Are you struggling to secure a loan from a small bank? If yes, then it is time to reach out to a big bank.

According to the latest Biz2Credit Small Business Lending Index™, small business loan approval rates at big banks ($10 billion+assests) reached a new record high in January 2020. The loan approval percentage for small businesses at big banks touched 28.3% last month, setting a new record high.

Be it purchasing equipment or expanding business operations or just increasing working capital, small businesses need to take out business loans for multiple reasons. And increasing loan approval percentage at big banks is certainly positive news for small business owners who are looking forward to applying for business loans.

Biz2Credit Lending Index January 2020

Biz2Credit Small Business Lending Index™ denotes loan approval rates for small businesses at different lenders.

Loan Approval at Big Banks

According to the latest Biz2Credit Small Business Lending Index, the loan approval share for small businesses at big banks reached 28.3% in January 2020, while it was 27.0% in the same month last year.

Talking about the monthly growth, the loan approval share was 28.2% in the month of December 2019, growing by 0.1% to reach 28.3% in January 2020.

Biz2Credit CEO, Rohit Arora, who oversees the monthly research, said in his prepared statement, “The economy is strong, and optimism among small business owners is high, which creates a fertile atmosphere for small business lending,”

“Interest rates remain low, which is encouraging to small companies seeking debt financing for their growth plans. The bottom line is that if your business performed well in the past two years, banks will be willing to lend,” He continued.

Loan Approval Among Institutional Lenders

Small businesses are employing around 60 million people and having good revenue growth in all 50 states. This is the reason why institutional lenders are also putting faith in small businesses.

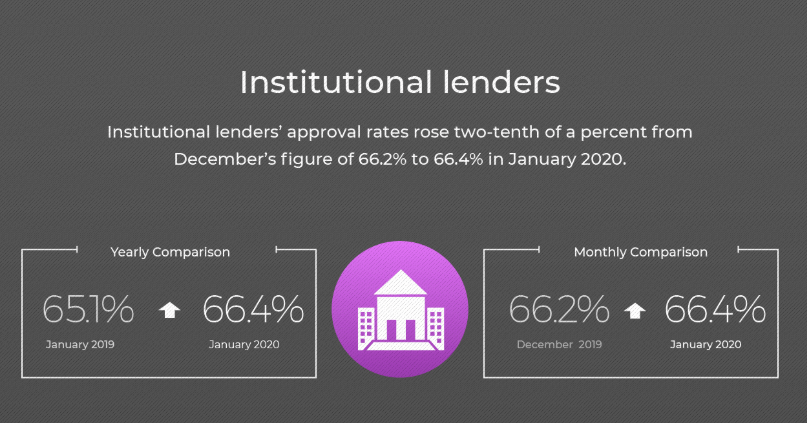

Like at big banks, loan approval share has also increased among institutional lenders (66.4%). It saw growth in both terms monthly and yearly in January 2020.

Rohit Arora who supervised this report said, “Institutional lenders keep expanding in the small business lending marketplace. They are able to offer funding at attractive rates and terms.”

Loan Approval at Small Banks

Loan approval share at small banks has seen a small decline in January 2020 as compared to December 2019.

However, there is a slight rise in the loan approval share if you compare the figure from the same month of the last year.

“Smaller banks because they process more SBA loans, and many SBA lending partner banks are likely to wait for 2019 tax returns to be filed before granting loans,” Arora explained. “This is a slight blip that happens every year in the first quarter. All signs indicate another strong year for small business growth,” commented Rohit Arora.

Be it a big bank or an institutional lender, all are having trust in small businesses of the country. So if you need money to scaleup your business operations, you can explore the option of business loans.

How to Improve Your Chance of Getting a Loan

Here are some ways that can help you increase the chances of securing a business loan:

- Make a solid business plan

- Fix your credit score before you apply for a business loan

- Do your paperwork diligently

- Explore multiple options to get a loan

You must understand that preparation is key to getting your loan request approved. Doing proper research and planning goes a long way.

About the Biz2Credit Small Business Lending Index

The index reports loan approval rates for small business requests at small big banks, big banks, local & regional lenders, micro-lenders, and others. The report analyzes data from 1000 monthly loan applications requested through Biz2Credit. Click here for more details about it.

Image: biz2credit.com