Online campaign optimization methods evolve.

Some of us remember well the times when a majority of ads were sold by reservation of a time slot on a webpage.

The advertiser paid, say, a monthly fee for a horizontal banner on the home page of a selected portal. The space for optimization was very limited.

From CPM to Profit Optimization

The first simple ad servers allowed rotation of the ads and counting of impressions, reach, and frequency. Advertisers started using CPM (cost per thousand impressions) optimization.

However, the impressions were sometimes hard to compare, especially in the case of different sizes and positions of the ads, therefore advertisers started to optimize the actual traffic delivered by the ads and their CPC (cost per click).

Soon it became obvious, that the quality of traffic also matters.

What visitors actually do on the advertiser’s website and how many desired actions, such as purchase or signup (conversions), the traffic generates must be carefully monitored.

Conversion tracking systems made possible optimization of CPA (cost per action). Then, assigning a value to the conversion started the ROI (return on investment) era when advertisers started to compare the actual income from the acquired traffic and cost of its purchase.

However, ROI is not the answer.

Many advertising agencies present case studies with enormous ROI, but as it usually applies to a limited campaign and it should be treated rather as an anomaly.

Today’s online advertising market is highly efficient. It means that usually, the cost of advertising reflects its value. Real bargains are rare and quickly disappear.

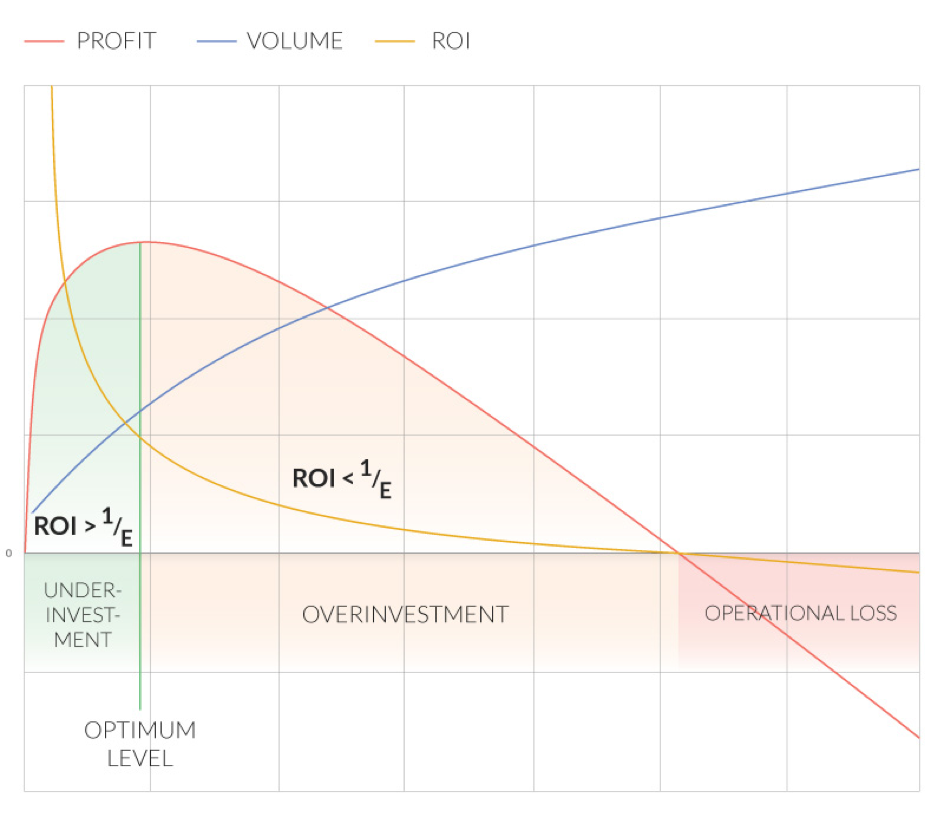

Today’s marketers face the classic “margin or volume” dilemma. The advertisers with low budgets and low volume expectations can start from the cheapest placements and low frequency.

Increasing volume requires buying more and more expensive placements, higher frequency, and higher ad position in search engine ads.

For this reason, the efficiency (ROI) of the ad decreases as the volume grows.

The general rule is that big players don’t buy cheaper, but it’s actually the opposite.

The more intense the advertising is, the higher the costs per impression, click, and conversion.

The total profit (income from campaign less its cost) initially increases, but the higher the volume is, the slower the growth.

At a certain point as the profits start to decrease, we say the advertiser has overinvested in the ads.

The thrust of advertising optimization aims for the sweet spot of maximum profit found between under- and overinvestment areas.

Profit-driven optimization is the most advanced and ultimate goal of budget and bid management.

