The IRS is auditing taxpayers a lot less than in previous years, but that doesn’t mean there isn’t room for error when it comes to filing your returns. A tough spot many face is filing their taxes without a W2 or pay stub.

So can you file your taxes without a W2? How do you file your taxes without pay stubs or your W2?

That’s what we’re here to look at today. Read on to find out more about how to file taxes without W2 in hand.

Can You Still File Taxes Without a W2?

Generally speaking, those who are employed by another person or a company get a W2 to file their returns. Sometimes, however, you either lose your W2 or you never received them.

The short answer to the question of whether you can file taxes without a W2 is: yes. However, you should always look for a copy whenever possible.

A Form 4852 serves as a substitute for a W2, but you preferably should have your last pay stub ready for this. If you don’t have your pay stub, you can estimate your earnings to complete the form.

Is It Legal to File Taxes Without a W2?

Those filing electronically can definitely do their taxes without a W2. With that said, you need to know specific numbers for some of the figures they ask for.

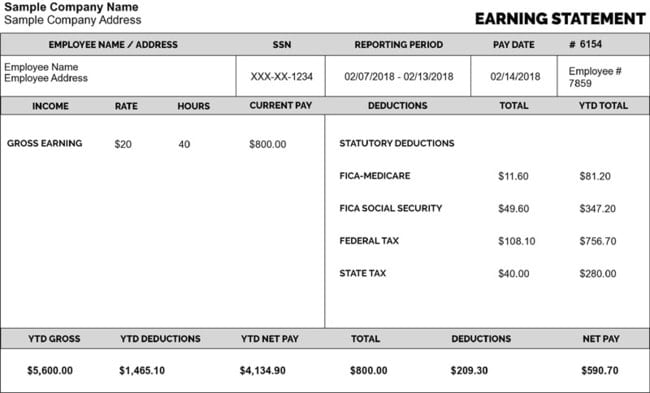

These figures include your Medicare tips, your employer’s identification number, the amount of federal income taxes withheld, and social security taxes.

While a W2 isn’t necessary when you file, you do need to know these numbers. Also, remember that you can’t file your taxes without a W2 if you file by mail.

You should try and receive your W2 in case you get audited. Failing to have your W2 ready here often leads to legal problems.

How to File Taxes Without W2

Before you file your taxes without your W2, make sure you try as best you can to get one from your employer. If that doesn’t work, you can go to the IRS for help. Or you create pay stubs online.

There’s a chance the employer sent it to the IRS, at which point you can provide your address and other personal information. While this may be a long shot, it’s worth pursuing before anything else.

If you can’t find or obtain your W2, you can file Form 4852 instead.

Ideally, you should have your pay stub records, but if you know your tax information, this isn’t necessary. The IRS provides Form 4852 copies on their site.

Make sure all the information is correct and attach the 4852 to your 1040 or another tax form. Above all else, make sure you file everything on time, even if you didn’t get your W2.

Filing Taxes the Right Way

Learning how to file taxes without W2 documents can be daunting since they contain a lot of key information. Use this guide to help you file your taxes even without your W2 or pay stub handy.

Remember to generate your pay stub records to file your returns!