis, and that level of response has led to large corporations having a strong approval rating across the 17 countries, even above that of governments.

This is just months after the 2020 Edelman Trust Barometer revealed businesses are currently lacking in consumer trust. Edelman themselves point out that trust is “based on two distinct attributes: competence (delivering on promises) and ethical behavior (doing the right thing and working to improve society)”.

Clearly, brands are proving the worth of their dependency and purpose during an existential threat.

This newfound trust has been awarded to the brands which have become more customer-centric when people need flexibility, and more ethical in diverting resources when society needs them. The test will be in whether or not these ethical considerations will be translated from short-term priorities to long-term ones.