Price Elasticity

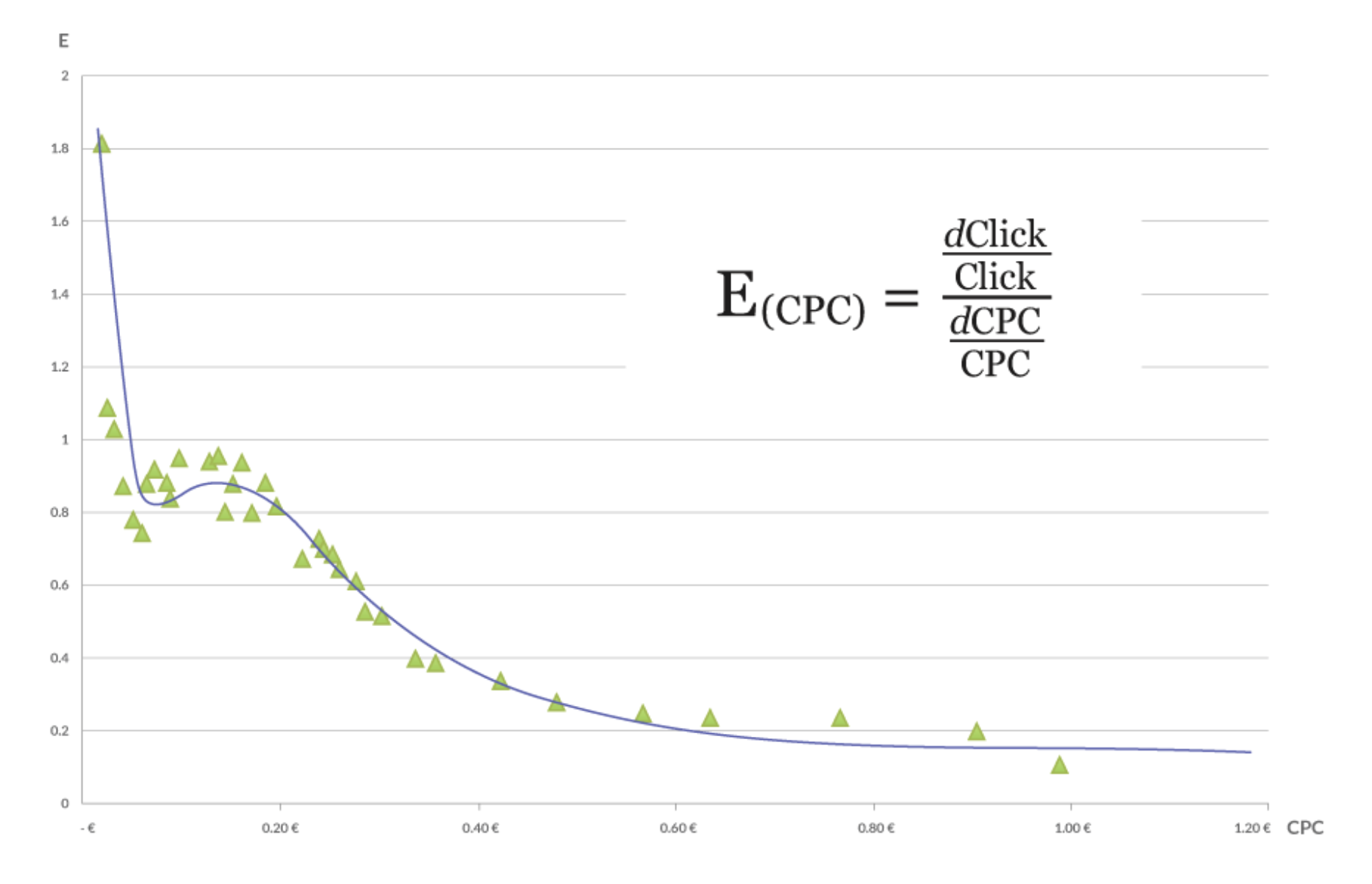

Price elasticity is a measure used in economics to show how the demand or supply responds to a change in price. It is the percentage change in quantity demanded or supplied in response to a one percent change in price.

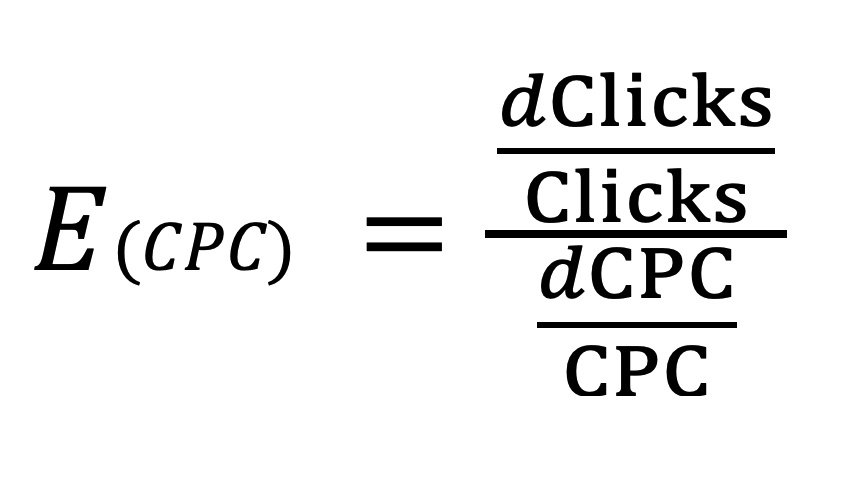

If the supply is the traffic bought by advertising (clicks) and the price is cost per click (CPC), the elasticity measures how the traffic responds to a change in CPC (d stands for small increase of the value):

The higher the value of the fraction, the higher the elasticity is. If the elasticity is less than one, it is said that the demand or supply is inelastic.

Price elasticity shows how fast the volume of clicks (and conversions) reacts to a change of unit price (CPC or CPA).

