Big Bank Lending to Small Business Hits Record High

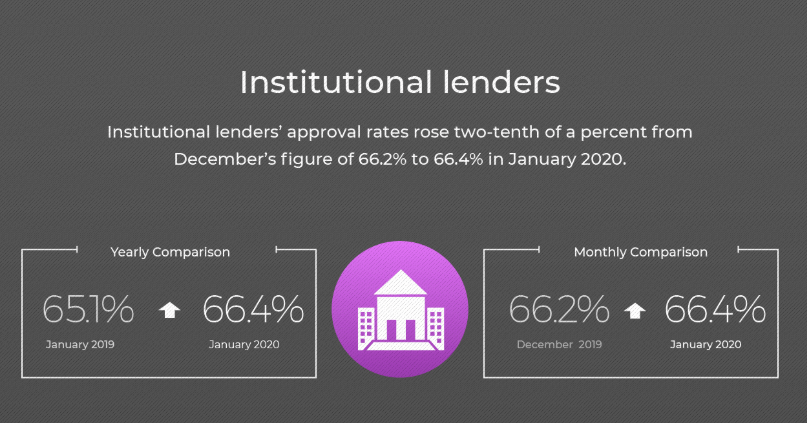

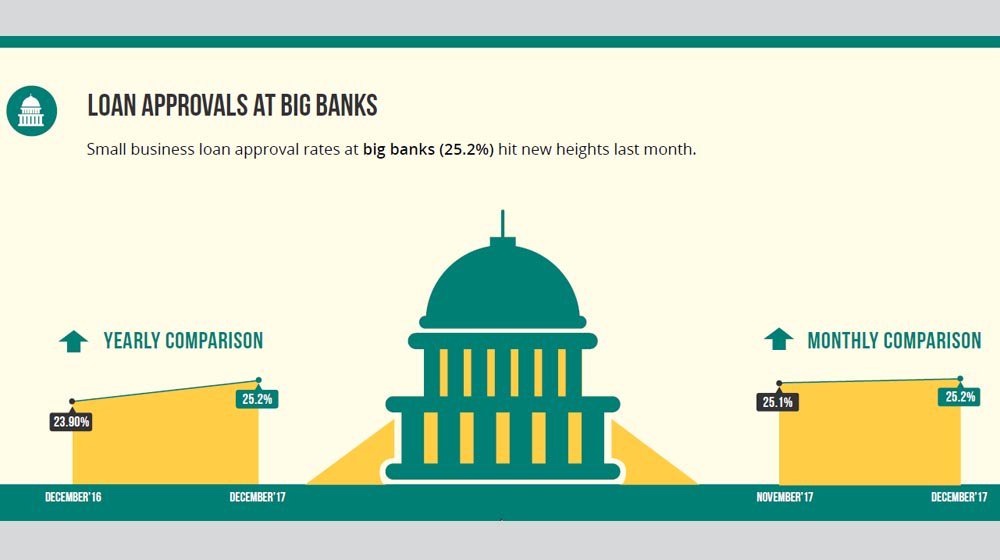

Are you struggling to secure a loan from a small bank? If yes, then it is time to reach out to a big bank. According to the latest Biz2Credit Small Business Lending Index™, small business loan approval rates at big banks ($10 billion+assests) reached a new record high in January 2020. The loan approval percentage […]

Big Bank Lending to Small Business Hits Record High Read More »