As social marketers, we’re always looking for new approaches to identify and reach likely buyers. Which social networks do our likely buyers use most? What kind of messaging and CTAs will resonate with them? What do they care about, and how do your brand’s offerings fit into that equation? Here’s how using a social media listening solution can help.

1. Identify Where the Bulk of the Conversation Is Happening

You can use listening to identify the social networks with the highest volume of conversation around topics relevant to your brand. Which social network has the highest volume of conversation for this particular brand?

Let’s say that I own a lipstick brand called “Lucy’s Amazing Lipstick.” I don’t want to know only the conversation on social that mentions my brand specifically–this gives me a limited view of the social media conversation about lipstick.

I want to widen my lens, and understand what the lipstick conversation looks like around people not directly tagging me or talking about my brand. This means I am looking at the conversation data around terms like “lipstick,” “smudge-free lipstick,” and “gloss,” as well as my brand name and my competitors’ brand names.

Armed with this knowledge, I can identify the social networks where my buyer—the person most interested in my topic—is spending the most time.

2. Identify Where Conversation Growth Is Happening

You don’t just want to know where the bulk of relevant conversation is occurring. You also want to know where the biggest conversation growth is occurring. In the section above, Twitter is where the most conversation is occurring (sorry, I couldn’t resist), but Instagram is seeing the biggest conversation growth.

This is important information to consider as you put together your targeting strategy and determine where to invest your finite resources.

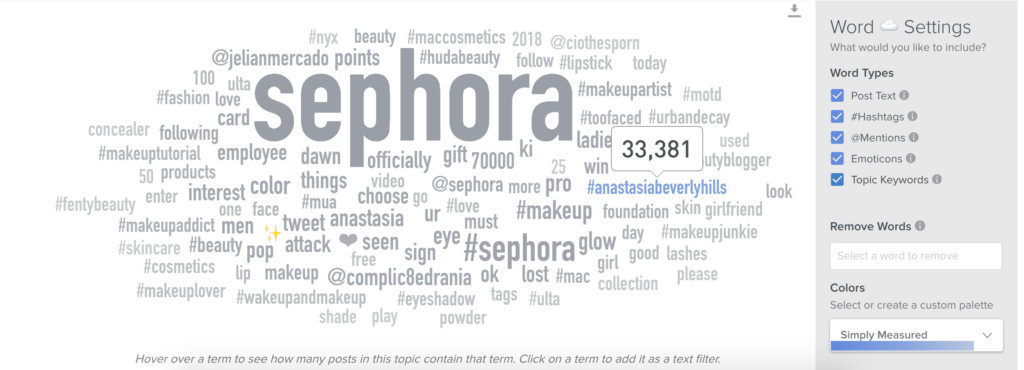

3. Identify What Drives the Conversation

You know how much conversation is happening, and where it’s happening…but what exactly is driving this conversation?

Which terms, hashtags, and events are generating the most response? Don’t avert your eyes. You’ll want to pay attention to the favorable conversations and engagement-drivers around your brand and/or market…

…as well as the not-so-favorable ones.

This will show you how to adjust your strategy and give you unique market research about your likely buyer. This is information you can use to better target social ads, put together a stronger awareness-building strategy, and even engage more effectively on a one-to-one basis.