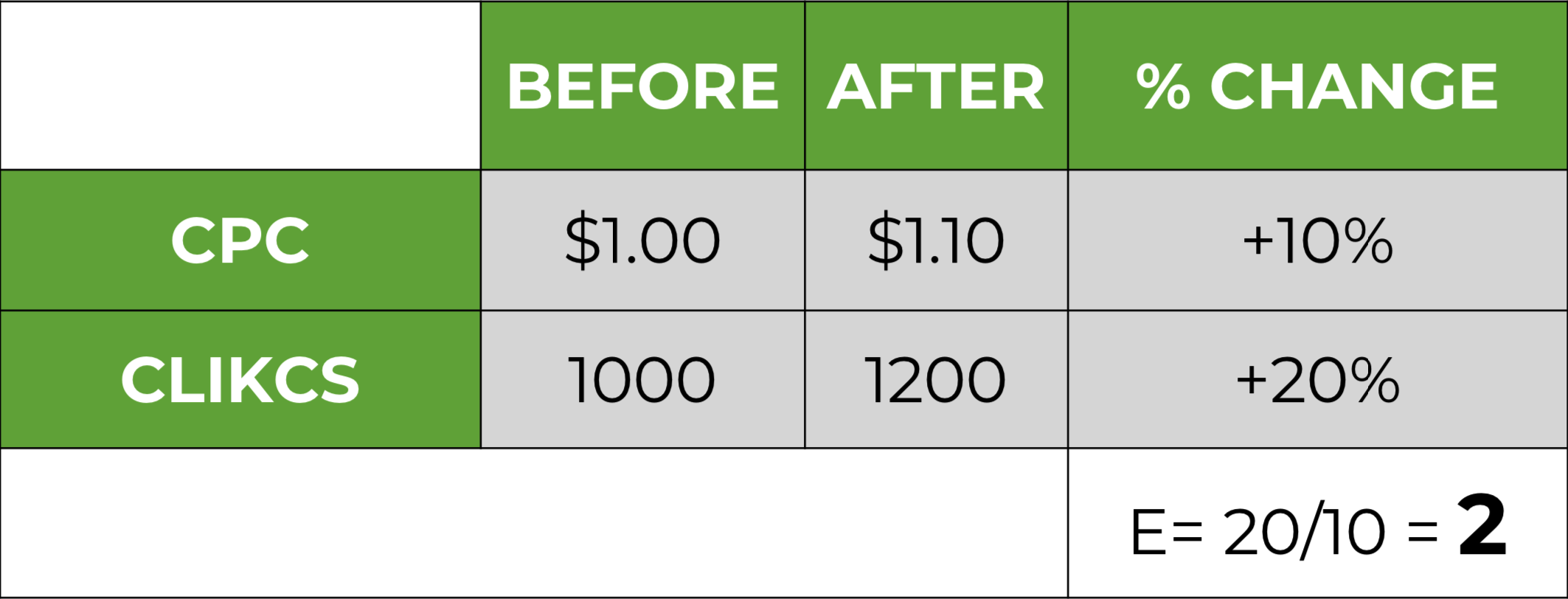

Say, a campaign generates 1,000 clicks at CPC $1, and after increase of CPC to $.1.10 (i.e., +10%), the click volume grows to 1,200 (+20%). In this case, the elasticity is relatively high and equals to 2:

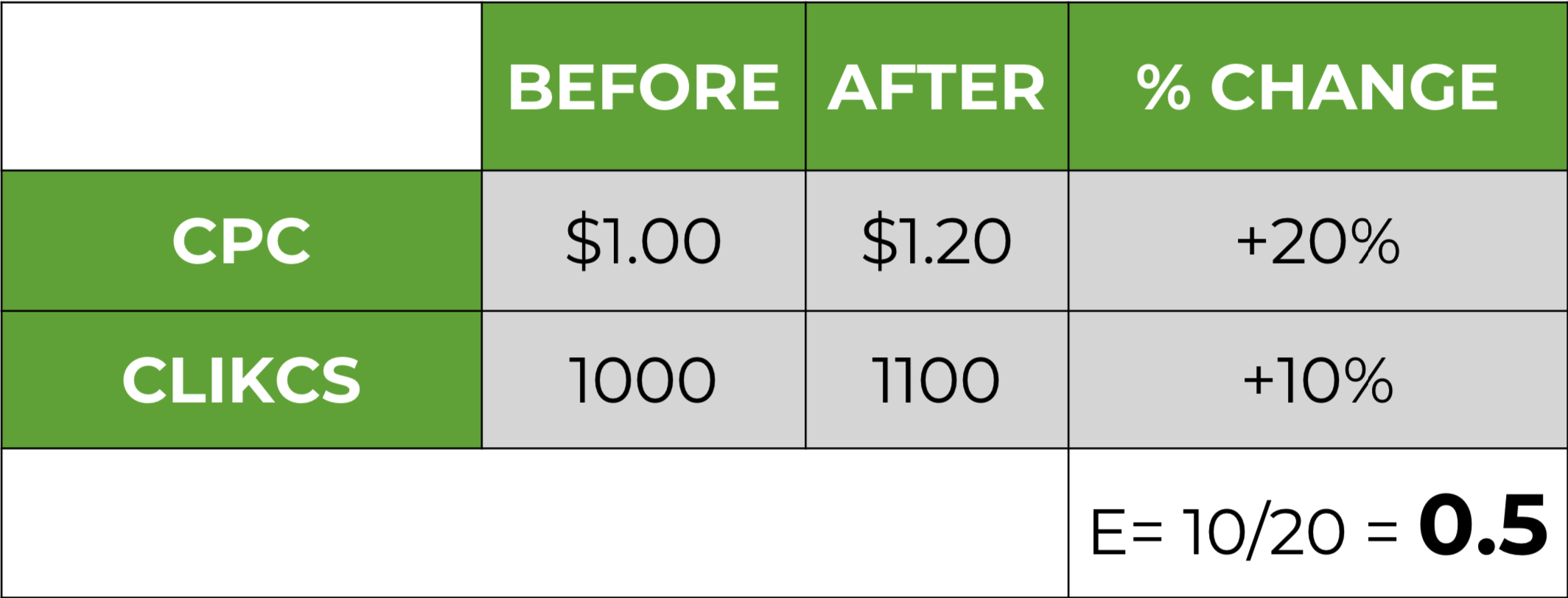

Another example: If the increase bids by +20% results in +10% growth of click volume, the elasticity is equal to 0.5.

