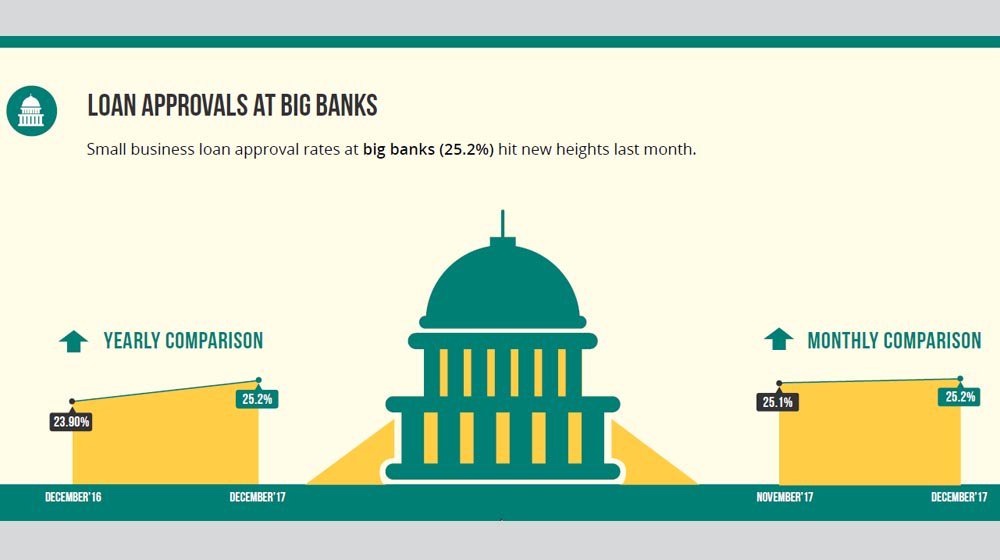

Small Business Lending at Big Banks and Institutional Lenders Up Again, Biz2Credit Says

Loan approval rates at big banks and institutional lenders reached new highs in December 2017, the Biz2Credit Small Business Lending Index reports. This increase also extended for the yearly comparison for both segments, delivering higher approval rates. Biz2Credit Lending Index December 2017 For the month of December, Biz2Credit reported small business loan approval rates for big […]

Small Business Lending at Big Banks and Institutional Lenders Up Again, Biz2Credit Says Read More »