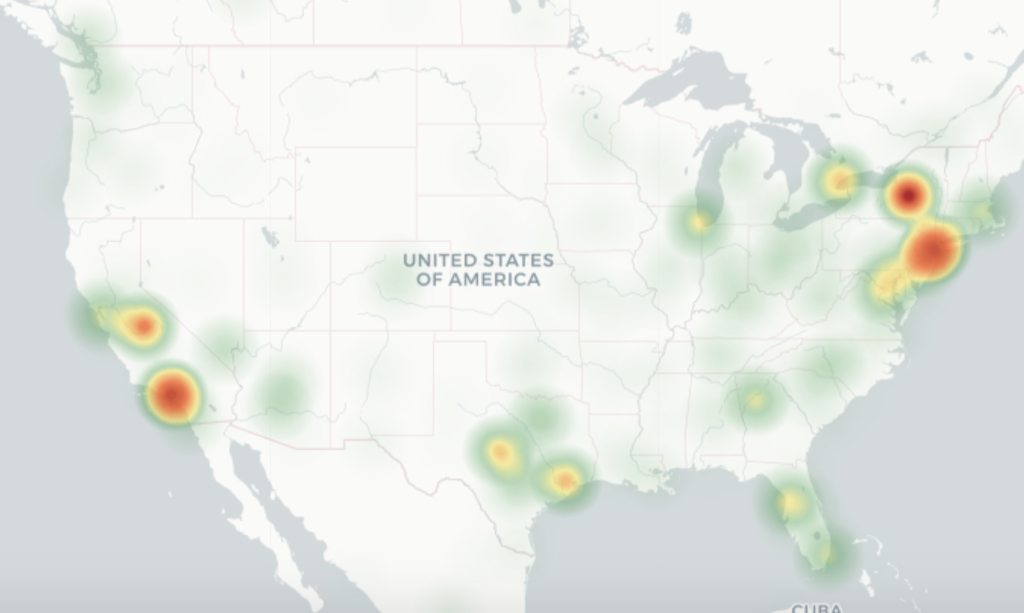

4. Identify Geographic Locations

Now you know what the conversation is about specifically, but do you know where it is coming from? Where do your likely buyers live?

Can you plan personalized experiences, events, and campaigns in these areas to reach likely buyers and turn them into actual buyers?

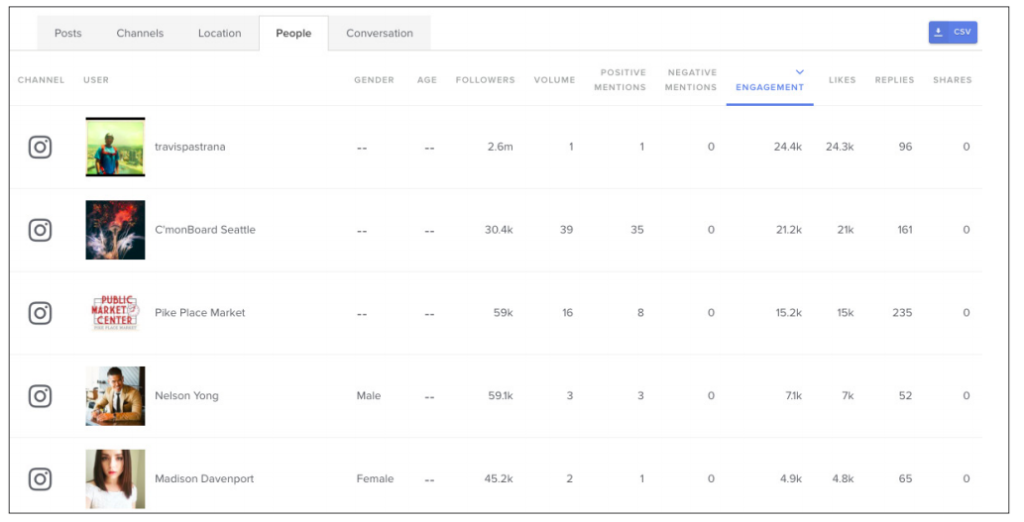

5. Identify Who’s Driving the Conversation

Which social users are driving the most conversation around your brand and relevant keywords? These folks are influencers in your space.

Contact them and form relationships with them. These people have built their followings from scratch—and their followers are your likely buyers. Influencers are another path towards your buyer.

6. Identify Your Conversation Types

Now that you have a good handle on the conversation around your brand and relevant topics, how can you a) identify your common conversation types and b) motivate your likely buyers in these conversations to buy or buy more?

For instance, let’s say you have five main conversation types within which most relevant conversations fall:

- Pleased with your service: The social user is happy with their experience on your website, in your store, or at your event, and wants the world to know.

- Pleased with your product: The social user is happy about your product, and wants the world to know.

- Displeased with your service: The social user is unhappy with their experience on your website, in your store, or at your event, and wants the world to know.

- Displeased with your product: The social user is unhappy about your product, and wants the world to know.

- Seeking advice about your service or product: The social user is looking for advice and insight about your service/product.

If these are your five categories, you’ll want to come up with subcategories. For instance, which specific services do social users commonly claim to be pleased with? Displeased with? Which specific products do social users commonly claim to be pleased and displeased with? And, perhaps most important for targeting that likely buyer, which subjects are social users looking for advice and insight about in your category—and not necessarily directly related to your brand?

Once you’ve come up with your subcategories, it’s time to strategize. Which strategies will you create for each of these common conversation types, to turn likely buyers into straight-up buyers?

7. Identify Your Buyer Personas on Social

Then begin marketing to them accordingly. More on that process here.