The price elasticity in online ads usually decreases with price. Increasing CPC (or CPM) bids increases the volumes, but the relative growth gets smaller and smaller.

Price elasticity (E) is one of the most important metrics for SEM bid management.

The point of the maximum profit is where the ROI = 1/E, and increasing CPC bids makes sense only if ROI > 1/E. Otherwise, the bids should be decreased.

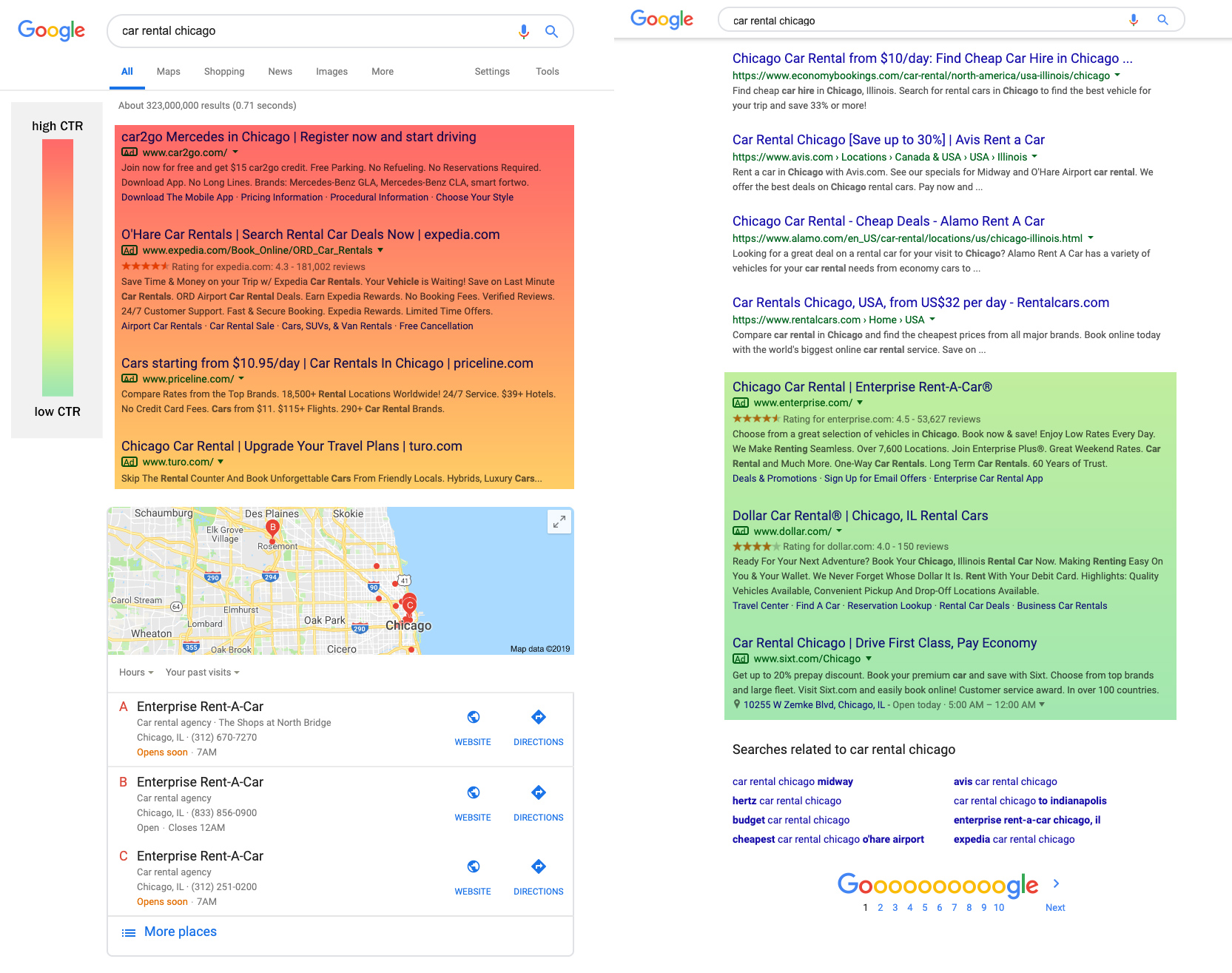

The price elasticity in Google Ads and other search engine advertising systems depends mainly on the position of the ad.

High positions on the top of the page usually have very low elasticity.

If the average position of the ad is 1.3 and it has a 99.9% impression share and it shows up in 97% of the occasions at the top of the page, increasing the CPC bid can’t significantly change the number of clicks.

On the other hand, the highest elasticity occurs when the ad starts to appear on the first page.

However, the high relative increase of traffic, in this case, results from the low traffic from ads displayed on the second page of the search results.

Even a low positioned ad on the first page normally acquires many more clicks.

Increase of elasticity occurs also when the position of the ad grows and the ad moves to the top of the search result page.

The CTR on the top is usually 10 to 20 times higher than for the “other” placements in the search results page.

Therefore, ads with a low impression share due to the rank (indicating that the bid is often below first page bid), ads with a low ad position, as well as ads with few “top” impressions, all have higher elasticity.

Bid simulator and Google Ads experiments help to determine the actual value of the price elasticity, as described in this article on this matter.

Practical Implications

How does this impact SEM bid management practice?

Usually the advertiser set an arbitrary goal of a certain CPA or ROI, and the budget and bid decisions are changed in order to achieve it.

If the source, campaign, ad group or keyword brings expensive conversions, the budgets are decreased or canceled.

If the conversion cost is low, or the ROI high, the budgets are increased in order to acquire more cheap conversions.

This is how many of us optimize, don’t we? And it’s not exactly the optimum.

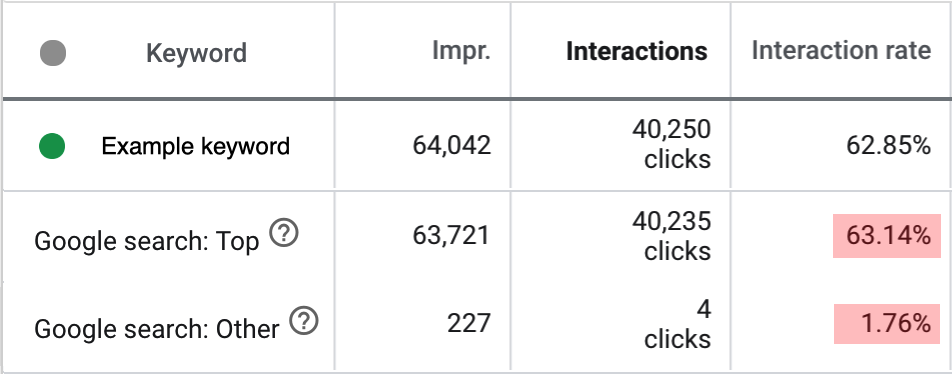

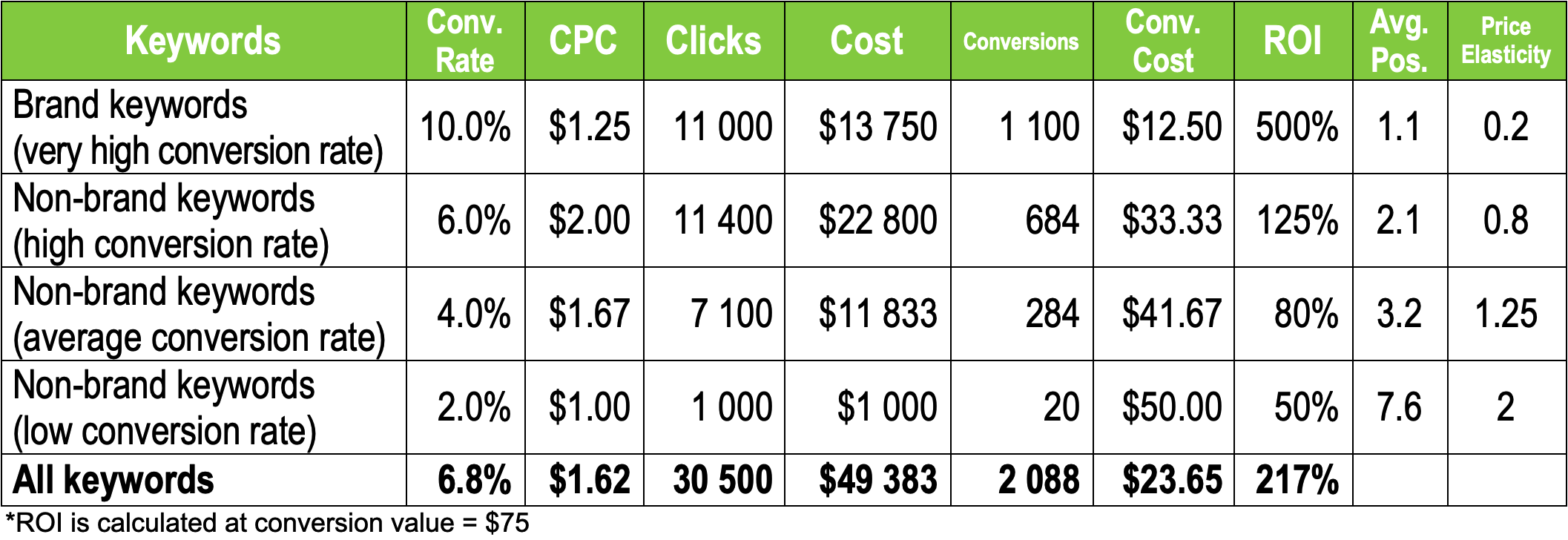

Keywords normally have different conversion rates.

The highest conversion rates usually occur in case of brand keywords (i.e., if the user is searching for the advertiser’s name or name of the offered product). This isn’t surprising, as the user intent is very specific.

The non-brand keywords, depending on relevancy, will have higher or lower conversion rates.

The low converting keywords, however, may be used by the advertiser, because the ROI may be still positive with a low CPC, which may be possible to achieve with worse ad positions.

So, the keywords have different CPC bids and positions. The impression loss due to the ad rank and the share of top impressions will also be different in the case of different keywords, and therefore the price elasticity will be also different.

The ROI > 1/E model shows that the only factor determining the optimum target ROI is price elasticity. For this reason, an arbitrary goal of fixed ROI for the entire campaign would not be optimal.

Keywords with low elasticity should have high ROI, while keywords with high elasticity may have lower ROI. Moreover, the target ROI should be set as 1/E, so the target ROI is actually not a matter of the advertiser’s choice.

Using a fixed and arbitrary ROI or CPA results in overinvestment in best converting keywords (e.g., brand keywords) and underinvestment in most general keywords.

In the majority of big brand SEM campaigns I have audited, the brand keyword bids were pumped to the extreme, while the other keywords were on the border of the first-page bid, as in the example below:

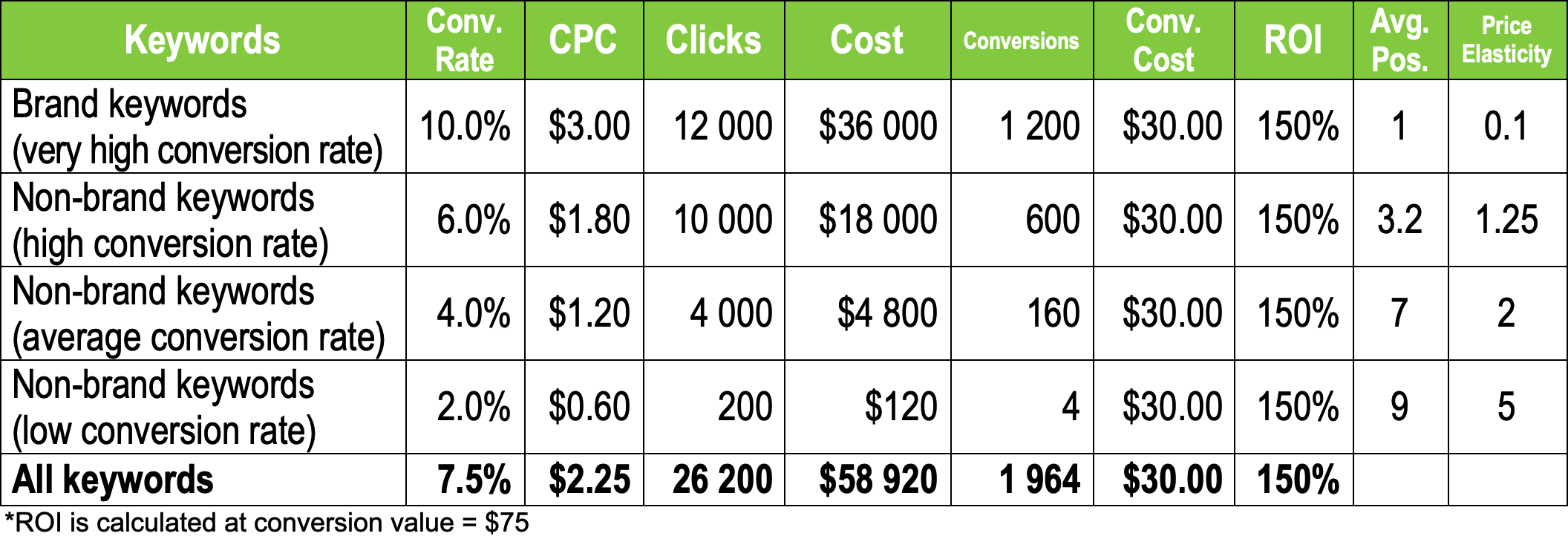

If understanding the meaning of price elasticity, instead of pursuing the same ROI goals, we would use different ROI goals for different keyword groups, the results of the campaign might look like this:

The number of conversions has increased and, at the same time, its cost has decreased.

The Paradox of Expensive Traffic Source

The application of profit-driven optimization may look counterintuitive. Instead of increasing bids and investment in the best converting keywords, the opposite actually happens.

The investment in the highest converting, but overinvested keywords is decreased, and the money saved is used to increase the budgets of “less attractive” but underinvested keywords with lower conversion rates.

These underinvested keywords have high price elasticity and therefore increased investment results in a relatively high increase in volume.

On the other hand, a significantly smaller investment in overinvested keywords results in a relatively small loss in volume.

Each keyword has its own price elasticity (E) and, for this reason, should have different target ROI = 1/E.

Yet if the keywords are grouped in a couple of groups of similar elasticity, and separate ROI targets are used for these groups, the bid management will be much more efficient.

The absolute minimum is to separate the brand and non-brand keywords.

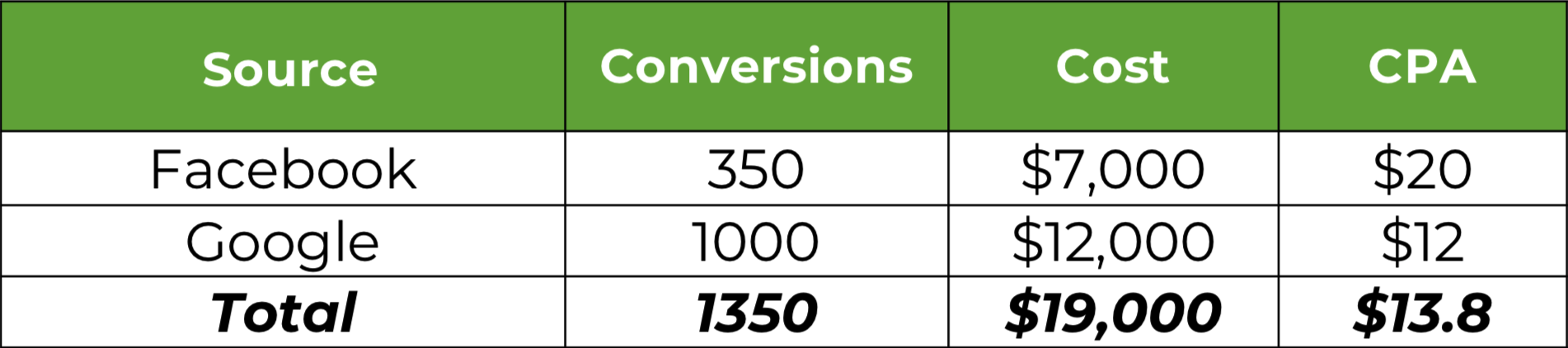

See another example. An advertiser runs two campaigns, one in Google and the other on Facebook. The CPA on Facebook ($20 ) looks high in comparison to the CPA in Google ($12):

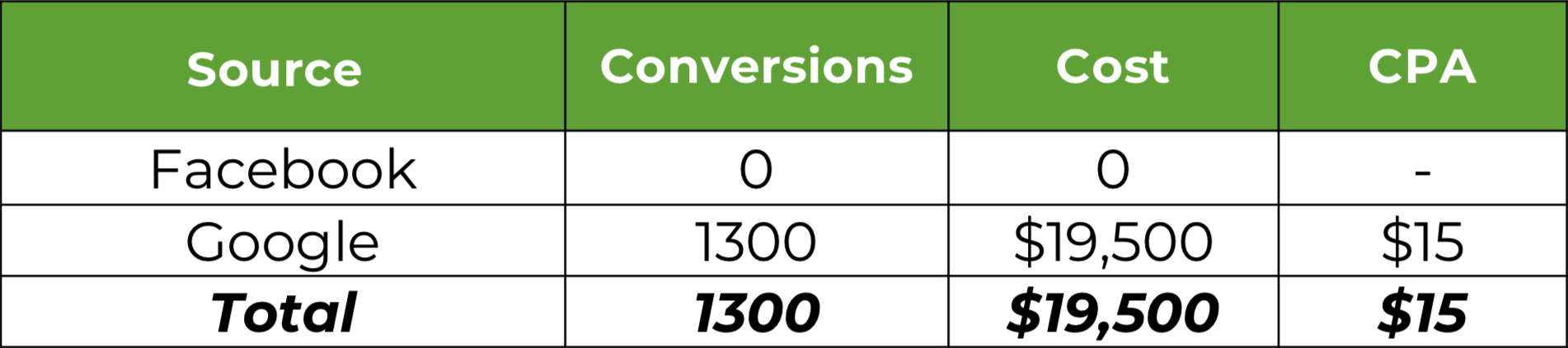

Therefore, the advertiser decides to pause the campaign on Facebook and instead, invest more in Google Ads:

But wait!

After this “optimization”, the total number of conversions is smaller, while the cost is higher than before. This is because the marginal CPA of Google campaign was:

($19,500 – $12,000) / (1300 – 1000) = $7,500 / 300 = $25

This is higher than the CPA of the Facebook campaign ($25).

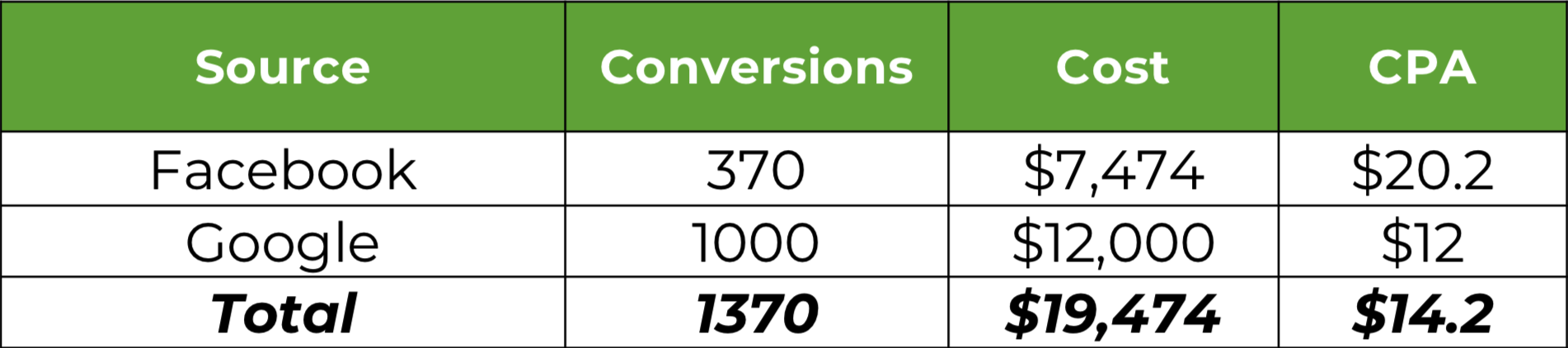

Actually, it was more profitable to increase the Facebook budget, because it produced +20 more conversions with lower cost ($26 less) than higher investment in Google:

Marginal CPA of the Facebook campaign was:

($7,474 – $7,000) / (370 – 350) = $474 / 20 = $23.7

This is lower than the marginal CPA in Google ($25).

Marginal CPA calculations make it clear, but at first sight, it does not look obvious that it is more efficient to invest in the campaign with worse CPA.

Real Life: How to Work with Fixed CPA Targets

In practice, marketers rarely know the real ROI of their ads.

Even if they know the actual profit and ROI from a transaction, they usually don’t know its lifetime value (LTV), or the LTV is only a rough estimation.

More often they work within a CPA or ROI target, where ROI is calculated without using the LTV factors.

Should the advertiser set a “non-negotiable” ROI (or CPA) target, using it for all campaigns is never optimal.

It does not make good commercial sense to push the best converting campaigns to the limit, reaching points of low elasticity where the cost grows quickly while the effects increase slightly.

It is better to set higher ROI goals for those campaigns where the elasticity is low and at the same time accept lower ROI for campaigns with higher elasticity.

By selecting different ROI goals for different campaigns, ad groups, and keywords, we can still achieve the desired average ROI, but the total number of conversions will be higher.

This is because we lose just a few conversions and save significant money on the less elastic campaign, and the money saved brings much more additional conversions if invested in more elastic campaigns, even if their ROI is lower.

Therefore, even if we have to work within a given ROI target, it is not optimal to have one target ROI for all sources, campaigns, keywords, devices and other biddable items.

Using different ROI targets depending on elasticity is the basic principle of portfolio bidding.

Mathematical models may help to calculate relevant adjustments to the target ROI, but in practice, we will have to use machine-learning optimizers who embrace this concept and find “trade-offs and hidden opportunities.” (See Search Ads 360 help article here.)

Elasticity adjustments may explain increased bids for lesser performing biddable items, made to improve overall performance.

Elasticity in Display Advertising

The concept of profit-driven marketing can be also used in display advertising.

Display ads can also be optimized by bid and placement selection and frequency capping.

More and more expensive placement can be achieved by increasing bids, and in this way, it resembles search advertising. However, a change in bids may change the actual structure of placements and audiences, too.

Different placements and audiences may have different conversion rates and different conversion costs, as opposed to search engine ads where the conversion rate does not depend on the position of the ad.

Regardless of the ad position, the SEM ads are clicked by the same people who search for the same keywords using the same search engine.

Therefore, the price elasticity of conversions may be a function with many local maxima and minima.

However, in the macroscale, display ads will also show decreasing elasticity.

There are many theories about the optimum frequency capping that advertisers should use. These theories usually say that the “best” frequency is between two and five times per unique user.

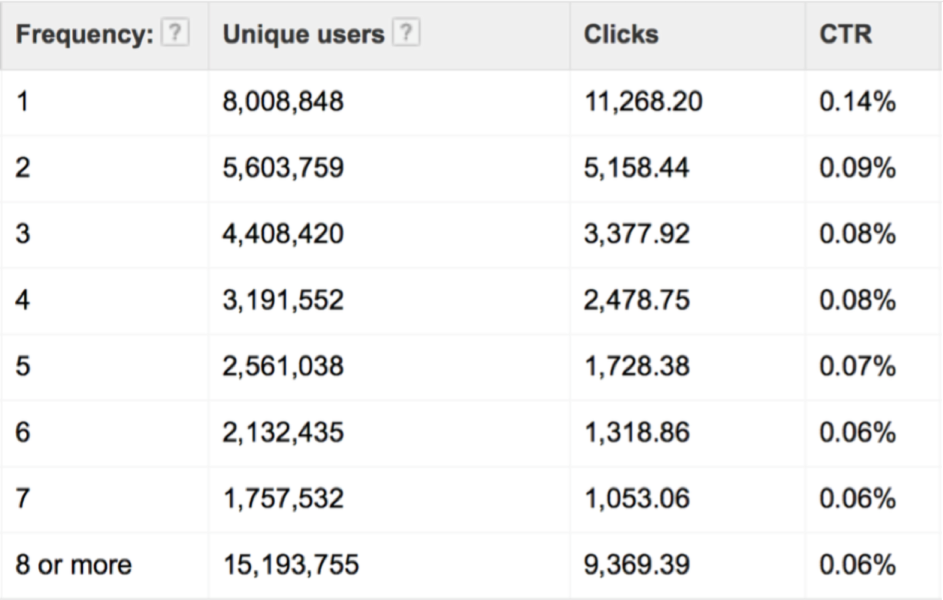

However, if we measure the ad efficiency using CTR, a metric that measures the grade of the users’ reaction to the ad, we usually can see that to a unique user each subsequent impression has a smaller impact.

The example reach and frequency report from Google Ads (Display) shows that the CTR decreases with every impression.

Lowering CTR causes increasing of CPC. The efficiency of the campaign decreases, and we have lower and lower response. The “unit price” grows.

Unfortunately, this Google Ads report has been discontinued, and we don’t have access to such detailed insights now.

However, we can still observe the changes in CTR and CPC depending on the frequency.

Whenever the frequency is high, we may expect that the elasticity of a campaign to be low, and even if the current ROI is good, increasing frequency capping may bring only a few additional conversions.

It may be better to increase the frequency of less profitable campaign with low frequency.

More Resources:

Image Credits

All screenshots taken by author, June 2019